- U.S. natural gas manufacturers are decreasing production in action to multi-year low costs.

- Some manufacturers are equipping up stocks of wells prepared to start pumping when rates rebound.

- Producers are positive about the long-lasting potentialcustomers of gas as a fuel both in America and abroad.

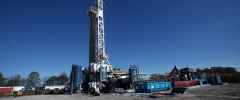

U.S. natural gas manufacturers are slashing production in action to multi-year low rates. But they are likewise looking beyond the present downturn, preparing to turn on more output by versatile operation of their stock of wells.

“Natural gas is presently rates at or listedbelow expenses of production,” an executive at an expedition and production business stated in comments in the quarterly Dallas Fed Energy Survey launched this week.

Prices are traditionally low due to weak winterseason need amidst milder weathercondition, record output at the end of 2023, and higher-than-average natural gas stocks.

Working natural gas stocks in the week to March 22 were 41% more than the five-year typical and 23% greater than last year at this time, per the newest EIA information.

The oversupply and low rates have triggered numerous manufacturers to start lowering production. But some are likewise equipping up stocks of wells allset to start pumping – or to be turned in line – as quickly as costs rebound. Producers anticipate natural gas costs to recuperate next year inthemiddleof growing need for LNG exports and brand-new LNG export plants that are slated to start operations in 2025.

“All of us in the natural gas organization are pinching as numerous cents as we can right now,” Josh Viets, Executive Vice President and Chief Operating Officer at Chesapeake Energy, told the audience at Hart Energy’s DUG GAS+ Conference & Exhibition 2024 in Louisiana this week.

But Chesapeake Energy, set to endedupbeing the leading U.S. natural gas manufacturer after the planned merger with Southwestern Energy, is likewise postponing production from around 80 wells this year, which would offer it up to 1.0 bcf/d of efficient capability offered from delayed turn in line wells (TILs) by the end of 2024.

“The method I like to believe about it is we’re utilizing the tank as storage,” Viets informed the conference, as brought by Bloomberg.

“When the market states, ‘hey, I requirement more gas,’ we’ll be in a position to rapidly bringback that to aid fulfill the requires of customers.”

In the Q4 2023 profits release in February, Chesapeake Energy said it would be structure efficient capability to lineup with customer need. By year-end, the business strategies to haveactually postponed around 35 drilled however uncompleted wells (DUCs) and about 80 TILs. A determined method to production activation would be responsive to market need, Chesapeake keptinmind.

Other U.S. natural gas drillers, consistingof the present top manufacturer EQT Corporation, have likewise lowered output in reaction to the low domestic rates.

“The low rates we are experiencing now are caus