TLDR

- Gold’s market capitalization hit $30 trillion as prices reached $4,357 per ounce, making it 14.5 times larger than Bitcoin’s $2.1 trillion market cap

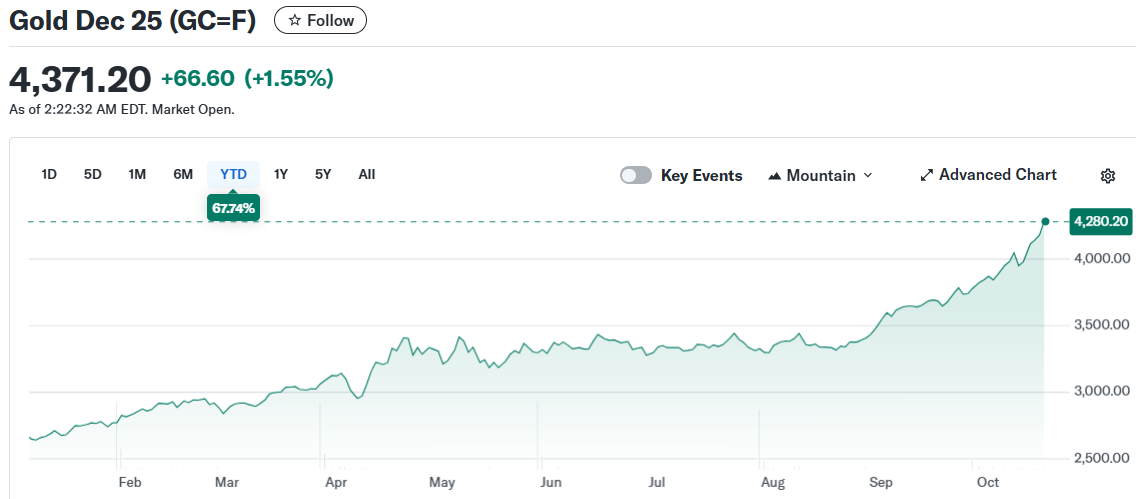

- Gold has surged 64% since January 2025 while Bitcoin has only gained 16%, with gold up nearly 60% year-to-date compared to Bitcoin’s 13%

- Analysts predict capital will rotate from gold into Bitcoin when the gold market cools, with some calling it “the trade after the trade”

- Crypto traders are struggling with 66% of positions being short on Hyperliquid, with only 35% of traders profitable amid high leverage

- Bitcoin experienced a $19 billion deleveraging event, one of the largest in its history, with funding rates dropping to 2022 FTX-collapse levels

Gold reached a market capitalization of $30 trillion on Thursday as the precious metal hit a new all-time high of $4,357 per ounce. The milestone puts gold’s value at 14.5 times larger than Bitcoin’s current market cap of approximately $2.1 trillion.

The gold market is now 1.5 times larger than the combined market capitalization of the seven largest tech companies. Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta and Tesla together total around $20 trillion in market value.

Gold has surged 64% since January 1, 2025, driven by investors seeking safety from dollar debasement, geopolitical tensions and trade tariff concerns. The precious metal has more than doubled in value since the beginning of 2024.

Bitcoin has underperformed this year with only a 16% gain from January 1 levels. The cryptocurrency currently trades almost 14% below its all-time high despite widespread expectations of a bull market.

Analysts Predict Bitcoin Rotation

Crypto analyst Sykodelic noted that gold added over $300 billion to its market cap in a single day. The analyst pointed out that gold has been adding an entire Bitcoin market cap worth of value each week.

Many market observers believe capital will flow into Bitcoin once gold’s rally slows. Venture investor Joe Consorti suggested Bitcoin could benefit if it reduces its correlation with US equities and captures gold outflows.

Analyst Merlijn the Trader observed that the M2 global money supply i