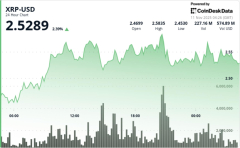

The breakout attempt at $2.57 met resistance as profit-taking emerged, though buyers held firm above the $2.52-$2.53 zone to confirm short-term support.

Updated Nov 11, 2025, 4: 38 a.m. Published Nov 11, 2025, 4: 38 a.m.

What to know:

- XRP outperformed the broader crypto market, rising 1.55% amid increased institutional flows and regulatory optimism.

- Trading volume surged 20.71% above the seven-day average, indicating strong institutional participation.

- XRP’s ability to maintain support above $2.50-$2.52 is crucial for sustaining its bullish momentum.

Institutional flows accelerated Tuesday as XRP broke from broader crypto weakness, posting steady gains amid improving regulatory clarity and controlled accumulation across key support zones.

News Background

- XRP climbed 1.55% to $2.53 in Tuesday’s session, outperforming the broader crypto market by 2.33 percentage points. The advance came as investors continued building positions on renewed optimism around regulatory progress and ETF developments, while broader digital assets traded mixed.

- Canary Capital, Bitwise, Franklin Templeton, and 21Shares filed amended S-1 registration statements for spot XRP exchange-traded funds, introducing standardized listing language designed to streamline SEC review under existing 8(a) procedures.

- The five spot XRP ETFs have been listed on DTCC ahead of a potential US launch this month.

- Trading volume surged 20.71% above the seven-day average, confirming institutional participation. Market data showed 140.2 million tokens changing hands during the peak of the session—86% above the 24-hour moving average—underscoring sustained professional flows at higher price levels.

- XRP’s move contrasts with sector underperformance, highlighting the token’s decoupling as regulated exposure expands globally and on-chain data points to controlled accumulation among large holders.

Price Action Summary

- XRP traded within a $0.13 intraday range, advancing from $2.47 to $2.54 while forming higher lows at $2.45, $2.50, and $2.52.

- The breakout attempt at $2.57 met resistance as profit-taking emerged, though buyers held firm above the $2.52-$2.53 zone to confirm short-term support.

- Volume distribution showed disciplined accumulation rather than speculative spikes, with buying concentrated around mid-range levels—consistent with institutional scaling behavior.

- Late-session trading printed sustained bid activity above $2.52 as volatility normalized from early-session highs.

Technical Analysis

- XRP maintains its ascending structure on the 4-hour chart, with RSI at 58 supporting further upside potential. MACD remains positive with a widening histogram, indicating strengthening short-term momentum.

- The token’s failure to break above $2.57 resistance highlights near-term consolidation risk, though the broader uptrend remains intact as long as price holds above $2.50.

- Volume patterns reinforce constructive positioning: the 21% increase above