TLDR

- Markets face a shortened trading week due to Presidents Day, with focus on Walmart earnings and delayed economic data from last year’s government shutdown

- Friday’s PCE inflation report for December and Q4 GDP data will give investors key insights into economic health and Federal Reserve rate decisions

- Walmart reports quarterly earnings Thursday under new CEO John Furner after recently hitting $1 trillion market cap with 4.2% comparable sales growth

- AI disruption fears continue hitting multiple sectors, with software, logistics, and tech stocks selling off on concerns about business model threats

- January jobs data showed 130,000 additions (double estimates) while CPI inflation cooled more than expected, keeping Fed rates likely steady through mid-2026

💥 Find the Next KnockoutStock!

Get live prices, charts, and KO Scores from KnockoutStocks.com, the data-driven platform ranking every stock by quality and breakout potential.

Markets will navigate a compressed trading schedule this week as investors await key earnings reports and delayed economic data. The Presidents Day holiday closes markets Monday before a busy week of corporate results and inflation numbers.

Walmart takes center stage Thursday with its quarterly earnings report. The release marks the first under new CEO John Furner following his recent promotion. The retail giant recently crossed $1 trillion in market capitalization, becoming the first big box store to reach that milestone.

#earnings for the week of February 16, 2026https://t.co/hLn2sKQhEY$HL $WMT $PANW $KGC $OPEN $CVNA $ADI $CDE $PAAS $ET $RIG $NEM $AG $CDNS $DASH $DVN $FIG $MDT $PWR $RGLD $EQT $TOL $DE $SSRM $RNW $LMND $AKAM $EQX $EBAY $FIX $KLAR $LYV $RELY $SXC $SEDG $SFM $TXRH $SON $OXY… pic.twitter.com/fnltw1qIDA

— Earnings Whispers (@eWhispers) February 13, 2026

In its previous report, Walmart posted a 4.2% increase in comparable sales. The company also raised its full-year sales forecast. Investors will watch closely to see if consumer spending remained strong through the holiday season.

Economic Data and Federal Reserve Focus

Friday brings the Personal Consumption Expenditures price index for December. The PCE report is the Federal Reserve’s preferred inflation measure. Recent Consumer Price Index data showed inflation remained unchanged in December, and the PCE numbers could influence the Fed’s rate policy decisions.

Thursday’s GDP release will show fourth quarter economic growth for the first time. The Bureau of Economic Analysis previously reported 4.4% growth for the third quarter. The new data will reveal whether that momentum continued into year-end.

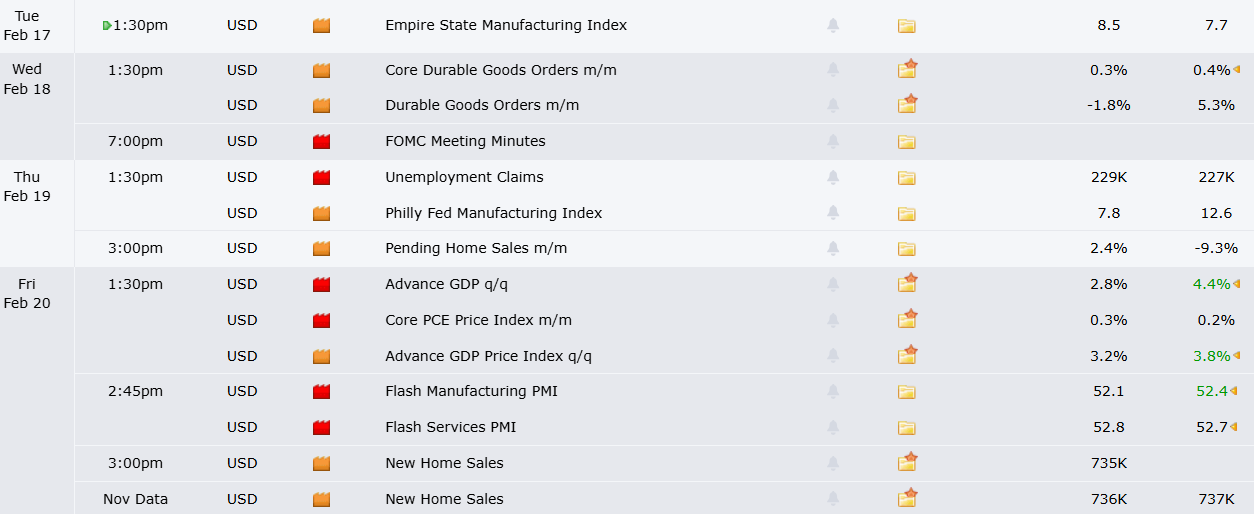

Housing market data delayed from last year’s government shutdown will also arrive this week. Both November and December figures for housing starts and new home sales are scheduled for release. Pending home sales for January will offer a forward-looking view of the market.

January’s Federal Reserve meeting minutes will provide insight into officials’ economic views. The minutes come as markets try to gauge when the central bank might adjust interest rates. Fed Vice Chair Michelle Bowman and other officials are scheduled to speak throughout the week.

AI Disruption Pressures Multiple Sectors

Recent market action has been dominated by AI-related selling pressure. Software stocks initially led the decline, followed by financial services, retail, and logistics companies. Investors are dumping stocks at the first sign that AI tools might disrupt traditional business models.

The Nasdaq Composite fell 2.1% last week while the S&P 500 dropped 1.4%. The Dow Jones Industrial Average declined 1.2%. These index moves masked sharper swings in individual stocks across various sectors.

A logistics company announcement this week triggered double-digit declines in freight stocks. CH Robinson Worldwide fell 12% and Universal Logistics dropped 10% after a karaoke machine maker unveiled an AI-powered logistics platform. The platform claims to scale freight volumes by 300% to 400% without adding staff.

Major tech stocks also slid despite rising AI spending projections from large corporation