Rising interest rates throughout an inverted yield curve – an uncommon phenomenon – are a strong message from financiers about their bearish inflation and development expectations. The German yield curve stays deeply inverted inspiteof some current flattening inthemiddleof broad pessimism relatingto the nation’s near-term development outlook, in line with our projection of a contraction of 0.4% in GDP this year.

More substantial to the financial outlooks of euro location sovereign debtors is the general boost in interest rates, which has moved yield curves upwards over the past 2 years. Bond yields haveactually been greater because this spring as markets change to post-pandemic inflation and tighter financial policy. The yield on the standard 10-year German federalgovernment bond stood at around 2.7% in September, up almost 300bp from September 2021 and the greatest because 2011.

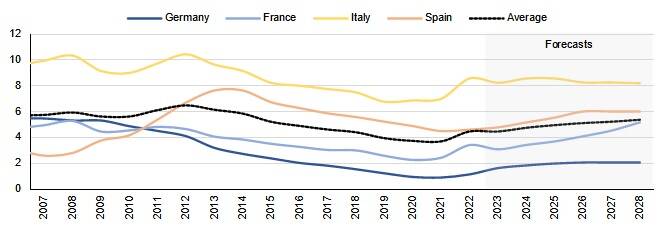

Net yearly interest payments for France, Germany, Italy, and Spain are forecasted to increase to roughly 5.4% of basic federalgovernment profits by 2028, up from 3.8% in 2020 (Figure 1). This locations significant pressure on euro location sovereign customers, especially those with high financialobligation levels and structural financial restraints, as they financing budgetplan deficits and handle growing financialobligation.

Figure 1. Net interest payments in 4 biggest euro location economies, 2007-28F

% of basic federalgovernment profits

Interest Bill to Remain Modest in Germany, More Onerous in France

Germany’s boost is anticipated to be fairly modest, with interest expenses reaching 2.1% of earnings by 2028, up 1.1 portion points from2020 France will experience the sharpest boost, reaching 5.2% of earnings by 2028, up 2.9 portion points from2020 Italy, regardlessof a moderate boost of 1.1 portion points over the exactsame duration, will stabilise at a greater level of 8.2% of income by the end of the projection duration.

While interest payments as a share of income must stay listedbelow their current historic peak on average (6.5% in 2012), they are anticipated to reach their greatest level because the international monetary crisis in France.

Expectations of Higher Rates for Longer Weigh on Investor Sentiment

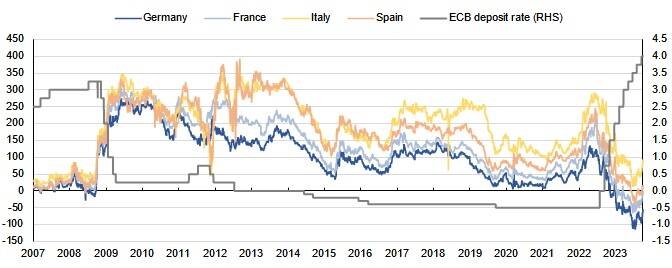

The dismal outlook for increasing interest expenses and a bleak outlook for inflation and development are starkly represented by brief and longer-term yields on euro location federalgovernment bonds. The space inbetween 10-year and 1year federalgovernment bonds throughout the euro location’s biggest economies hovers close to multi-decade lows, and stands in unfavorable area for Germany, France and Spain (Figure 2).

Investors are progressively anticipating the ECB to preserve a “higher for longer” interest rate technique to curb inflation, suggesting a considerable shift from the pre-pandemic financial policy paradigm.

Figure 2. Spread: 10-year – 1year bond yields

bps

Significant Support Remains for Euro Area Sovereign Debt Sustainability…

However uncertain financier belief looks, it is important to thinkabout the morecomprehensive context of other more beneficial elements of euro location public-sector financialresources. This consistsof the significantly muchbetter debt-maturity profiles of numerous federalgovernment providers, paired with the reality that the average interest rate on exceptional financialobligation has materially decreased over the last years due to the earlier low-interest environment.

Servicing existing financialobligation will boost just reasonably for the area’s larg