The past three years in the mortgage industry were cutthroat, with origination volume shrinking, and while things are looking better for 2024, lenders are still in a position where they must make bold moves to stem losses on the production side of the business, according to a report from Stratmor Group, a mortgage advisory firm.

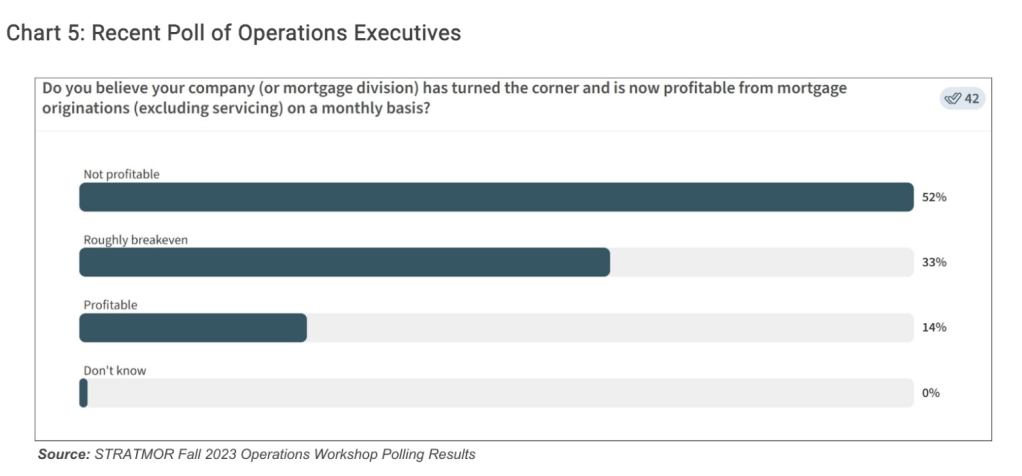

More than half of mortgage executives who participated in Stratmor’s recent survey indicated that they do not believe their companies have turned the corner to become profitable when it comes to originations — excluding servicing.

About 85% of surveyed executives believed that their company was either not profitable or was roughly breaking even in production.

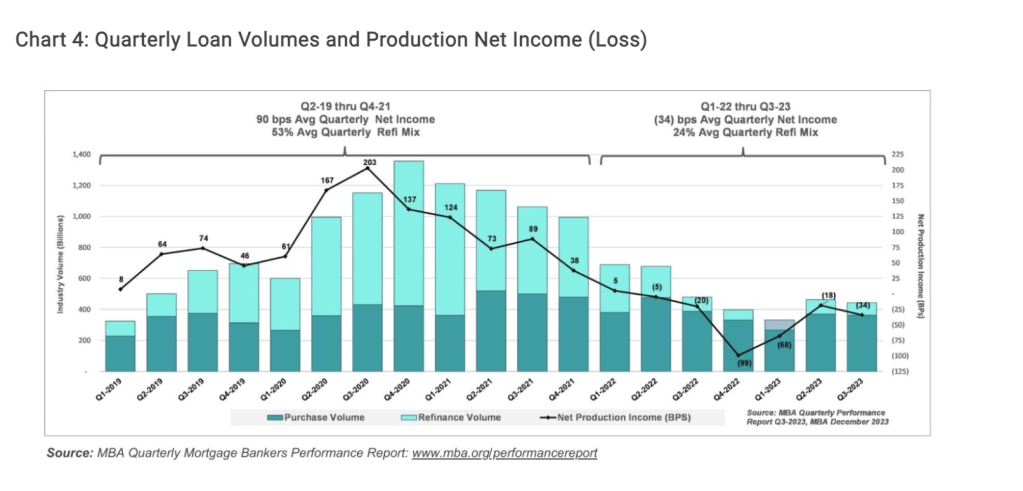

If lenders’ losses come in as expected during fourth-quarter 2023 and first-quarter 2024, it will represent eight consecutive quarters of losses for more than 350 independent mortgage bankers, said Jim Cameron, senior partner at Stratmor.

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks have collectively been in the red for six consecutive quarters. Most recently, they reported an average net loss of $1,015 on each loan they originated in third-quarter 2023 — doubling the reported loss of $534 per loan in Q2, according to data from the Mortgage Bankers Association (MBA).

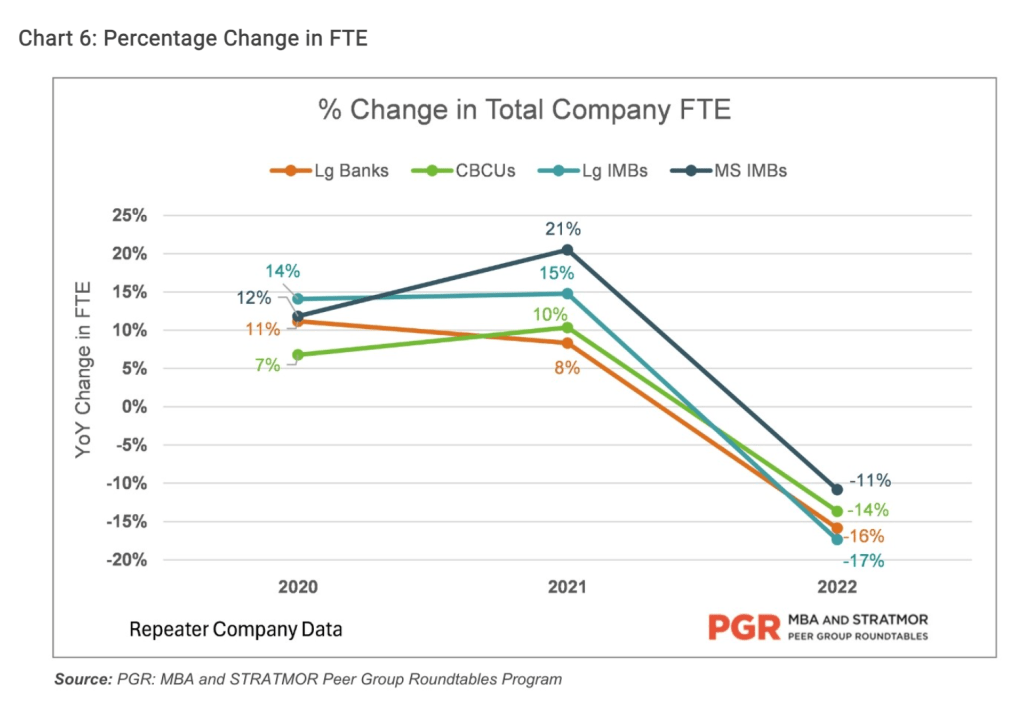

While lenders have been aggressively cutting labor costs — their largest type of expense — it has not been enough to reduce per-loan production expense.

Even with massive cuts to gross production expenses (from $44 million per company in Q3 2020 to $18 million in Q1 2023), the cost per loan has increased to more $13,000 as loan production units dropped off dramatically during that period.

As of Q3 2023, total loan production expenses were $11,441 per loan, up slightly from $11,044 in the prior quarter.

“As we head into 2024, it is clear we still have excess capacity and lenders must continue to be disciplined and aggressive in managing staffing levels,” Cameron said.

While labor is the priority when it comes to reducing costs, cutting down lease costs and making use of the hybrid work model; reviewing vendor contracts; and weeding out plug-ins with high costs and low adoption rates are needed, according to the report.

The silver lining for IMBs, in general, are their strong cash balances, the report noted.

After bouncing between the $6 million to $8 million range in 2018 and 2019, average cash balances now stand at about $11.5 million as of Q3 2023. Lenders sold off much of their servicing portfolios in 2022 and 2023, and balances would have been much lower without these moves, according Came