In a brand-new weekly upgrade for pv publication, OPIS, a Dow Jones business, offers a fast appearance at the primary cost patterns in the international PV market.

OPIS

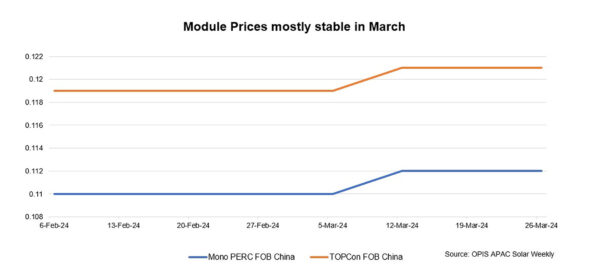

The Chinese Module Marker (CMM), the OPIS criteria evaluation for TOPCon modules was evaluated at $0.121 per W, thesame week to week while mono PERC modules from China were evaluated at $0.112/W, steady from the previous week inthemiddleof thesame market principles.

The past coupleof weeks of cost walkings in the Chinese market saw a minor reprieve this week with lotsof market individuals pointing out that market activity had quietened down and rates were beginning to support in the domestic market.

Overseas need continued to stay company as March and April are the start of a strong quarter for solar releases throughout Europe, with numerous business settingup the stockpile of agreements they had collected over the winterseason, a market source stated.

Turkey has executed anti-dumping procedures on solar panel imports from Vietnam, Malaysia, Thailand, Croatia, and Jordan where a assurance charge of $25 per square meter will be imposed on photovoltaic (PV) cells that are puttogether in modules or setup in panels comingfrom from these nations.

According to OPIS sources, these procedures would not have a huge effect on Southeast Asia modules as the bulk of Southeast Asia modules are predestined for the UnitedStates market. The existing US Section 201 tariff exemption of bifacial modules from Southeast Asia that is set to end in June was anticipated to have a higher effect.

Freight rates from Southeast Asia to the United States stayed at $0.02-0.03 with some gamers locking in their freights at lower rates, a market individual stated. About 30 GW of module stock that was imported last year to the United States was d