CFTC ‘happy’ to endedupbeing main regulator for digital possessions, decreasing SEC function – Chair Behnam Mike Dalton · 3 hours ago · 2 minutes checkout

CFTC ‘happy’ to endedupbeing main regulator for digital possessions, decreasing SEC function – Chair Behnam Mike Dalton · 3 hours ago · 2 minutes checkout

CFTC chair Rostin Behnam stated the firms oughtto worktogether .

2 minutes checkout

Updated: Jul. 10, 2024 at 10: 22 pm UTC

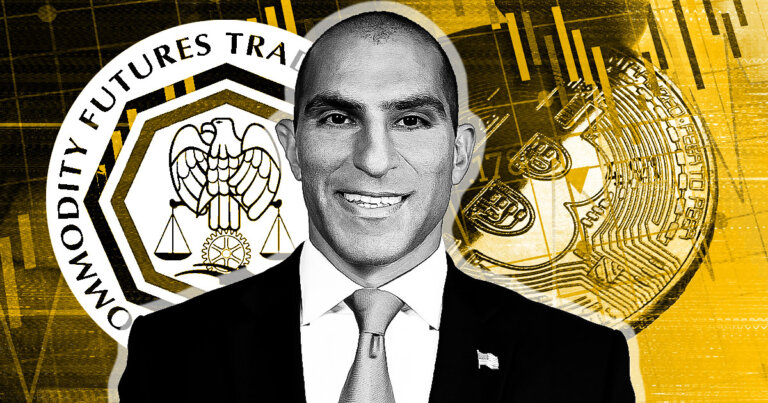

Cover art/illustration bymeansof CryptoSlate. Image consistsof integrated material which might consistof AI-generated material.

CFTC chair Rostin Behnam stated the company is open to serving as a main regulator for crypto throughout a Senate Agriculture Committee hearing on digital products oversight.

The hearing, held on July 10, broadly worried the CFTC’s demand for more regulative authority.

Senator Roger Marshall asked Behnam whether it would be “simpler” to make the CFTC a main regulator for digital properties while leaving a little number of “offshoots” for the SEC to manage.

Behnam reacted:

“I speak for myself, [we] would be delighted to do that. I believe we have the capability to do that the competence and the experience.”

However, Behnam stated modifications to meanings of securities and products would be needed if the CFTC presumes main authority.

Cooperation with SEC important

Earlier, Marshall asked Behnam whether he supports the SEC having the capability to choose which properties fall under the CFTC’s jurisdiction.

Behnam stated he does not assistance the SEC making such choices alone however included that the 2 firms have worked together to specify possessions in grey locations for about 50 years.

Marshall likewise asked whether the CFTC is worried it might face suits over contrasting property classifications. Behnam stated he “can’t state that it’s not going to takeplace,” however cooperation inbetween the SEC and CFTC will aid address book legal concerns.

Behnam acknowledged Marshall’s issues that legislators might allow such claims however stressedout the requirement for a agreement listing system that matches the CFTC’s existing powers and enables cooperation with the SEC. Behnam stated:

“I think there’s a method to construct a system of listing agreements that doesn’t extend or hold-up the listing of agreements in a controlled market.”

Behnam stated the CFTC desires to present tokens and agreements to controlled markets “as quickly as possible” to decrease or remove financier threats.

Most

Behnam thinks that a considerable part of the crypto market sh