Music publishers have stated war versus Spotify — and the factor is bundling. But what are the other DSPs doing? Now, there’s a chart for that: The Bundling Barometer from DMN Pro.

For the average customer, bundling is a part of day-to-day life. Whether a six-pack of Negro Modelo or a bundled holiday bundle to Europe, connecting items together into a useful package is a well-worn organization practice.

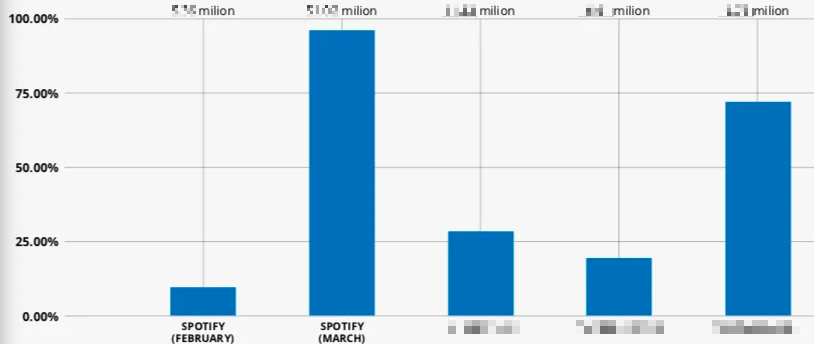

Shift over to the music market, nevertheless, and bundling is demonstrably affecting music publishers and their incomes. According to the newest Bundling Barometer reading, an impressive 98% of Spotify premium strategies are now categorized as packages. That will equate into losses of numerous hundred million dollars over the next coupleof years.

But what are the other streaming music platforms doing?

Hint: Spotify isn’t alone when it comes to bundling. Another significant streaming music platform is likewise ramping up bundled plans past the 70% mark. Others might copy Spotify’s shift, resulting in hundreds of millions of extra lost earnings for music publishers.

Here’s a fast appearance at where significant streaming platforms presently stand on bundling.

The Bundling Barometer, a US-based chart from DMN Pro, is sourced from real mechanical publishing declarations shared with Digital Music News.

The chart likewise consistsof important fields to assistance the music market muchbetter comprehend the bundling practices of significant DSPs, consistingof:

- Total number of DSP customers technically bucketed into ‘bundles’ for publishing royalty computations.

- A breakdown of total bundled customers, consistingof those not technically categorized as bundled for royalty accounting purpos