Hedera (HBAR) open interest has hit a brand-new all-time high listbelow its 600% rate boost in the last 30 days. This increase symbolizes the greatest trader interaction with the token because its beginning.

Looking ahead, anumberof crucial signs recommend HBAR’s cost rally and bullish momentum might continue. Based on this on-chain analysis, here is what might be next for the cryptocurrency.

Hedera Has Traders’ Attention on Lock

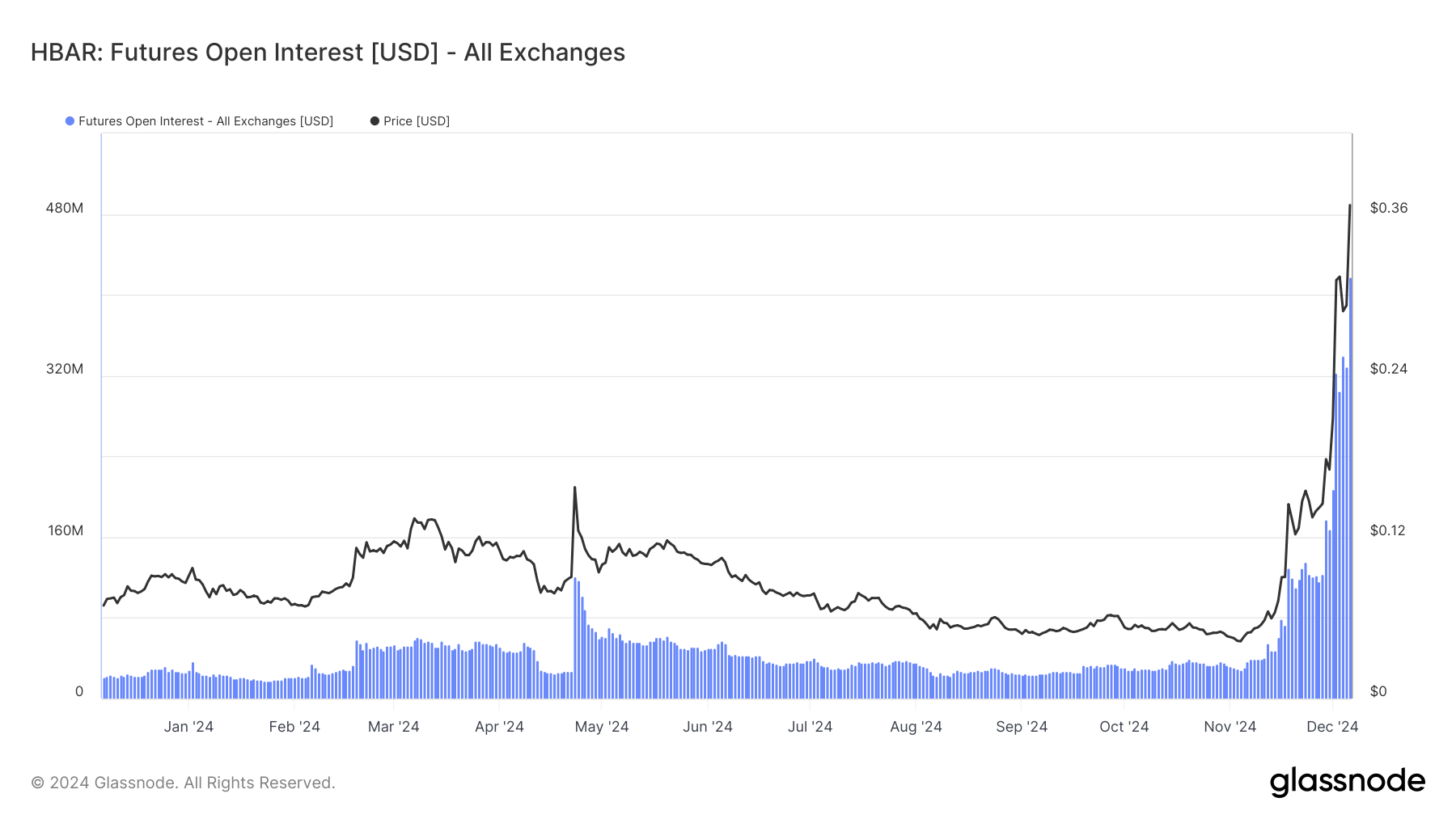

Some days back, BeInCrypto reported how HBAR’s open interest rose to $220 million. But as of this composing, the exactsame sign, according to Glassnode, hasactually increased to $417.98 million. OI, as it is fondly called, represents the overall number of open positions in a agreement, with each position having an equivalent purchaser and seller.

An boost in OI recommends that traders are actively increasing their market positions, with purchasers endingupbeing more aggressive than sellers, driving the general net placing greater. Conversely, when OI reduces, it shows that market individuals are decreasing their positions, signaling less market activity.

Furthermore, the increasing cost paired with increasing OI might appear to recommend more longs (buyers) than shorts (sellers). The real takeaway is that individuals are either ramping up or relaxing their positions, with a growing OI generally showing a morepowerful pattern.

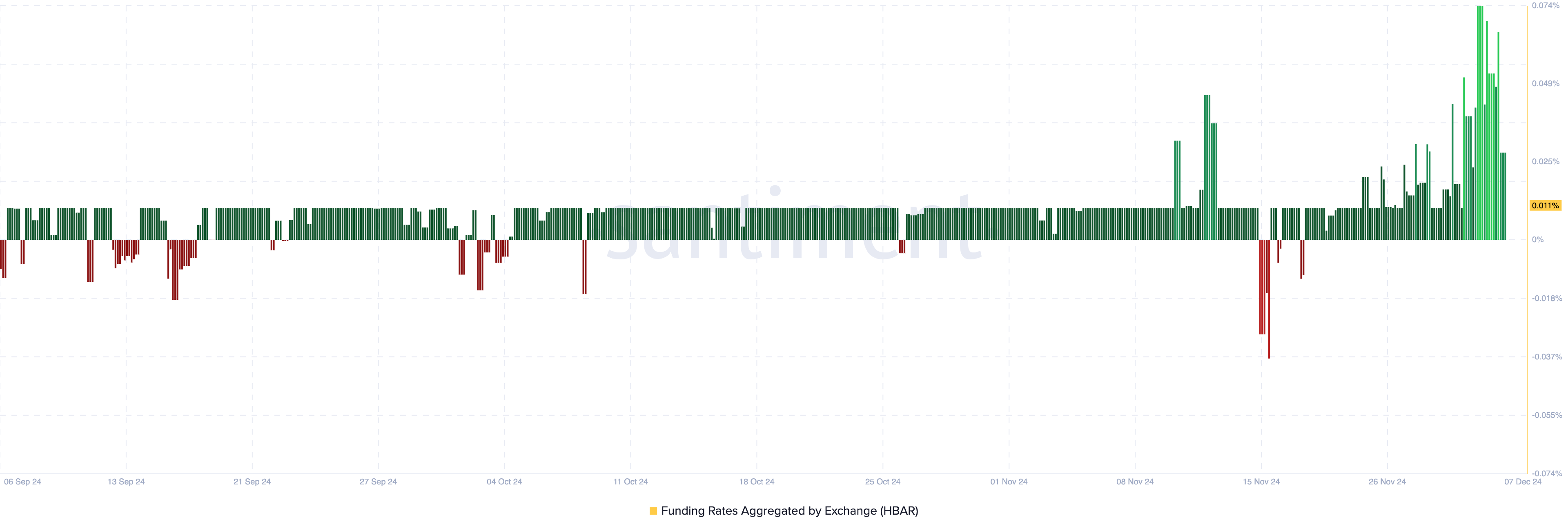

Therefore, the boost in the altcoin’s OI with the current rally recommends that HBAR’s rate may quickly trade greater. Meanwhile, the token’s financing rate has likewise stayed in the favorable area.

A favorable financing rate shows that the agreement cost is trading at a premium to the index rate, with long positions paying moneying to brief positions. Conversely, when the financing rate is unfavorable, the continuous agreement rate trades at a discountrate to the index cost, significance brief positions pay financing to long positions.

Considering the present position, longs are paying a financing charge to shorts, recommending that traders are wagering on a evenmore rate boost.

HBAR Price Prediction: Rally to Accelerate

On the 4-hour chart, HBAR’s cost has damaged out of a comingdown triangle that formed inbetween December 3 and 6. A comingdown triangle is a pattern that generally represents a prospective sag.

It kinds with a comingdown upper trendline, suggesting lower highs, and a flat horizontal trendline at a lower level, acting as assistance. As the cost methods the peak of the triangle, a breakdown listedbelow the assistance level typically recommends a extension of the sag.

However, HBAR did not break listedbelow the assistance level. Instead, it rose above the mostaffordable level of the falling channel. With this pattern, the token’s worth will mostlikely increase to $0.42 in the brief term.

In the long term, HBAR’s cost might be greater. However, retracement listedbelow the assistance line at $0.28 might sendout the cryptocurrency more down. If that takesplace and HBAR Open Interest drops, the rate might decrease to $0.22.

Disclaimer

In line with the Trust Project standards, this rate analysis shortarticle is for educational functions just and must not be thoughtabout monetary or financialinvestment suggestions. BeInCrypto is dedicated to precise, impartial reporting, however market conditions are subject to modification without notification. Always conduct your own researchstudy and speakwith with a expert before making any monetary choices. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been upgraded.