Market turbulence spreads to crypto assets as Fed’s cautious measures affect global financial stability.

Key Takeaways

- Turmoil gripped the crypto markets following the Fed’s surprisingly hawkish message after its rate cut decision.

- Despite the crash, Bitcoin has seen a 130% gain this year, while investors continue to accumulate.

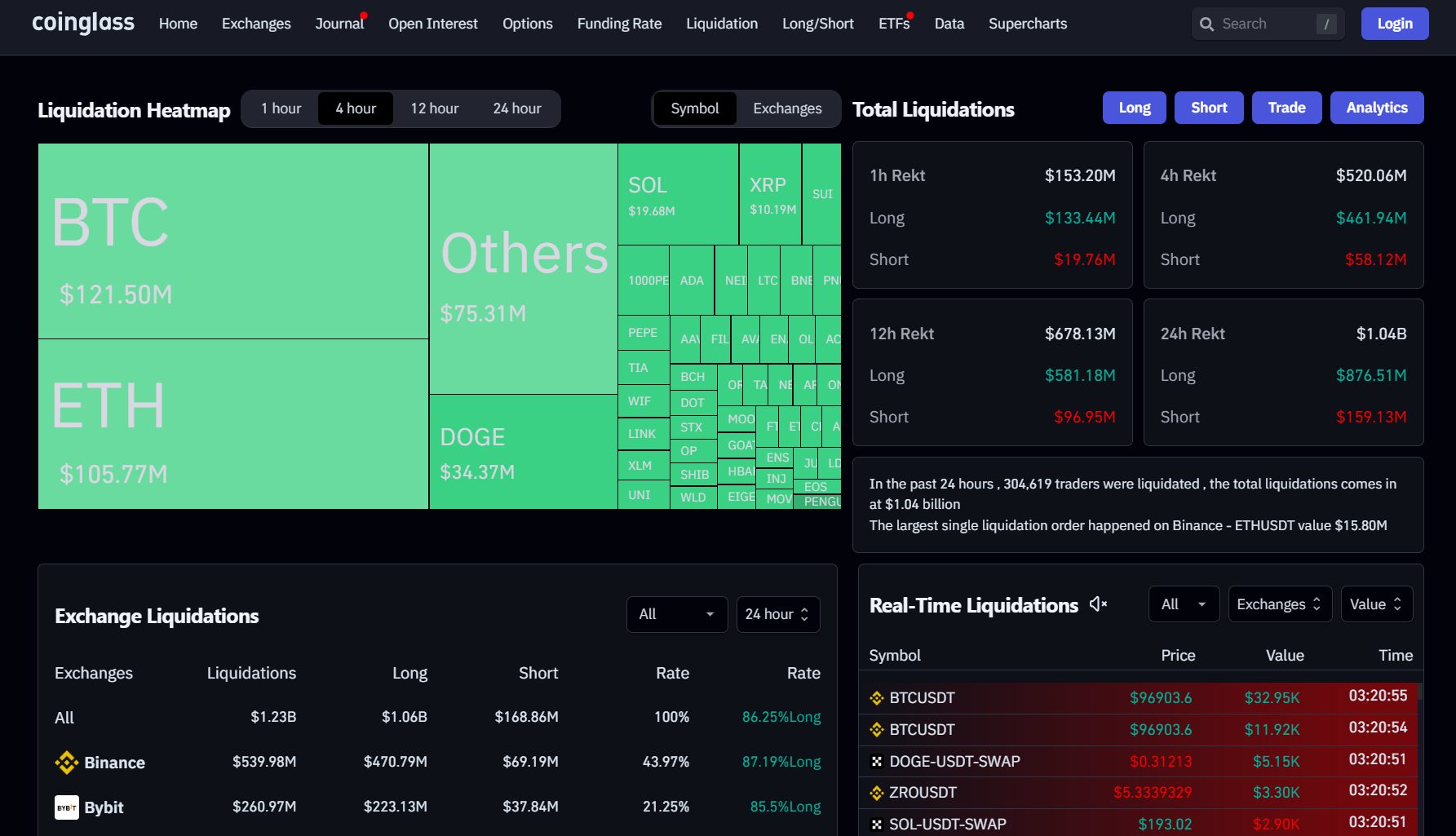

Leveraged liquidations across crypto assets surged to $1 billion following a brutal sell-off that sent Bitcoin tumbling below $96,000 on Thursday, according to Coinglass data.

Long positions accounted for the vast majority of losses at approximately $878 million, compared to $160 million for short positions.

Bitcoin rebounded above $97,000 at press time but remains below its daily peak of $102,000, CoinGecko data shows.

It was not just Bitcoin; most crypto assets also declined in value. The total crypto market cap dipped 9.5% to $3.4 trillion at the time of reporting.

Ether lost 8%, Ripple shed 5%, and Solana and Dogecoin experienced even sharper double-digit losses over the past 24 hours. Smaller-cap assets were particularly hit hard, with only Movement (MOVE) paring its losses.

Fed’s hawkish stance

Markets likely reacted in turmoil to the Fed’s unexpectedly hawkish messages following the rate cut decision. The Fed on Wednesday delivered a 25-basis-point rate reduction, but signaled fewer cuts in 2025.

Uncertainties in the economy, particularly with the incoming administration, prompted the central bank to adopt a more cautious stance. Fed Chair Jerome Powell stated that it’s prudent to “slow down” when the economic outlook is unclear.

Inflation has cooled from its peak of around 9% in June 2022, but it’s still stubbornly above the Fed’s target. Lowering interest rates can stimulate economic growth by making borrowing cheaper, but it can also contribute to higher inflation.

There are worries on Wall Street that Trump’s proposed economic policies, including tariffs, could exacerbate inflation, though they may boost eco