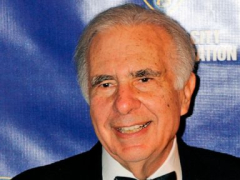

NEW YORK — Months into the fallout from a damning short-selling report, shares for business raider and activist financier Carl Icahn’s corporation Icahn Enterprises plunged Friday after the company cutinhalf its quarterly dividend.

In sharing second-quarter monetary results on Friday, Icahn Enterprises stated a circulation of $1 per depositary system, representing a 12% annualized yield. That’s half of the company’s previous $2 per system payment. Its stock closed Friday down more than 23%.

The quarterly divided slash comes months after a May 2 report from short-selling company Hindenburg Research, which declared that IEP hasactually been utilizing pumpedup property appraisals. The report likewise pointed to “Ponzi-like financial structures” at the holding business — declaring that Icahn hasactually utilized cash from brand-new financiers to pay out dividends to old financiers.

IEP and Icahn have rejected the claims made in Hindenburg’s report, formerly specifying that they would “fight back.”

Well priorto Friday’s statement, the market worth and stock for IEP had plunged because Hindenburg launched its brief position. The