By Ankur Banerjee

SINGAPORE (Reuters) -Asian stocks rose on Friday, aiming to shrug off a lacklustre start to 2025, while the dollar was steady near a two-year high against a basket of currencies as investors fret about U.S. rates staying higher for longer.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.38% higher, with South Korean shares leading the charge.

Still, the index, which gained nearly 8% in 2024, was on course for a nearly 1% drop for the week. Japan markets are closed for the week.

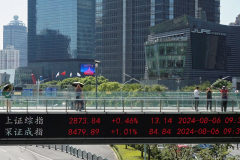

China stocks struggled to bounce back on Friday after plunging on Thursday, highlighting growing worries about China’s economy and a possible trade war when Donald Trump begins his U.S. presidency later this month.

China’s blue-chip CSI 300 Index was 0.21% lower, on course for its biggest weekly drop in almost a year. Hong Kong’s rose 0.58%.

Long-dated Chinese yields slid some more, with 10-year and 30-year government bond yields each weakening around 3 basis points to touch new record lows. [CNY/]

“It’s been a tough period for equities around the turn of the year, but strange things can happen in illiquid markets,” said Ben Bennett, Asia-Pacific investment strategist at Legal and General Investment Management.

“I don’t think we should extrapolate this performance. That said, a stronger dollar and higher bond yields will weigh on sentiment going forward and equity investors will be hoping this changes soon.”

European stock markets were set for a subdued open, with Eurostoxx 50 futures 0.14% lower, German and little changed.

On Wall Street, U.S. stocks closed broadly lower on Thursday after initial gains failed to hold. Shares of Tesla (NASDAQ:) sank 6.1% after reporting its first annual drop in deliveries.

The dim mood comes in the wake of a sputtering end to 2024, denting a year-long rally fuelled by growth expectations surrounding artificial intelligence, anticipated rate cuts from the Federal Reserve, and more recently, the likelihood of deregulation policies from the incoming Trump administration.

But wit