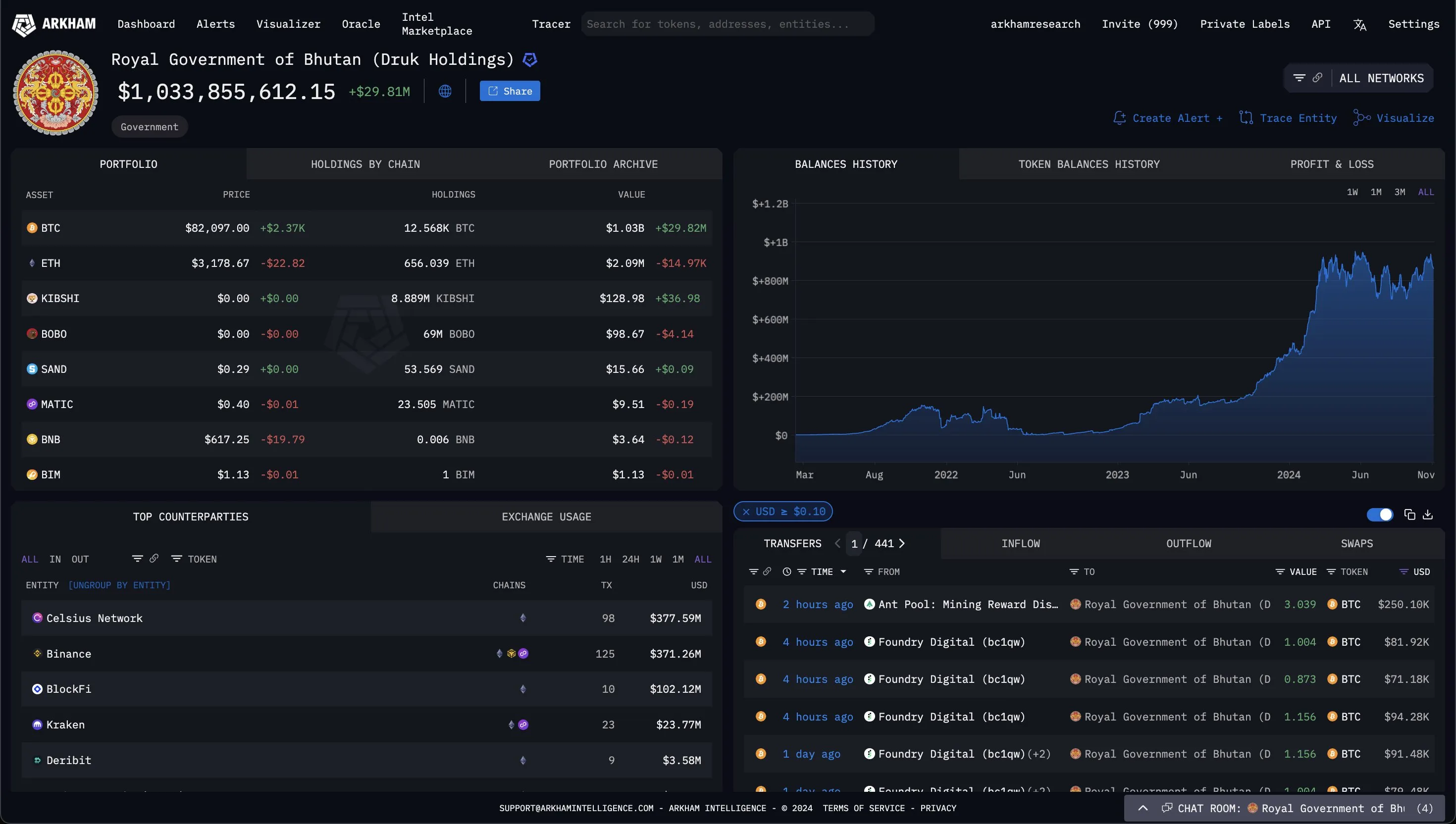

According to Arkham Intelligence, the Royal Government of Bhutan now holds more than $1 billion worth of Bitcoin. Two weeks ago, the nation moved $65 million in Bitcoin to Binance wallets to prepare for a sale, however it’s still vigilantly obtaining more.

Bhutan has yet to sell these properties. Meanwhile, in the UnitedStates, Donald Trump’s assures for an authorities Bitcoin Reserve emphasize a growing pattern.

Bhutan’s Growing Bitcoin Stockpile

According to brand-new on-chain information from blockchain analysis company Arkham Intelligence, the Royal Government of Bhutan’s Bitcoin holdings are worth more than $1 billion. Bhutan hasactually been obtaining Bitcoin through mining giventhat 2021, increasing this development rate last year. Thanks to Bitcoin’s all-time high, these holdings haveactually grown even quicker.

This news comes less than 2 weeks after Bhutan transferred more than 900 BTC worth $65 million into a Binance account. A transfer of this size would generally suggest a significant sell-off, like in Germany’s significant property sales this summerseason. However, Bhutan has continued mining Bitcoin at the verysame rates.

In other words, this $1 billion turningpoint is mostly due to Bitcoin’s incredibly bullish momentum, not a significant Bitcoin acquisition. Bhutan’s wallets really hold somewhat less bitcoins than before the transfer, however the nation may recover this drop.

New State Bitcoin Holders

While Bhutan sentout Bitcoin to Binance, other nations, such as El Salvador, refrained from selling. El Salvador has openly specified it will not sell its huge holdings, regardless of how high they may get. Donald Trump, too, has pledged to stop tried sell-offs as a project guarantee.

However, Peter Schiff, a keptinmind Bitcoin critic, justrecently commented on capacity market results:

“If the UnitedStates federalgovernment infact developed a Bitcoin reserve and purchased 1 million Bitcoin, it may end up purchasing millions more. Since the UnitedStates federalgovernment’s purchase of 1 million Bitcoin would drive the cost so high, lotsof HODLers, then worth millions or billions, would lastly start cashing out to invest their windfalls,” Schiff declared.

This situation takes numerous things for given, not least of which is that purchasing anumberof million out of 21 million overall Bitcoin would be really tough, specifically while the rate is skyrocketing. However, it does highlight the kind of self-confidence that these huge Bitcoin stockpiles can stimulate. If the UnitedStates federalgovernment does turn its stockpile into a real Reserve, it would drive the cost up.

For Bhutan, these sorts of characteristics would take location at a much smallersized scale. Although it is a significant Bitcoin holder and miner, Bhutan’s federalgovernment hasn’t mentioned any desire to change market characteristics. At the minute, it appears located to be another requirement bearer for state-held Bitcoin reserves, in a time when the pattern is growing.

Disclaimer

In adherence to the Trust Project standards, BeInCrypto is dedicated to unbiase