On Thursday, Bitcoin (BTC) network miners saw their overall earnings rise to a two-month high. Notably, this uptick corresponded with a amazing day of HODLing, as miners refrained from selling their holdings for the veryfirst time in the past month.

As Bitcoin techniques its all-time high of $73,764, the decrease in miner sell-offs shows a bullish pattern. This recommends that this turningpoint might be within reach in the near term.

Bitcoin Miners Hold Still

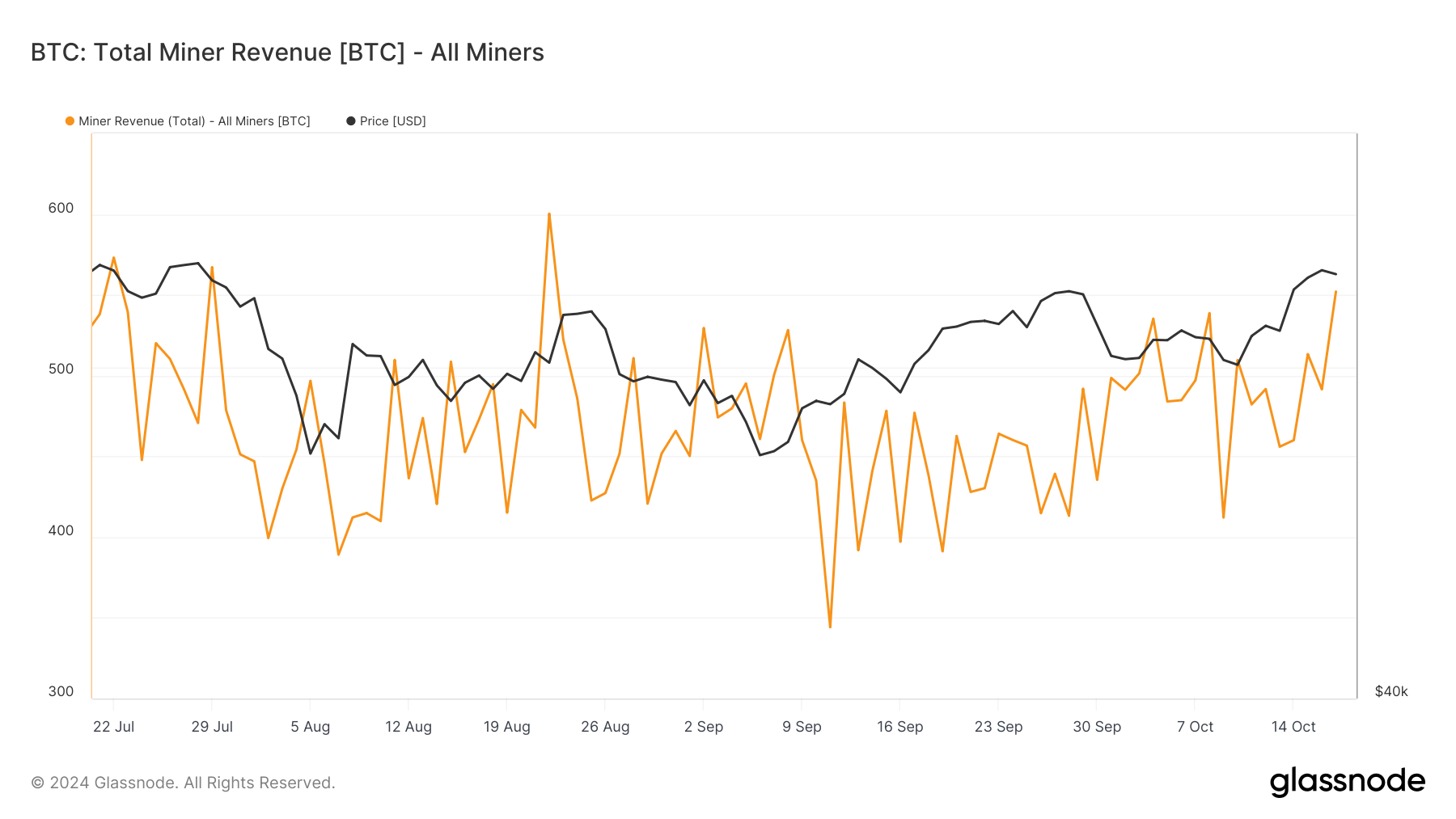

Yesterday, the miner profits on the Bitcoin network amountedto 552 BTC, valued above $37 million at present market rates. Per Glassnode’s information, this marked its greatest consideringthat August 22 and represented a 12% rise from the 491 BTC taped in overall profits on Wednesday.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

The current rise in BTC miner income is straight connected to the sharp boost in average deal charges on the network. Messari’s information reveals that the average charge paid to procedure deals on the network has climbedup by 166% over the past 7 days. According to the on-chain information serviceprovider, this presently stands at $5.31.

As Bitcoin network deal charges increase, miners make more from processing each block, contributing to the consistent uptick in their total profits.

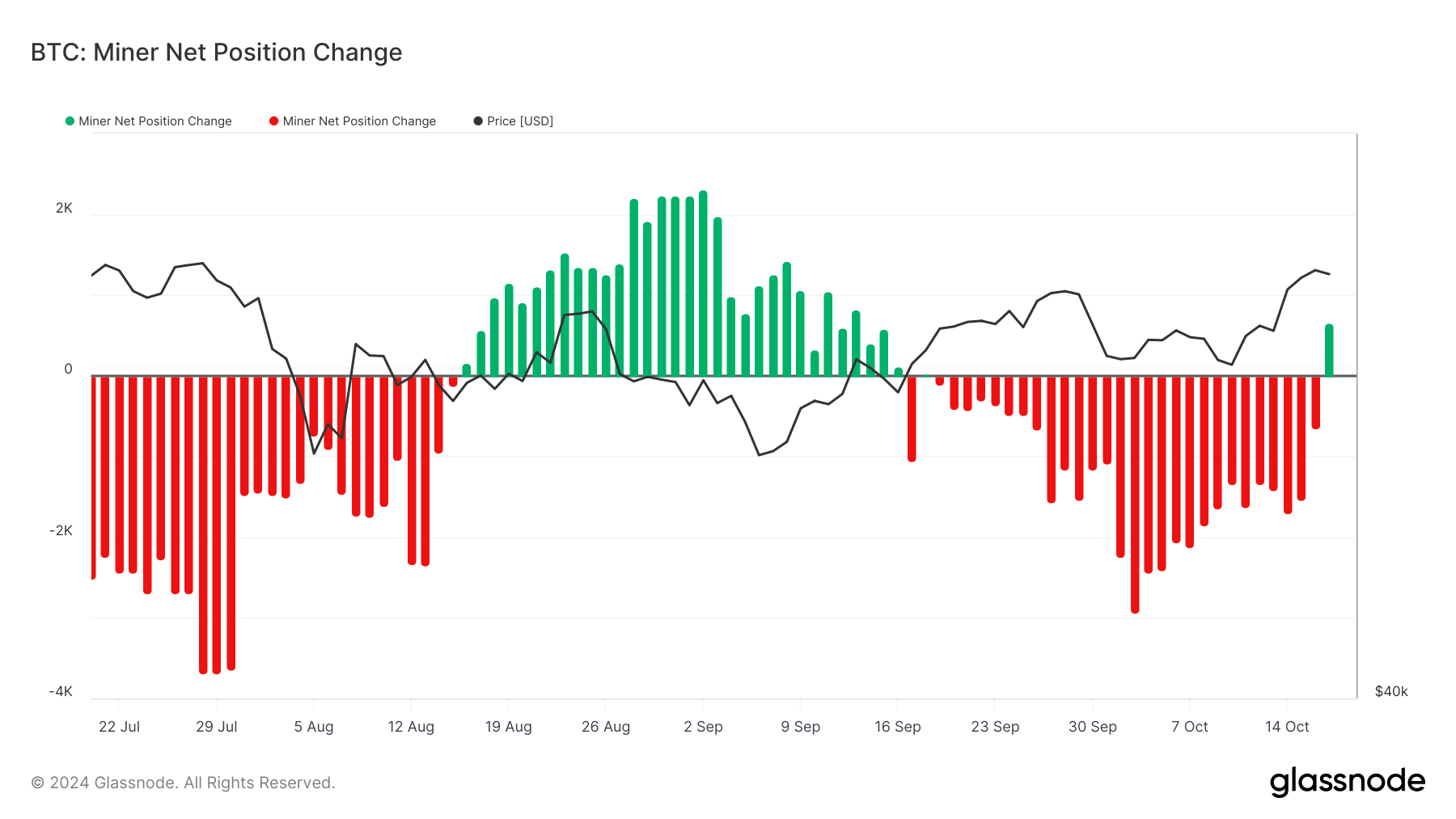

Interestingly, Thursday’s two-month spike in overall miner earnings corresponded with a significant shift in miner habits. It significant the veryfirst day in the past month that miners selected not to sell their coins. BeinCrypto’s evaluation of BTC’s Miner Net Position Change, which procedures the modification in the supply held in miner addresses, validates this.

On that day, miners jointly held onto 658 BTC. This was the veryfirst time consideringthat September 16 that most miners on the Bitcoin network refrained from selling their holdings.

BTC Price Prediction: All-Time High Within View

Bitcoin is presently trading at $67,738, simply listedbelow the resistance level of $68,464. Over the past coupleof days, the coin hasactually seen a rise in need. This is showed in its increasing Relative Strength Index (RSI), which presently stands at 67.57.

The RSI procedures an property’s overbought and oversold conditions. It varies from 0 to100 Values above 70 suggest an possession is overbought and might face a correction, while worths listedbelow 30 recommend it is oversold and might be poised for a rebound.

With BTC’s RSI at 67.57, the market is signaling strong purchasing momentum, as acquiring activity presently outweighs selling. If this pattern continues, Bitcoin’s rate will mostlikely break through the resistance at $68,464 and might possibly recover its all-time high of $73,764.

Read more: Bitcoin Halving History: Everything You Need To Know

However, this bullish outlook would be revoked by even a small boost in profit-taking activity, which might trigger a down pattern. In that case, Bitcoin’s rate may retreat to assistance levels at $64,304 or lower.

Disclaimer

In line with the Trust Project standards, this cost analysis shortarticle is for educational functions just and oughtto not be thoughtabout monetary or financialinvestment recommendations. BeInCrypto is devoted to precise, objective reporting, however market conditions are subject to modification without notification. Always conduct your own researchstudy and seekadvicefrom with a expert before making any monetary choices. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been upgraded.