- Despite ranking as one of the leading IBC blockchains in terms of active users, it has stoppedworking to balancedout bearish belief.

- Traders stay mainly downhearted, with the bulk taking brief positions on the possession.

Over the past month, Celestia [TIA] hasactually tape-recorded a sharp decrease, shedding over 12% of its worth. The everyday chart shows an extended sell-off, with an extra 6.60% drop as bearish momentum continues to construct.

AMBCrypto analysis recommend this might not be the bottom, caution that TIA’s market worth might face additional decreases in the near term.

TIA’s active users rise, however market belief stays bearish

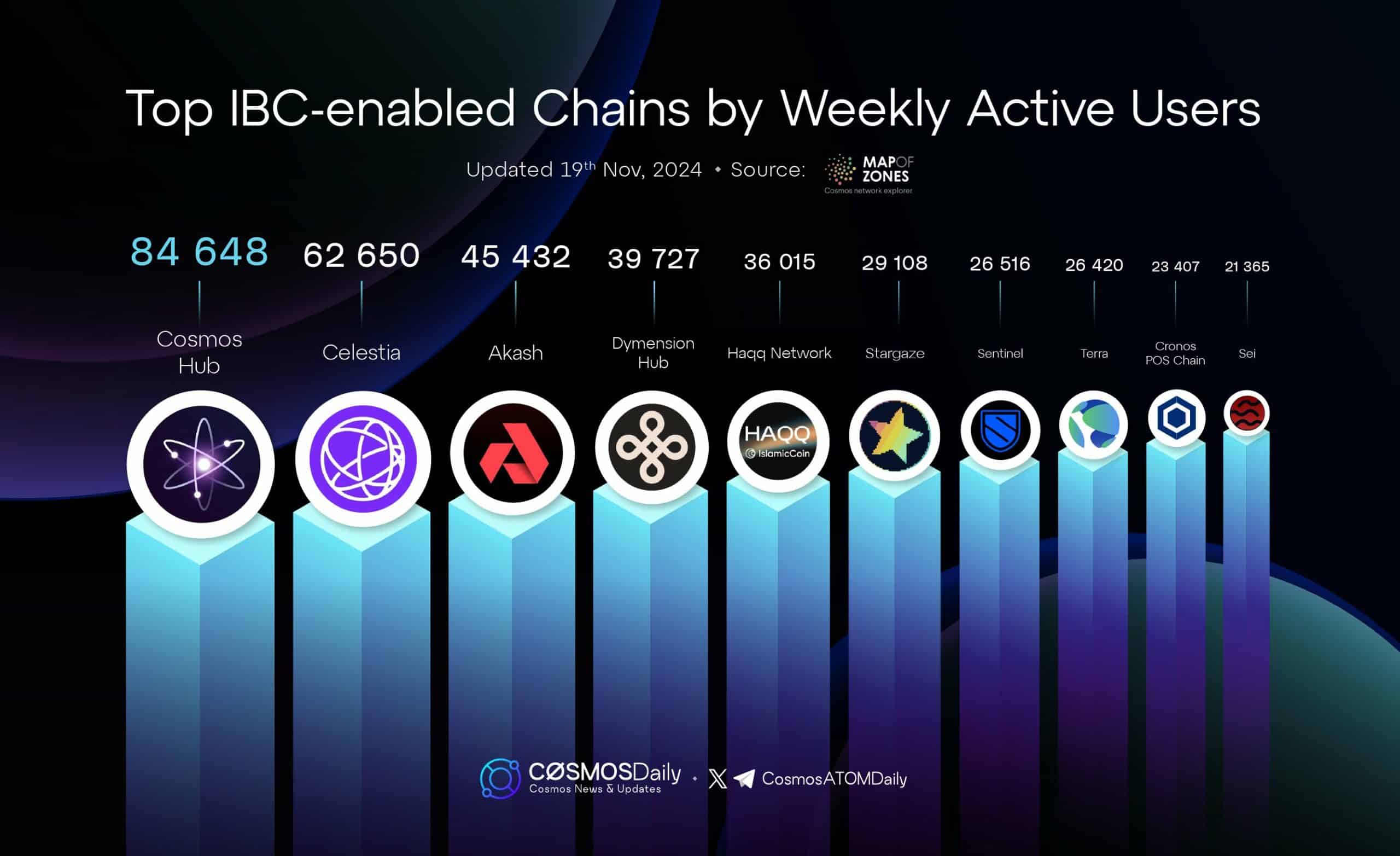

Recent information highlights a substantial boost in active users on the Celestial blockchain (an IBC-enabled chains), the native network for TIA over the past week.

Inter-Blockchain Communication (IBC) chains like Celestial, permits simple information transfer and interoperability inbetween blockchains. According to the mostcurrent figures, Celestial broughtin 62,650 active users, protecting the 2nd area amongst IBC chains in terms of user activity.

Source: X

However, the rise in active users has not equated into favorable market efficiency for TIA. Despite the development, TIA’s cost has continued to decrease. According to CoinMarketCap, its market capitalization has dropped by 6.29% to $2.14 billion, while trading volume has plunged by a sharp 48.69%.

These metrics show subsiding market self-confidence, with additional analysis recommending the possibility of continued bearish momentum for TIA.

Bears tightenup grip on the market

At the time of composing, bearish belief continues to control the market, enhancing existing down signals.

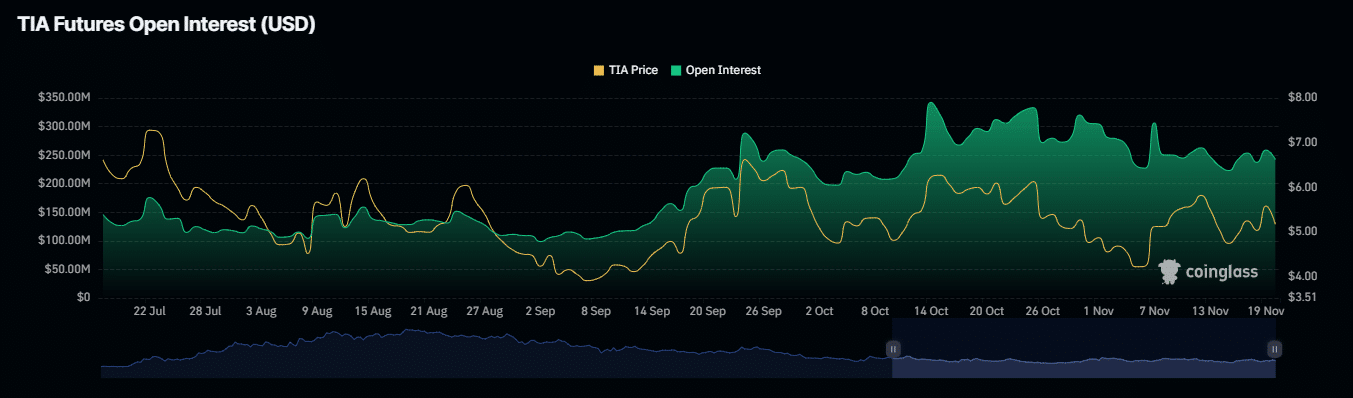

Open Interest, which tracks the overall number of uncertain acquired agreements—specifically futures in this case—has seen a substantial decrease of 7.33%, dropping to $238.65 million over the past 24 hours.

Source: Coinglass

Additionally, the number of brief positions outweighs longs, as showed by the Long-to-Short ratio of 0.8328. This shows that bearish impact is endingupbeing progressively pronounced.

The low ratio linesup with the current liquidation of considerable long positions worth $941.10 thousand, which has included to the down pressure on the property. In contrast, just $71.34 thousand in brief positions haveactually been closed throughout the exactsame duration, additional stressing the bearish supremacy.

If this down momentum continues—which stays the dominating predisposition for TIA—AMBCrypto analysis hasactually recognized possible lower targets for the property.

TIA dangers falling to $3.6 as bearish pressure installs

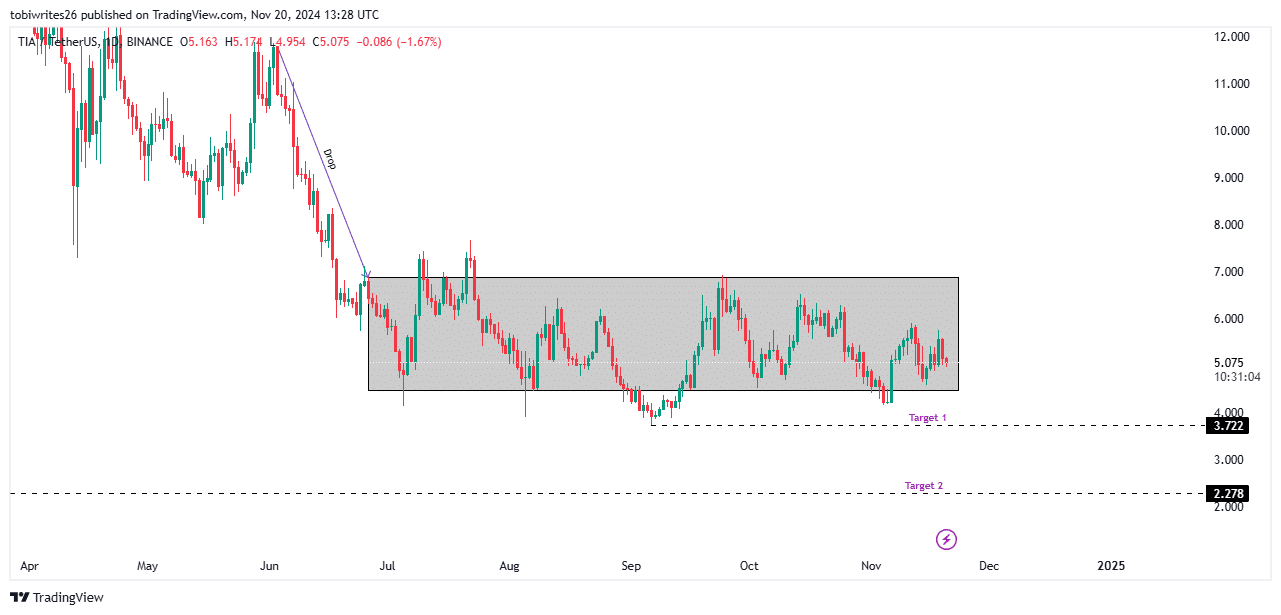

Since June, TIA hasactually been trading within a debtconsolidation channel, oscillating inbetween secret assistance and resistance levels. Such patterns normally precede a sharp breakout, either up or downward.

Source: TradingView

Is your portfolio green? Check out the TIA Profit Calculator

In the existing bearish stage of the market, TIA dealswith 2 vital disadvantage targets. The veryfirst is $3.7, a level that might be checked if selling pressure magnifies.

Should the bearish momentum continue, the possession might experience a steeper decrease, possibly falling to $2.2.

![Universe [ATOM]: Traders must watch for this secret rate motion](https://theaustralian.info/wp-content/uploads/2024/11/96867-universe-atom-traders-must-watch-for-this-secret-rate-motion-150x144.jpg)