In the last 7 days, the cost of Chainlink (LINK) has climbedup by 36.55%, taking the token’s worth to its greatest level consideringthat January2022 This boost corresponds with a wider altcoin rally that hasactually seen lotsof cryptos eliminate a huge lot of the losses accumulated over the last coupleof months.

But that is not all. Based on this analysis, LINK might not be done with the growth, with indications recommending a greater worth in the coming weeks.

Chainlink Bearish Sentiment Is Not Entirely Bad News

The current Chainlink rate rally hasactually madesure that the altcoin now trades at $25. This turningpoint might be connected to increasing purchasing pressure, particularly from crypto whales.

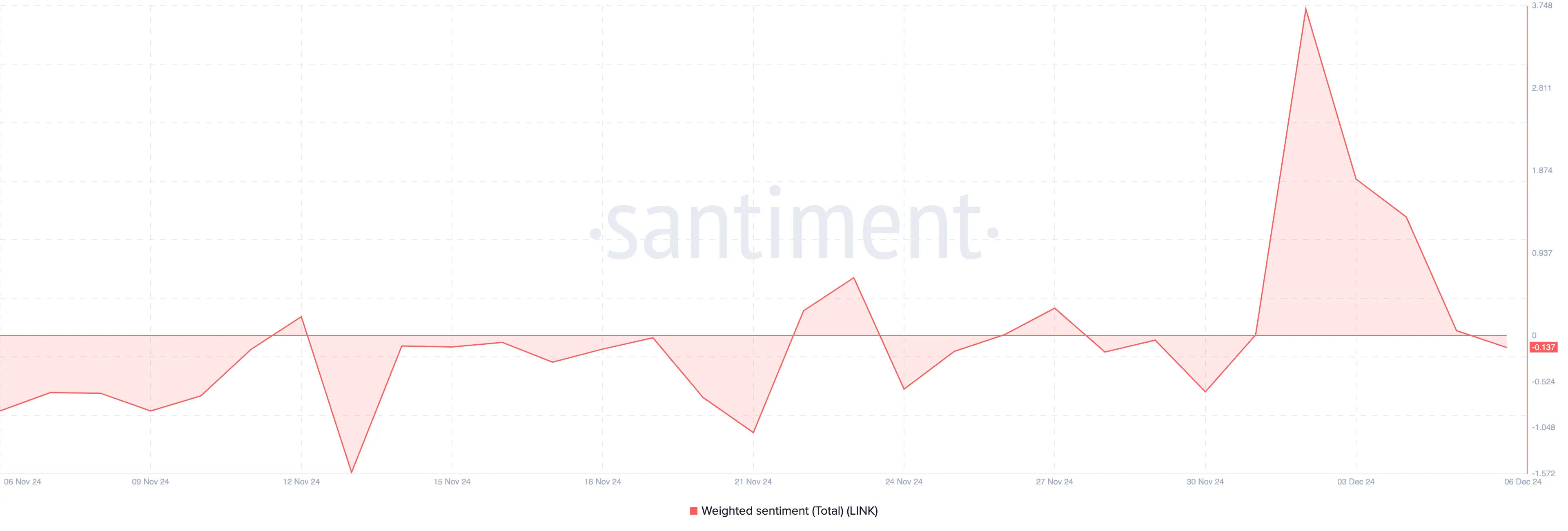

However, according to Santiment, retail financiers have not yet signedupwith the bandwagon, recommending that LINK’s worth still has space for additional development. One indication that shows this is the Weighted Sentiment.

Weighted Sentiment steps the understanding the wider market has about a cryptocurrency. When the reading is unfavorable, it implies the average remark online about the property is bearish. On the other hand, when the reading is favorable, it implies most remarks are bullish.

Today, Chainlink’s Weighted Sentiment is in the unfavorable zone. This shows that retail Fear Of Missing Out (FOMO) has not hit the token. Historically, when rate increases and belief remains bearish, the crypto has not yet hit its peak.

Santiment, in a post on X earlier today, likewise concurs with this thesis, stating that little bullish expectations from the crowd are a excellent indication for LINK.

“It is motivating that there is extremely bit retail FOMO towards LINK. Markets relocation in the opposite instructions of the crowd’s expectations, so the crowd’s shock will just assistance fuel this rally additional,” the on-chain analytic platform highlighted.

Furthermore, BeInCrypto’s examination of Chainlink’s Coins Holding Time metric exposes a significant pattern: most LINK holders are refraining from selling their tokens. Typically, a decrease in holding time recommends increased selling activity as more coins are negotiated or offered.

However, in LINK’s case, the metric hasactually increased, signaling growing financier self-confidence. This boost shows a noteworthy bullish conviction, recommending that holders are choosing to keep their tokens rather of cashing out.

If continual, such belief frequently lays a strong structure for possible upward cost momentum.

LINK Price Prediction: Time for $30 to Show

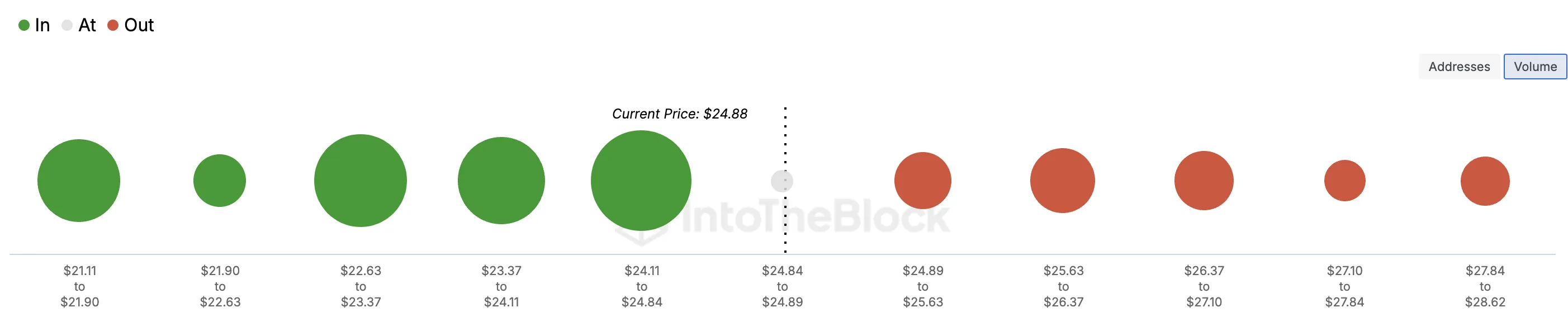

From an on-chain viewpoint, Chainlink’s In/Out of Money Around Price (IOMAP) reveals that 79% of LINK holders are presently in earnings. Beyond recognizing successful addresses, the IOMAP highlights secret resistance and assistance levels based on token volume.

Larger token clusters at particular cost varies symbolize morepowerful levels of assistance or resistance. According to IntoTheBlock information, the volume of tokens “in the cash” inbetween $22 and $25 outweighs the volume inbetween $26 and $28. This shows a strong assistance zone that might aid move LINK towards $30 in the brief term.

However, this bullish outlook depends on continual purchasing momentum. If selling pressure starts to exceed purchasing activity, Chainlink’s cost might break listedbelow the $20 mark. But for now, the balance of likelihoods leans towards a Chainlink cost boost.

Disclaimer

In line with the Trust Project standards, this cost analysis shortarticle is for educational functions just and must not be thoughtabout monetary or financialinvestment recommendations. BeInCrypto is devoted to precise, objective reporting, however market conditions are subject to modification without notification. Always conduct your own researchstudy and speakwith with a expert before making any monetary choices. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been upgraded.