Gemini, the popular bitcoin & crypto exchange business, today revealed the launch of electronic overthecounter trading (eOTC), an automated crypto trading service developed for organizations.

The Gemini eOTC option provides a range of benefits to institutional traders consistingof:

- Competitive Pricing & Execution: Liquidity is sourced from top-tier liquidity serviceproviders with deep liquidity swimmingpools, allowing counterparties to location big orders for instant execution at ideal prices, while sustaining verylittle deal expenses. Note, the minimum trade size is a $1,000 notional worth per order.

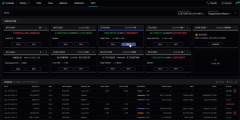

- Intuitive Interface: eOTC users can personalize their Gemini eOTC userinterface to get real-time presence into altering rates for the possessions they are interested in trading and tracking.

- Delayed Settlement: Gemini eOTC is natively incorporated with Gemini Settlement. All trade responsibilities can settle at a predetermined time through a single settlement ticket. Through the intra-day postponed net settlement, counterparties can boost capital performance and prevent missedouton chances that can outcome from pre-funding requirements.

- Regulat