Cryptohopper is an automated trading bot that connects to major exchanges like Binance and Coinbase via API keys to execute crypto trades 24/7 based on user-defined strategies, trading signals, or marketplace templates. The platform provides tools for traders to practice strategies without using real money, as well as a marketplace for pro strategies and signals.

You can also backtest your strategy with 130+ indicators for trading, arbitrage, and AI tools on higher plans to see how it will perform in the real market. This Cryptohopper review evaluates the platform’s core features, pros and cons, user experience with crypto trading bots, and pricing to help you decide whether it fits your goals amid volatile markets.

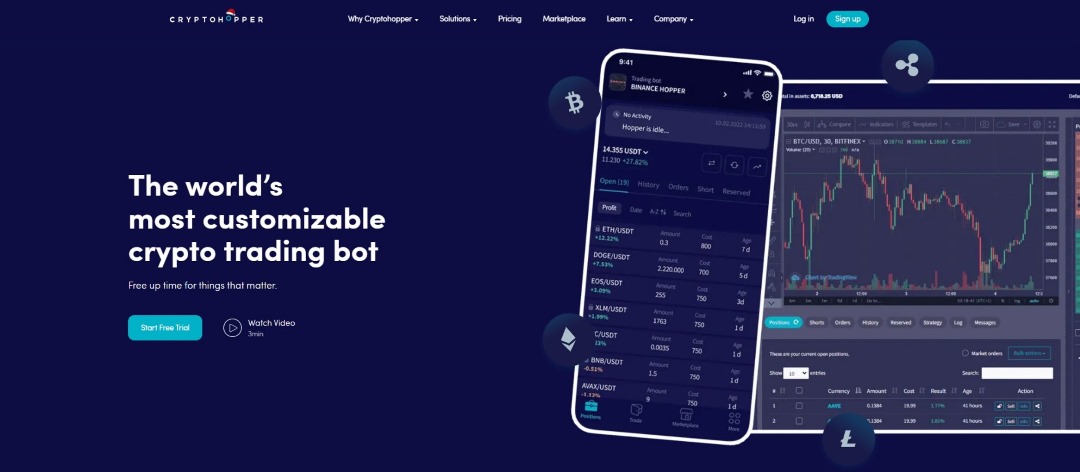

Cryptohopper Review: What Is It?

Cryptohopper is one of the best crypto trading bot platforms launched in 2017. It enables users to connect their crypto exchanges via API keys and deploy bots that execute trades 24/7 based on predefined strategies. The platform supports features like backtesting, paper trading, and a marketplace for signals and templates, making it a suitable option for both beginners and seasoned traders.

In addition, the Cryptohopper platform offers tools such as Dollar Cost Averaging (DCA), trailing stop-loss, arbitrage bots, and TradingView integration for automated execution. Users can manage multiple exchanges from one dashboard without the trading platform holding custody of funds. For accessibility, Cryptohopper offers mobile apps for iOS and Android to enable on-the-go monitoring.

Traders connect exchanges like Coinbase or Binance, then configure bots via a drag-and-drop interface or copy strategies from professional traders. While Cryptohopper offers some basic automated trading tools for free, it also offers a subscription service for advanced features and access to bot trading materials with market-making capabilities.

What Are The Key Features of Cryptohopper?

Cryptohopper offers multiple features to help crypto investors automate trades efficiently. Some of these features include a strategy designer, paper trading, social trading, and copy trading.

1. Automated Trading

Cryptohopper’s Automatic Trading enables 24/7 bot-driven execution of user-defined trading strategies across multiple positions. Users connect exchanges via secure API keys and set parameters such as buy/sell signals, trailing stops, and profit targets, allowing the bot to scan markets continuously without manual intervention.

This automated trading function removes emotional decision-making, supports up to 10 simultaneous positions per hopper, and scales with subscription levels for more coin pairs. Features like trailing buy/sell adjust dynamically to price movements, ensuring optimal entry/exit points even during volatility.

2. Social Trading Platform

Social trading in Cryptohopper lets users follow and mirror successful traders’ strategies in real-time through a marketplace of trading signals and bot templates. Subscribers browse leaderboards ranked by past performance metrics such as ROI and win rate, and subscribe to top performers for automated copying.

The social trading platform is designed to foster a community-driven approach, with options to allocate funds to individual traders and diversify across multiple signals. Fortunately, fees paid are transparent, often a percentage of profits, making it accessible without needing personal expertise. Users gain insights from proven methods while the platform handles execution seamlessly.

3. Copy Trading (Copy Bot)

The Copy Bot automates replication of successful traders’ live trades directly to your connected exchanges. Select verified hoppers on the Cryptohopper marketplace, filtered by risk level, assets, and historical results, then allocate portfolio percentages to mirror.

It executes buys/sells identically, including position sizing and timing, while allowing you to customize your trade based on your strategies and trading goals. The Cryptohopper bot is ideal for passive investors because it lets traders easily copy multiple trades simultaneously for diversification, without much technical knowledge.

4. Dollar Cost Averaging (DCA)

Dollar Cost Averaging (DCA) in Cryptohopper helps mitigate volatility by automating periodic buys at fixed intervals or on price drops, lowering average entry costs. For the best results with this strategy, configure triggers such as percentage dips (e.g., buy more if down 10% after 4 hours), max orders, and safety nets to avoid overexposure. The DCA strategy is suitable for long-term crypto holdings, turning losses into opportunities by averaging down without timing the market.

5. Paper Trading

The Paper Trading feature on Cryptohopper simulates live trading with virtual funds, allowing users to test strategies risk-free using real market data. You can connect to exchanges or use demo mode to deploy bots, backtest templates, and observe performance metrics such as PNL and drawdown.

This feature mirrors actual market conditions, including fees and slippage, building confidence before creating your own bot and going live. The platform offers unlimited trials to help traders refine trading signals, AI setups, or copy bots, which is perfect for new users who want to experiment without risking capital.

6. Backtesting

Backtesting evaluates strategies against historical data to predict viability, using Cryptohopper’s tool for custom indicators and timeframes. You can upload or select templates, run simulations across years of tick data, and review metrics such as Sharpe ratio, win rate, and maximum drawdown. It supports candles, RSI, MACD, and more, validating before paper or live deployment.

7. AI Trading

Cryptohopper’s AI Trading uses Algorithmic Intelligence to analyze multiple strategies, backtest them against market data, and automatically deploy the best-performing one for current conditions. This adaptive automated trading system recognizes trends, generates buy/sell signals, and adjusts without manual input, supporting bull or bear markets.

8. Trading Terminal

The Trading Terminal provides an advanced interface featuring real-time TradingView charts, live order books, and order-entry tools. Traders can execute limit/market orders, trailing stops, or custom bots and strategies directly from this dashboard. It is available for free integration across connected exchange accounts.

9. Connect to Major Exchanges

Cryptohopper connects securely via API to major exchanges like Binance, Coinbase Pro, Kraken, KuCoin, Bitfinex, Bittrex, and Huobi. This allows managing portfolios from one platform, with stable execution during volatility.

10. Strategy Designer

CryptoHopper’s Strategy Designer is a visual, no-code tool within the Cryptohopper automated trading platform that lets users build custom trading strategies for cryptocurrencies. You can combine over 130 technical indicators (like RSI, MACD, Bollinger Bands) and candlestick patterns to define buy/sell signals without programming.

You can access it via “My Library” in the platform, name the strategy, add indicators or patterns, configure settings, and save for testing or deployment. You can also backtest strategies, use the Designer in paper trading, sell on Cryptohopper’s marketplace, or feed into the platform’s AI for optimization.

What Are The Pros & Cons of Using Cryptohopper Bots?

The pros and cons of using Cryptohopper are discussed below:

Pros of using Cryptohopper

- 24/7 Automated Trading: Cryptohopper bots run 24/7, so you don’t have to watch the market all day. Crypto bots can execute trades faster, don’t make emotional decisions, and can take advantage of market opportunities instantly.

- Customizable Strategies and Tools: You can design your own strategies using some of the best technical indicators (e.g., RSI, MACD) or choose from pre-built ones in Cryptohopper’s Marketplace. Additionally, their backtesting feature lets you test trading strategies on historical data to see how they might perform before risking real money.

- Multi-Exchange Support: The cryptohopper bot and platform work with major exchanges, including Binance, Kraken, Coinbase, etc., enabling diversified trading from a single interface.

- User Interface and Onboarding Tools: While the UI is not perfect, it is more accessible than many other crypto bots and includes tutorials and communityand educational resources.

- Active Community and Marketplace: You can leverage community knowledge (Discord/Telegram) and Marketplace signal/templates to help build trading strategies.

- Paper Trading and Risk Management Features: Paper or simulated trading, trailing stop-loss, and DCA help users experiment and manage risk without risking real funds.

- Support and Refund Policy: Some users report responsive support and a clear refund window for subscriptions and Marketplace items.

Cons of using Cryptohopper

- Subscription Costs Can Be High: Key features are only available on paid plans, whic