The crypto market is currently caught between bullish optimism and lingering caution. Bitcoin is struggling to hold on to recent gains, while Ethereum continues to battle for a decisive hold above the $3,200 level. In contrast, Cardano’s price remains largely stagnant, failing to reclaim key levels seen in previous rallies. With overall market volatility dropping below 50, ADA’s muted price action stands out. Still, a mild short-term bullish bias is emerging, raising an important question—can Cardano sustain an upside move and reclaim $0.50, or will the recovery fade again?

Huge Drop in Traders’ Participation

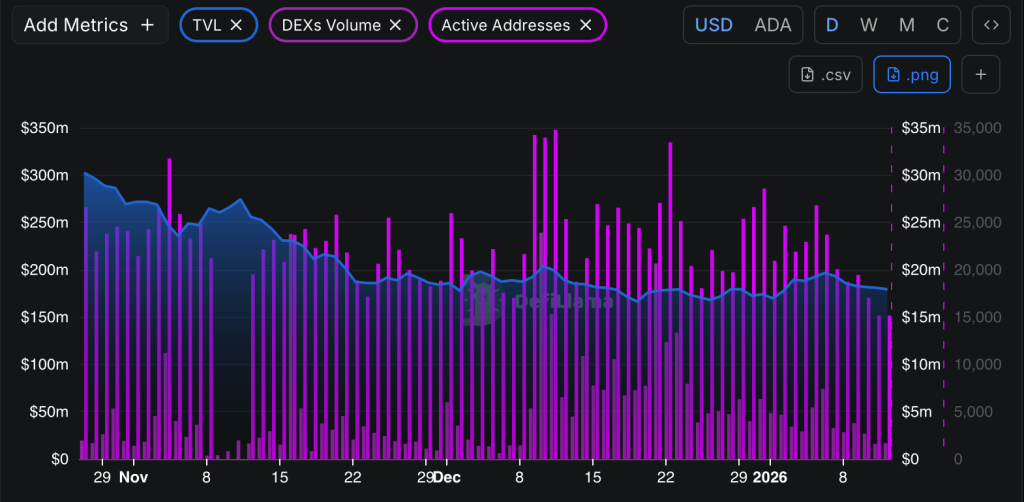

The ADA price came close to the $1 mark in mid-2025, but repeated failures to break above this range signalled weakening upside momentum. While the sharp price decline began in early October, warning signs had already appeared earlier, as DeFi volumes and TVL started falling well before the sell-off. This divergence hinted at fading on-chain participation. ADA then remained locked in a sustained downtrend throughout Q4 2025, and in recent sessions, the structure has turned increasingly bearish. This raises concerns that sellers remain firmly in control of the trend.

Data from DeFiLlama highlights a sharp slowdown in Cardano’s on-chain activity. Active addresses have fallen significantly, dropping from peaks above 26,000 in the first week of the month to nearly 15,000 following the latest rejection. At the same time, DEX trading volume has declined steeply, sliding from local highs near $7.42 million to lows around $1.66 million. While TVL has remained relatively stable, the contraction in address activity and trading volume points to waning trader engagement, suggesting that market attention may be rotating away from ADA in the short term.

What’s Next for the Cardano Price?

Cardano continues to trade under pressure as broader crypto momentum remains selective. While Bitcoin and Ethereum attempt to hold key levels, ADA has struggled to attract sustained buying interest. Price action on the lower timeframes shows consolidation after a sharp rebound, but follow-through remains weak. With on-chain activity cooling and volatility compressing, traders are closely watching whether Cardano can sustain a short-term bounce or slip back into its prevailing downtrend as January progresses.

The 4-hour chart shows ADA compressing inside a descending triangle, with lower highs capped by a falling trendline and support holding near $0.38–$0.39. Bollinger Bands are tightening, signalling an imminent volatility move. A bullish breakout above $0.41–$0.42 could open upside toward $0.45 and $0.48 this month. However, a breakdown below $0.38 may drag the price toward $0.35 or lower, keeping the broader bearish structure intact.

Will Cardano (ADA) Price Reach $1?

Right now