- Analysts forecasted that Ethereum might outperform Bitcoin due to secret indications.

- Ethereum area ETF inflows and rising rate channels showed capacity cost targets up to $10,000.

Ethereum [ETH] has so far been notable to keep up the rate with Bitcoin’s [BTC] constant upward momentum.

While Bitcoin hasactually signedup brand-new all-time highs in current weeks, Ethereum still stays 36.2% reduction away from its all-time high of $4,878 signedup in 2021.

At the time of composing, ETH traded at a cost of $3,111 down by 0.6% in the past day and approximately 1% in the past week. This efficiency variation hasactually raised concerns about whether Ethereum can catch up to Bitcoin.

Despite this uninspired motion, some market experts stayed positive about Ethereum’s capacity.

One such expert, Ali, justrecently expressed a favorable position on social media, forecasting that ETH will quickly outshine Bitcoin.

Ali’s self-confidence stemmed from several indications, consistingof the “alt season sign.”

According to him, every market cycle traditionally experiences a stage where Ethereum surpasses Bitcoin, however this has yet to happen in the present cycle. Ali seen this as a prospective purchasing chance.

What’s supporting Ethereum’s upside?

Ali likewise highlighted the MVRV (Market Value to Realized Value) metric as a considerable sign for Ethereum’s future efficiency.

The MVRV metric steps the ratio inbetween the market worth and recognized worth of an property, offering insights into whether an possession is misestimated or underestimated.

Ali keptinmind that when Ethereum’s MVRV Momentum crosses its 180-day moving average (MA), it traditionally indicates a duration of outperformance for the cryptocurrency.

Although Ethereum’s rate justrecently increased from $2,400 to $2,800, this cross has yet to happen, recommending evenmore upside capacity.

In addition to the MVRV metric, Ali pointed to an boost in inflows to ETH area ETFs. He described that financiers have moved from circulation to build-up, with ETH area ETFs amassing over $147 million in ETH.

Moreover, Ethereum whales have apparently acquired over $1.40 billion worth of ETH, evenmore supporting Ali’s bullish outlook.

According to Ali, Ethereum’s capacity rate trajectory might include screening resistance levels at $4,000 and $6,000, with a bullish circumstance forecasting a target as high as $10,000 if Ethereum mirrors the S&P 500’s cost action.

Examining market position

While Ali’s analysis provided a appealing outlook for ETH, analyzing secret metrics might offer evenmore insights into whether Ethereum might reasonably outshine Bitcoin.

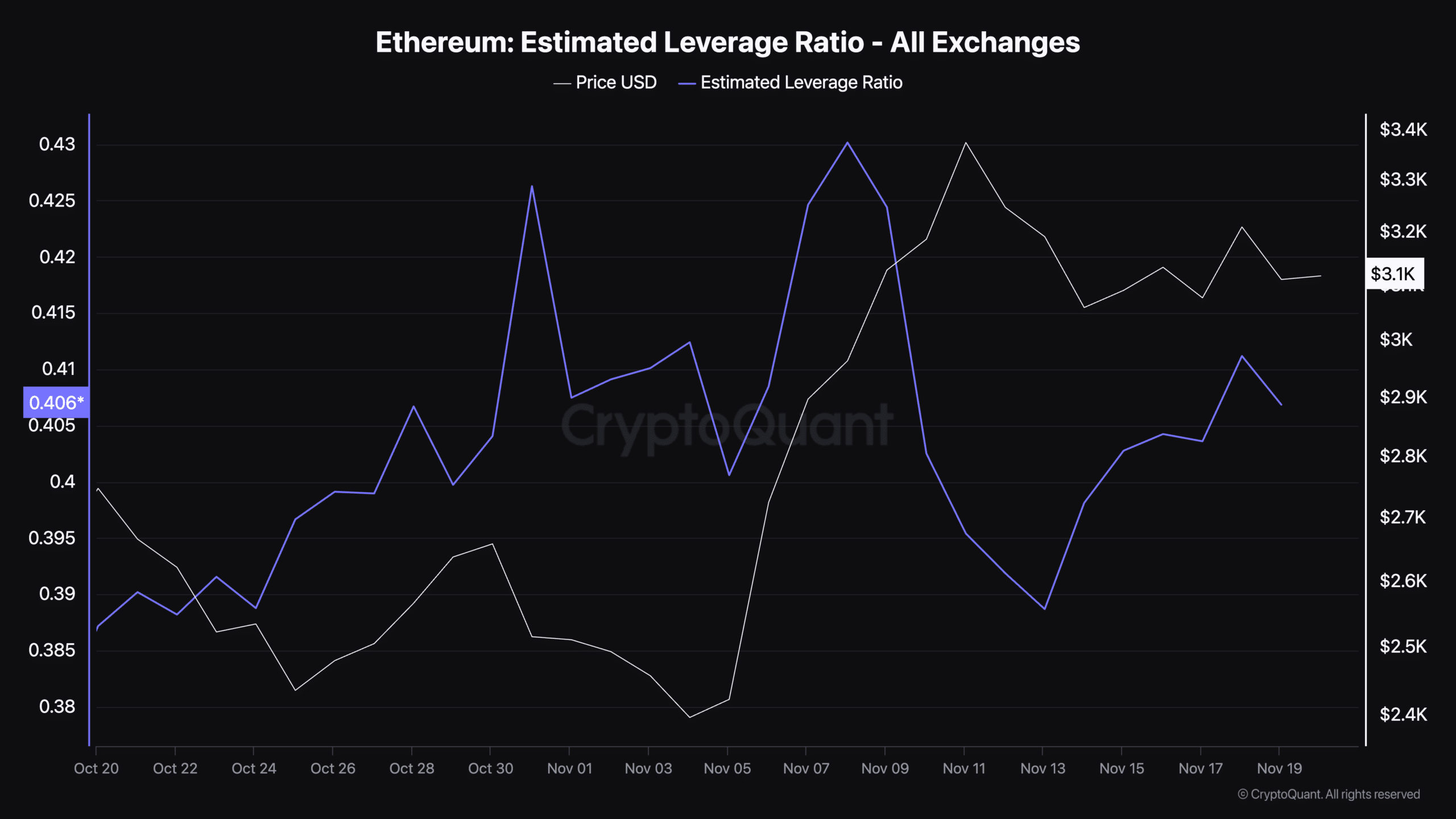

One such metric is the Estimated Leverage Ratio, which shows the level of takeadvantageof utilized by traders in the derivatives market.

A high utilize ratio frequently suggested increased threat and possible volatility, while a decrease might recommend minimized speculation.

According to data from CryptoQuant, Ethereum’s approximated utilize ratio has dropped to 0.40 as of the 19th of November, after peaking at 0.430 earlier in the month.

This decrease might show minimized speculative activity, possibly paving the method for more steady development.

Source: CryptoQuant

Data from Coinglass additional revealed that Ethereum’s Open Interest has decreased by 0.09%, taking its existing evaluation to $17.88 billion.

Read Ether