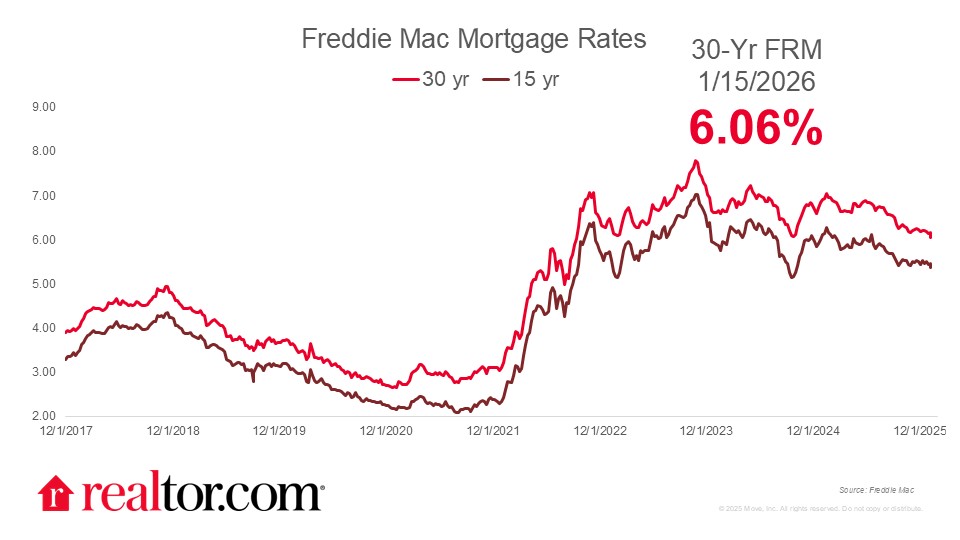

What happened to mortgage rates this week

The Freddie Mac 30-year fixed mortgage rate dropped by 10 basis points to 6.06% this week, marking its lowest level in more than three years. Mortgage rates first climbed above the 6% threshold in fall 2022 and have remained elevated since, contributing to strained affordability conditions and a persistent mortgage lock-in effect.

Last week, President Donald Trump announced that he was instructing Fannie Mae and Freddie Mac to buy $200 billion in mortgage-backed securities. The announcement triggered a sharp decline in mortgage rates as MBS prices surged, since higher MBS prices generally translate into lower borrowing costs for consumers. This source of rate volatility largely overshadowed the December jobs report, which sent mixed signals with softer-than-expected payroll growth alongside an improved unemployment rate.

What it means for the housing market

December existing-home sales increased both month over month and year over year as buyers responded to easing mortgage rates and gradually improving inventory levels. At the same time, the share of homeowners with mortgage rates above 6% now exceeds the share below 3%, signaling a slow shift in the housing market as some homeowners with ultralow-rate m