In This Story

Nvidia’s (NVDA+3.34%) revenue and outlook topped analysts’ expectations, driven by demand for its new Blackwell chips. The stock fluctuated in after-hours trading after closing up 3.7%.

Bitcoin price plunges below $85,000. Here’s what might be causing it

The chipmaker reported revenue of $39.3 billion for its fiscal fourth quarter — a 78% increase from the previous year and an all-time high. Consensus had been for $38.1 billion. Net income was $22 billion for earnings per share of 89 cents, also beats. Nvidia’s full-year revenue more than doubled year over year to $130.5 billion.

Revenue guidance for the first quarter of the current fiscal year was set at $43 billion, plus or minus 2% — also above Wall Street’s expectations of $42 billion.

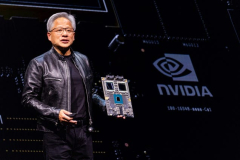

“We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter,” Nvidia CEO Jensen Huang said in a statement. He called demand for the new chips “amazing” as companies roll out reasoning AI models.

The company’s gross margins will be in the low 70s, but is expected to return to the mid-70s later in the fiscal year as Blackwell fully ramps up, CFO Colette Kress said on Nvidia’s earnings call.

Nvidia’s data center revenue rose 93% year on year to a record $35.6 billion last quarter. However, data center sales in China remain low due to restrictions, Kress said, adding that the company will continue complying with chip export controls.

Ahead of the earnings, analysts were optimistic that the chipmaker would beat expectations and raise its outlook as it ramps up production of its Blackwell chips — despite shockwaves from Chinese artificial intelligence startup DeepSeek.

In December, Hangzhou-based DeepSeek released a model it said cost just $5.6 million to train and develop on Nvidia’s reduced-capability H800 chips. This cheaper but still powerful reasoning model spooked investors, causing Nvidia’s stock to plunge 17%, wiping out nearly $600 billion in value — a record loss for a U.S. company.

“Nvidia’s upcoming earnings will crush the DeepSeek anxiety,” Kevin Cook, senior stock strategist at Zacks Investment Research, told Quartz ahead of the results. The company dominates “the technology stack that enterprises want and the next stacks they don’t even know they need yet.”

Encouraging updates on production and shipments of the Blackwell platform will probably move the stock, Kunjan Sobhani, lead semiconductor analyst at Bloomberg Intelligence, told Quartz ahead of earnings. Investors are wary of a potential “air pocket” in growth between the first and second quarters of the current fiscal year