U.S. stock futures tumbled on Friday after President Donald Trump said he will start sending out letters informing countries of what tariffs they will face.

On Thursday, he told reporters that about “10 or 12” letters would go out Friday, with additional letters coming “over the next few days.” The rates would become effective Aug. 1.

“They’ll range in value from maybe 60 or 70% tariffs to 10 and 20% tariffs,” Trump added.

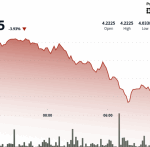

While U.S. markets were closed for the July 4 holiday, futures tied to the Dow Jones Industrial Average dropped 251 points, or 0.56%. S&P 500 futures were down 0.64%, and Nasdaq futures fell 0.68%.

U.S. oil prices slipped 0.75% to $66.50 per barrel, and Brent crude lost 0.41% to $68.52. Gold edged up 0.11% to $3,346.70 per ounce, while the U.S. dollar fell 0.16% against the euro and 0.30% against the yen.

The Trump administration has been negotiating with top trade partners since the president put his “Liberation Day” tariffs on a 90-day pause.

That reprieve will expire on Wednesday, July 9. So far, only a few limited trade deals have been announced, and negotiations with other countries were expected to require more time.

So as the Wednesday deadline approached, Wall Street was expecting Trump to announce an extension to the tariff pause by Tuesday, reviving the so-called TACO trade that alludes to his history of pulling back from his maximalist threats.

“We suspect that further last-minute concessions will be made to permit extensions for most countries, but a few of the ‘worst offenders’ may be singled out for punitive treatment,” analysts at Capital Economics predicted earlier this week. “Markets seem to be positioned for a fairly benign outcome, implying a risk of some near-term turbulence if that fails to materialise.”

That assumes Trump won’t risk a repeat of the epic April selloff that was triggered by his Liberation Day tariffs, and Capital Economics also warned such an assumption could be compl