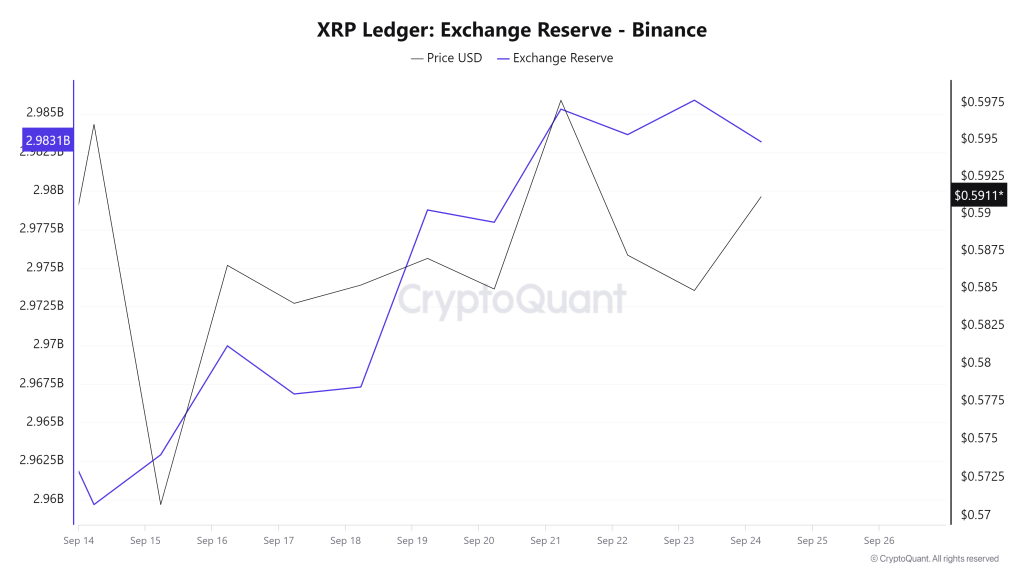

Ripple’s native token XRP appears bearish and is poised for a cost decrease as whales have moved millions of tokens to centralized exchanges. XRP hasactually been in debtconsolidation mode for almost 3 weeks, throughout which whales moved a considerable 23.5 million tokens worth $13.63 million to exchanges, according to the on-chain analytics company CryptoQuant.

XRP’s Exchanges Reserve Soars

It appears that whales are losing interest in XRP, which might produce a unfavorable effect on its rate. According to CryptoQuant information, throughout the duration of XRP’s combination, the exchanges reserve hasactually been continually increasing, which is a unfavorable indication.

When crypto whales or organizations relocation their holding to exchanges, it is typically thoughtabout a indication of a possible sell-off.

Current Price Momentum

At press time, XRP is trading near $0.585 and has knowledgeable a cost decrease of over 1% in the past 24 hours. During the verysame duration, its trading volume hasactually increased by 3%, suggesting greater involvement from traders amidst continuous debtconsolidation.

XRP Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, XRP is in an uptrend as it trades above the 200 Exponential Moving Average (EMA) on a everyday time frame. The 200 EMA is a technical indication that traders and financiers usage to figureout whether an possession is in