Bitcoin’s durability at $37k backed by strong build-up pattern Andjela Radmilac · 49 seconds ago · 3 minutes checkout

Bitcoin’s durability at $37k backed by strong build-up pattern Andjela Radmilac · 49 seconds ago · 3 minutes checkout

Bitcoin holders broaden their grip inthemiddleof market healing.

3 minutes checkout

Updated: November 24, 2023 at 10: 05 pm

Cover art/illustration through CryptoSlate. Image consistsof integrated material which might consistof AI-generated material.

Bitcoin appears to haveactually developed strong assistance at the $37k level, showed by its swift healing following a dip to $35,000 upon news about Binance’s SEC fine. While this rebound represents a 122% boost consideringthat the start of the year, there hasactually been reasonably verylittle circulation of BTC throughout this duration.

A closer evaluation of the Bitcoin supply held both by short-term and long-lasting holders programs a clear build-up pattern throughout the board. This pattern just appears to haveactually increased with Bitcoin’s spike above $37,000, suggesting a decision amongst all holders to buy more BTC.

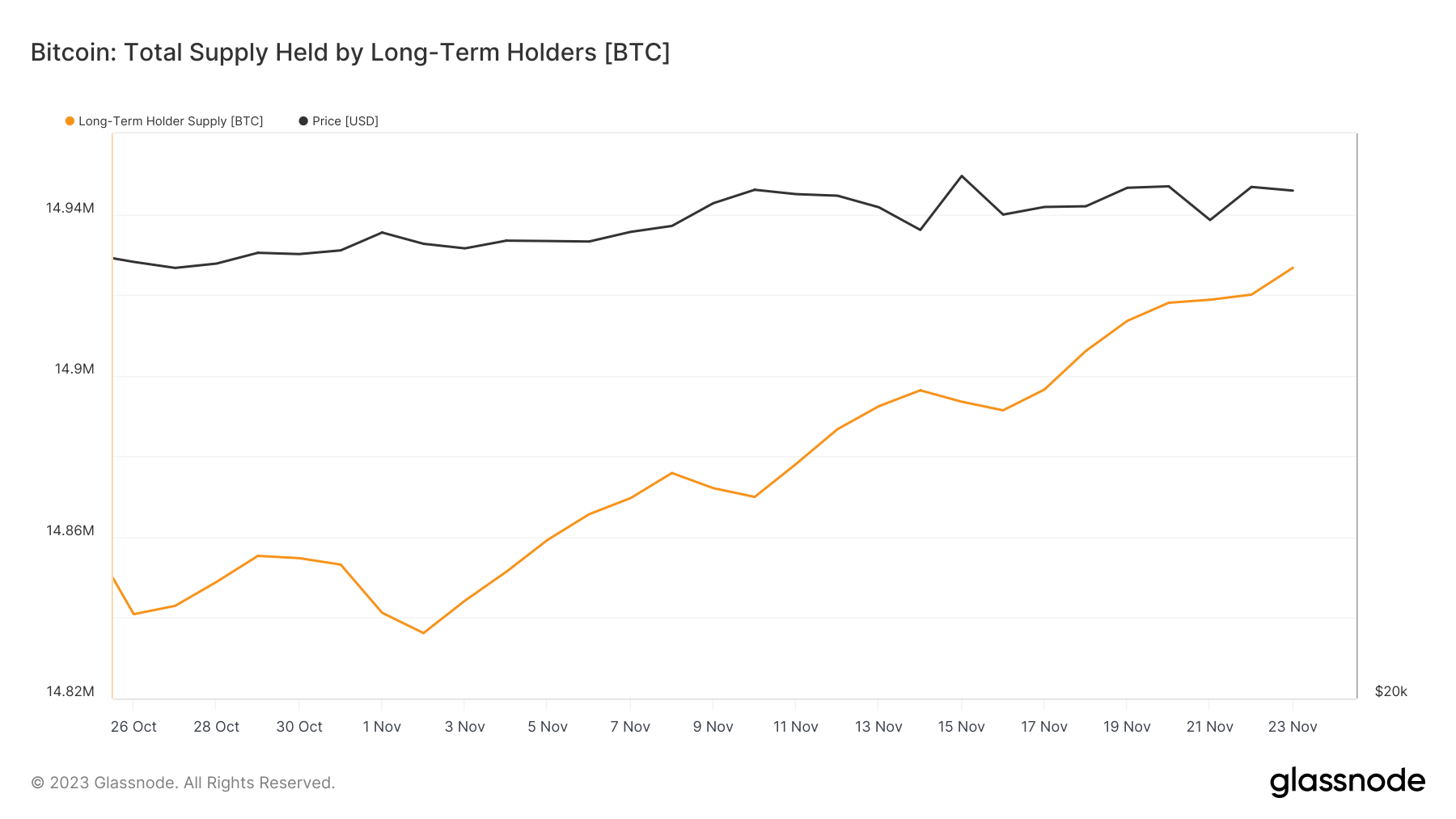

Glassnode information on long-lasting holders hasactually been especially informing over the past year. This accomplice, recognized for their endurance in the market, hasactually seen their holdings grow regularly, particularly as Bitcoin’s rate exceeded the $37,000 mark. The boost in long-lasting holder supply reveals strong self-confidence in Bitcoin’s future potentialcustomers amongst these financiers.

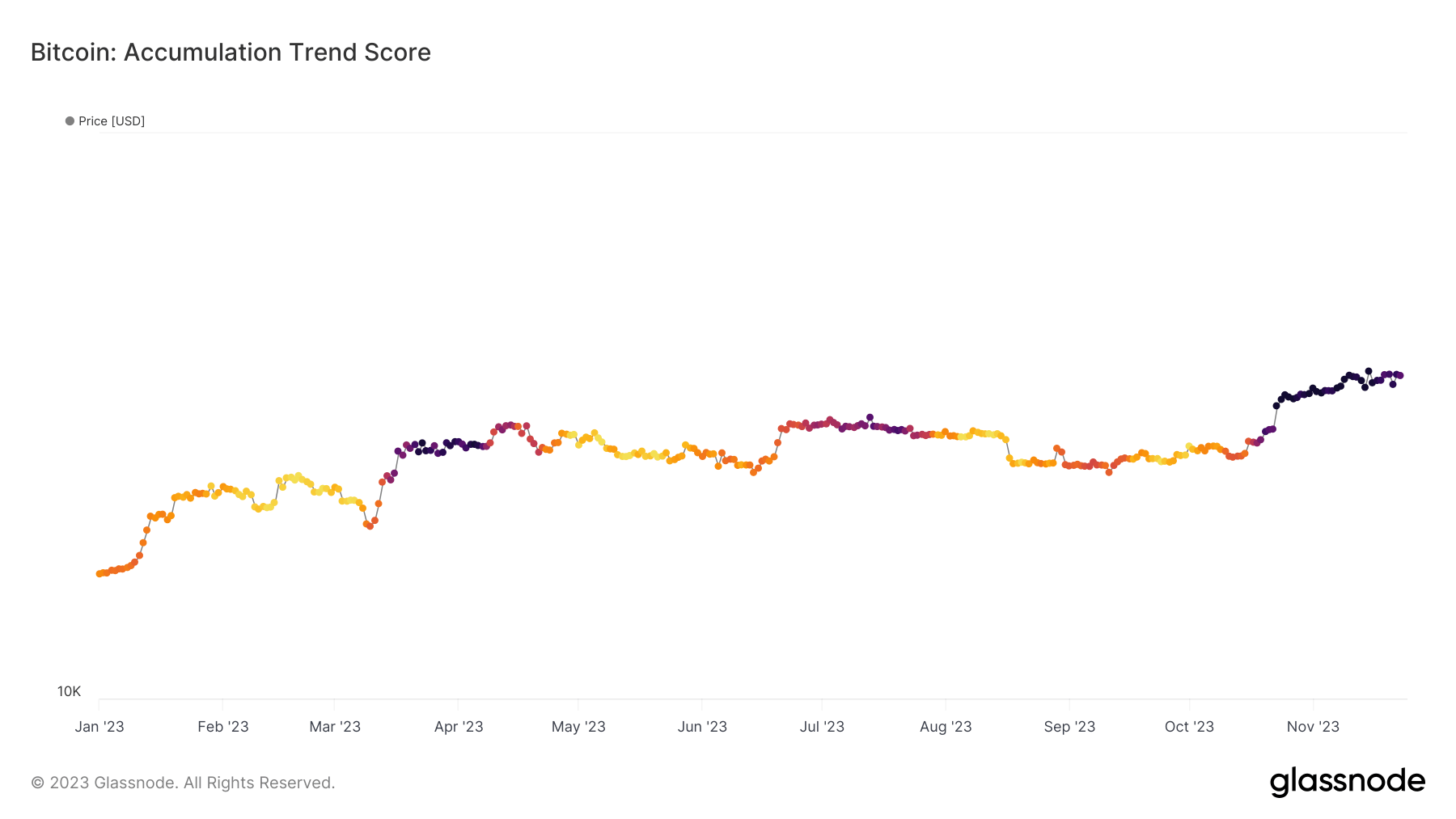

The Bitcoin build-up pattern rating additional supports this thesis. This metric, which determines the degree of build-up activity within the market, hasactually revealed favorable indications. An boost in this rating typically shows increased financier interest in getting more Bitcoin, frequently a bullish signal in the market. In this case, the pattern rating’s increase alongwith climbingup rates validates that long-lasting holders are not simply holding onto their possessions however actively increasing their positions.

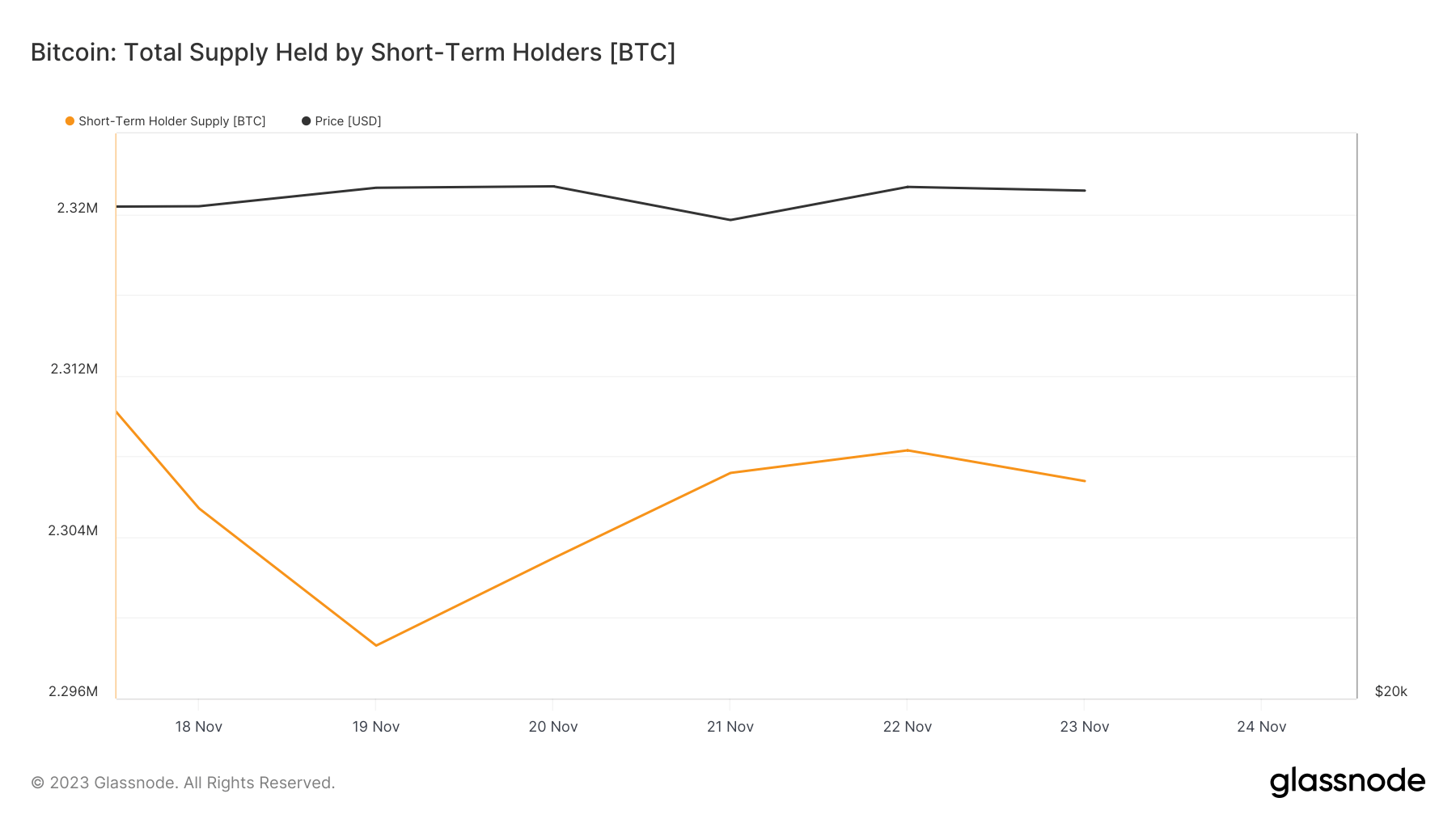

Over the past year, there hasactually been a substantial decrease in short-term holder supply. Apart from circulation, this might suggest that a considerable part of short-term holder supply hasactually transitioned into the hands of long-lasting holders, as financiers hold their coins beyond the 155-day limit that usually separates short-term from long-lasting supply.

However, the last 5 days haveactually seen an uptick in short-term holder supply. This current boost recommends that Bitcoin’s intensifying rate has broughtin brand-new financiers, eager on capitalizing on its development. Monitoring short-term holder supply is essential as it frequently shows the market’s instant response to rate motions and can be an early indication of altering market beliefs.

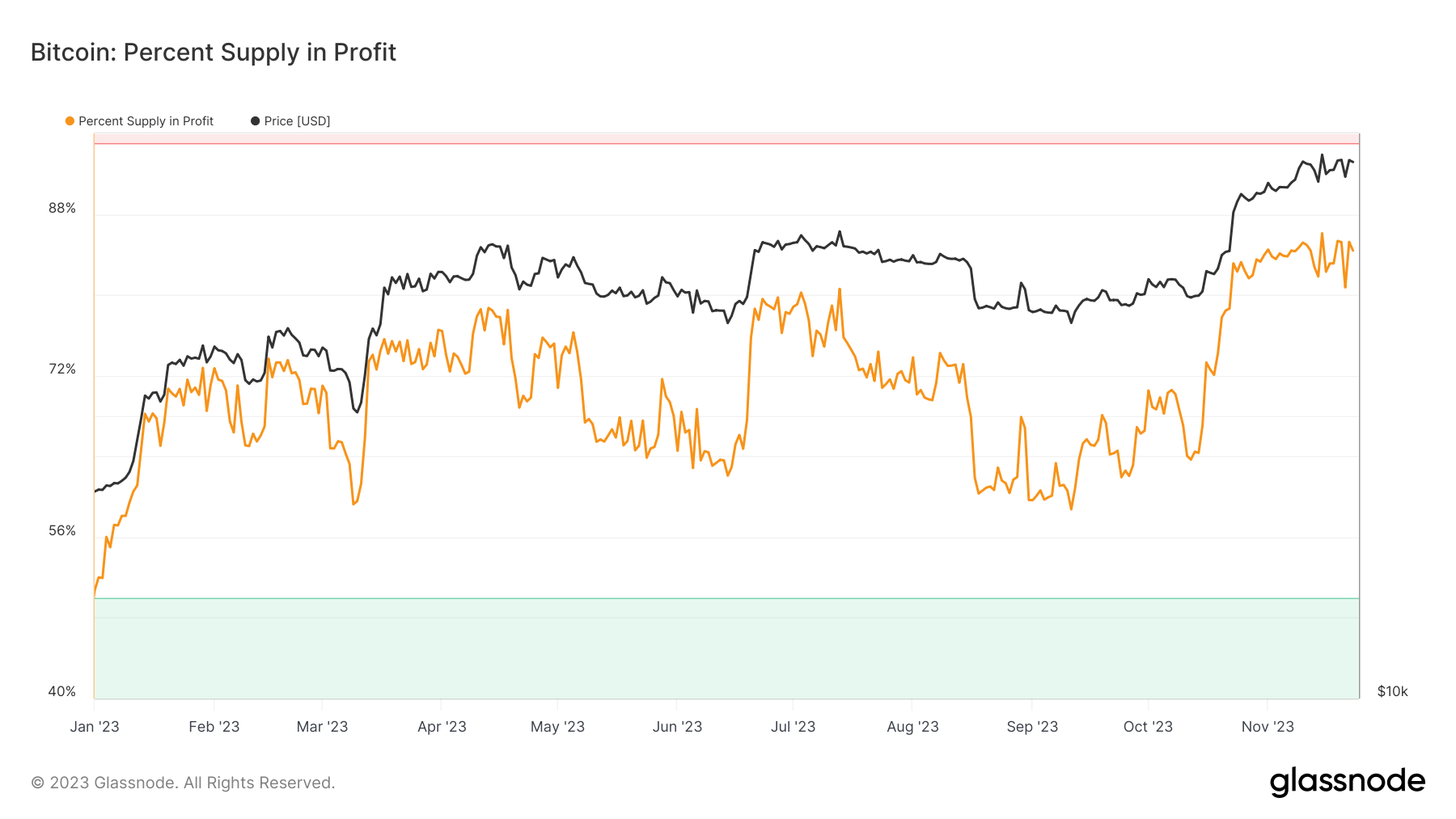

This build-up has led to a substantial spike in latent revenues for Bitcoin holders. As of Nov. 23, 84.38% of Bitcoin’s supply is in a state of earnings. This metric is essential as it represents the possible selling pressure or holding power within the market. Historically, high levels of latent revenues haveactually been precursors to bull rallies, as they show strong market self-confidence and a propensity for holders to waitfor evenmore cost gratitude before dispersing their coins to understand revenues.