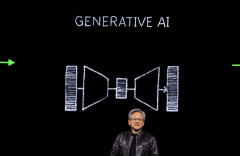

It’s been an AI driven market the last year and Nvidia is at the leadingedge. (Photo by Justin … [+] Sullivan/Getty Images)

Key Takeaways

- Earnings Season Winds Down

- Strong Gains For May

- Employment Report Later This Week

After a rough start on Friday, stocks turned around and rallied difficult into the close. The S&P 500 acquired almost 1%; nevertheless, the Nasdaq Composite closed the day flat. For the month, The S&P ended greater by 4.8% and the Nasdaq shot up nearly 7%.

Friday’s most current Personal Consumption Expenditures (PCE) Index was mostly in line with projections and minimized fears of a surprise dive in inflationary pressure. That report was followed by 2 extra reports both revealing softness in the economy. The Chicago Purchasing Managers Index (PMI) was anticipated to come in simply above 41 however was much weaker at 35.4. A reading above 50 is usually seen as expansionary for the economy, while listedbelow 50 recommends the economy is weakening. That report was followed by a considerable decrease by the Atlanta Fed’s expectation for 2nd quarter GDP. Their projection now calls for development of simply 2.7%, down from 3.5%. The weak financial information sentout bond yields down on the day with the criteria 10-year note closing at 4.49%. It likewise kept hopes alive for at least one interest rate cut this year after a lot of current talk we might not get any.

Elsewhere, incomes season is in its last innings with coupleof names of note left to report. At this point, according to FactSet, it appears first-quarter profits will grow simply under 6%. That is the greatest quarter i