Ethereum (ETH) price has gained 6% over the past week, attempting to build momentum for a surge toward the $4,000 level. The recent formation of a golden cross, combined with an RSI currently at 63.6, shows the potential for continued upward movement.

Additionally, whale accumulation has resumed, with the number of wallets holding at least 1,000 ETH rebounding after a brief decline earlier in January. As ETH hovers near key support and resistance levels, its ability to maintain bullish momentum will be critical in determining whether it can sustain its rally or face a pullback.

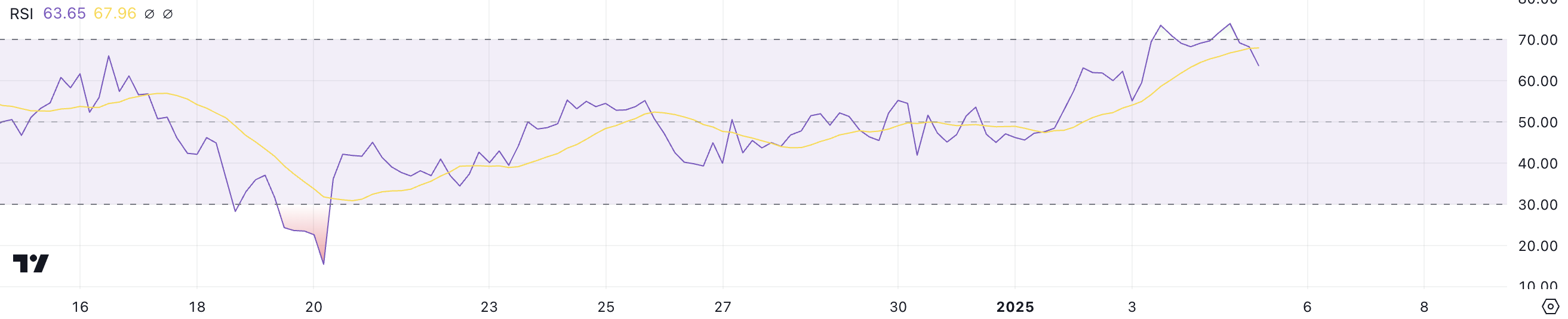

ETH RSI Is Down From 70

Ethereum Relative Strength Index (RSI) is currently at 63.6, after briefly surpassing the overbought threshold of 70 between January 3 and January 4. The RSI measures the speed and magnitude of price movements on a scale from 0 to 100, offering insights into market momentum.

Readings above 70 indicate overbought conditions, suggesting a potential pullback, while readings below 30 signal oversold conditions, which may point to a price recovery. ETH’s current RSI below 70 indicates that while buying pressure has eased, bullish momentum still remains in play.

At 63.6, ETH’s RSI suggests a neutral-to-bullish outlook for the short term. The retreat from overbought levels could indicate that the asset is entering a phase of consolidation or mild correction as traders take profits.

However, the RSI remains comfortably above 50, highlighting continued buying interest. If the RSI rises again toward 70, ETH could see renewed upward momentum, but a further drop below 50 might signal waning bullish momentum, potentially leading to a broader price retracement.

Ethereum Whales Are Accumulating Again

The number of Ethereum whales holding at least 1,000 ETH reached a month-high of 5,634 on December 25 before declining to 5,604 by January 2. Tracking whale activity is crucial because these large holders can significantly influence market trends.

An increase in whale accumulation often signals growing confidence in the asset, potentially driving prices higher, while a decline may indicate reduced interest or selling pressure.