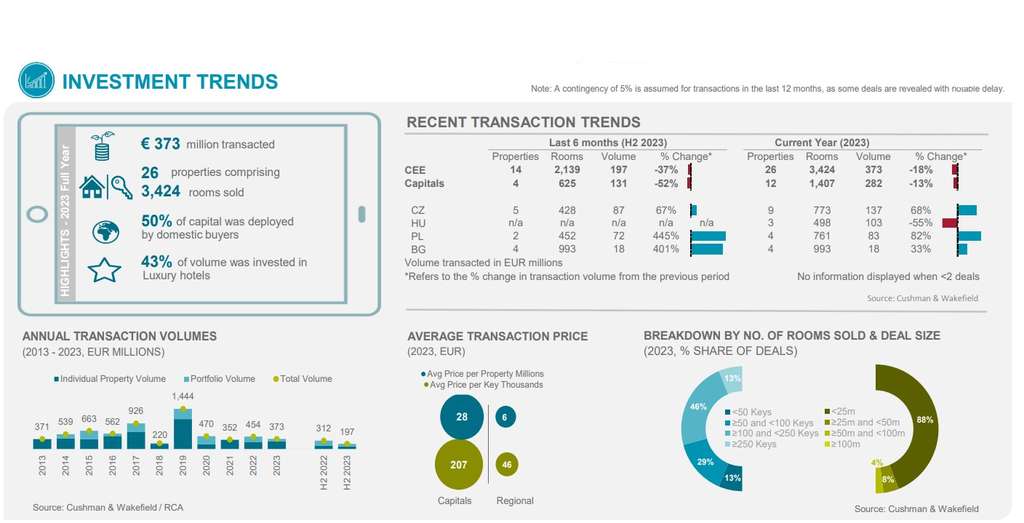

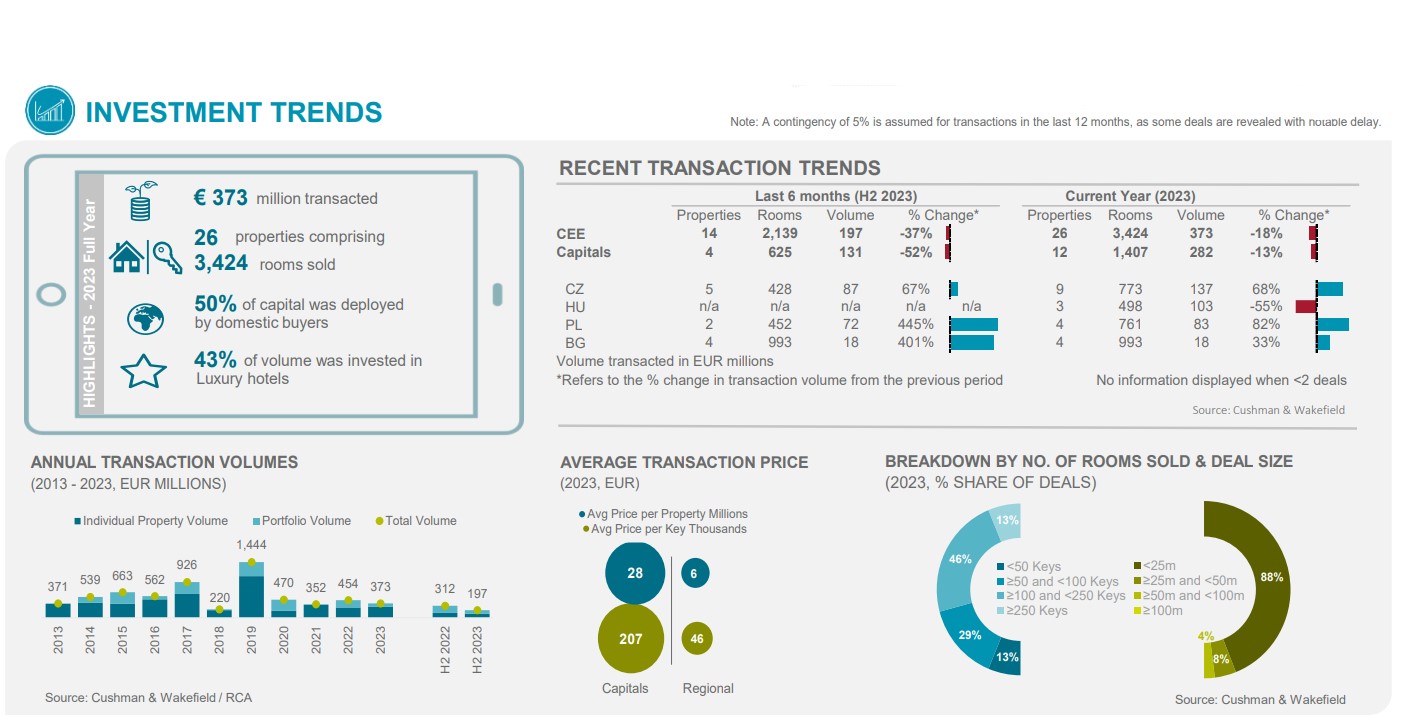

Investment Trends

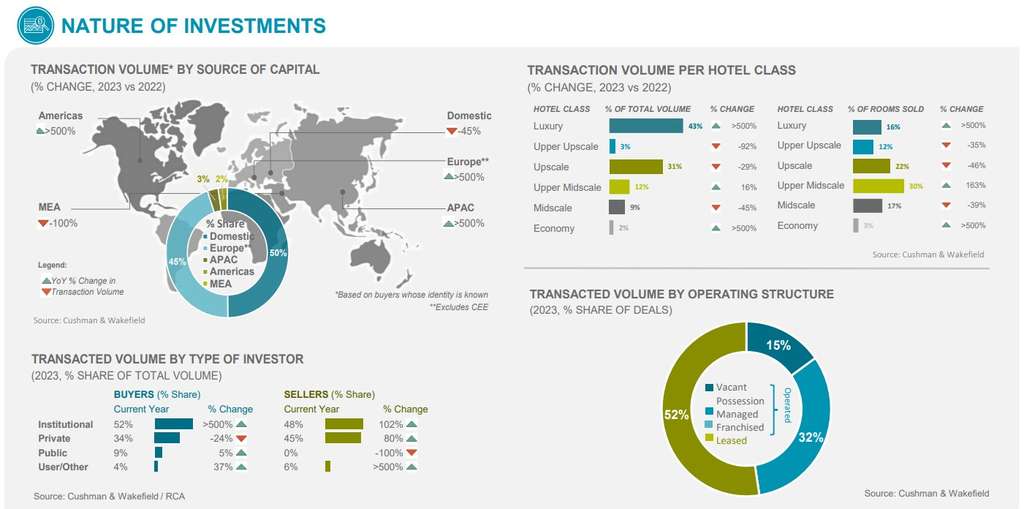

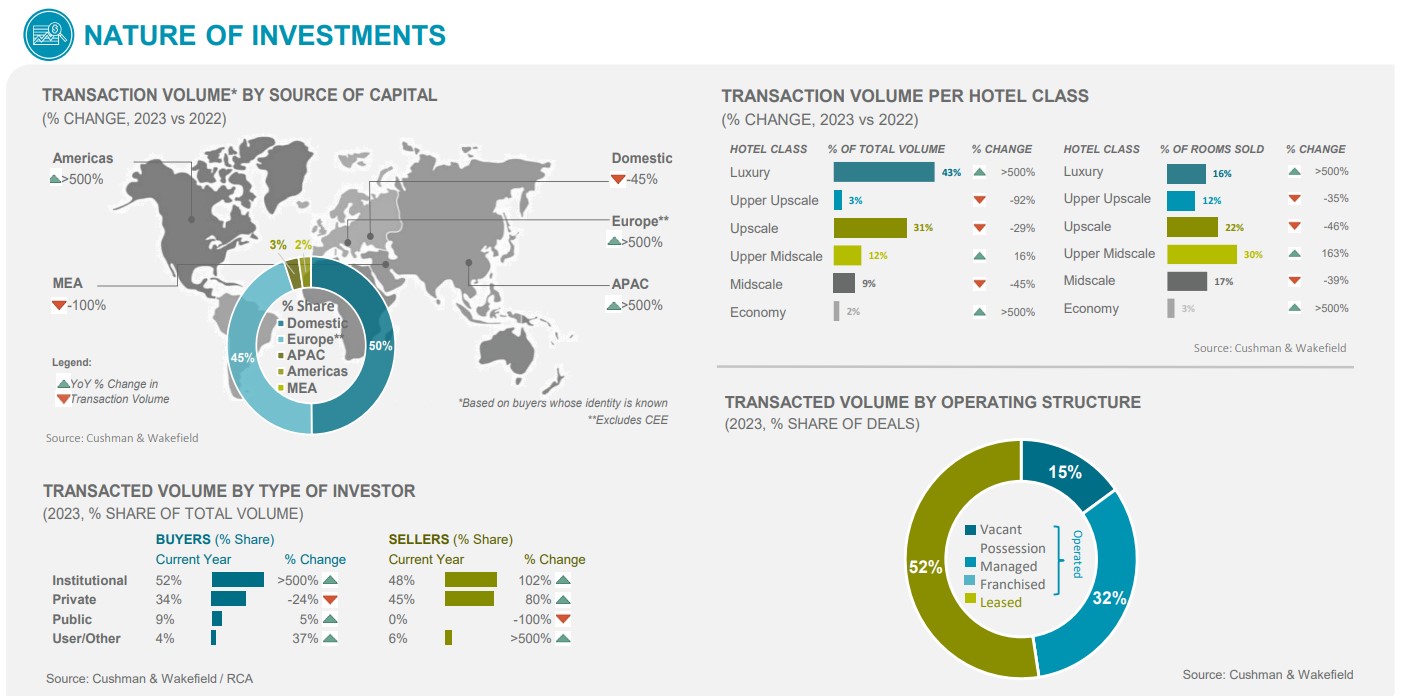

Increased expense of funding and continuous financial and geopolitical headwinds in the CEE area, triggered 2023 deal volumes to drop by 18% compared to2022 However, the volume invested by global purchasers increased by 197% over the exactsame duration, showing the area’s increasing appearance for incoming capital. Several substantial offers are advancing giventhat the year-end 2023 recommending deal volumes will increase in 2024.

Prime Yields

Rising financialobligation expenses in 2023 applied prices pressure on hotel genuine estate in all CEE markets, resulting in yield decompression varying from +25 bps in Warsaw to +75 bps in Bratislava and Sofia compared to2022 Despite this, the effect was partially balancedout by enhanced operating earnings. The preparedfor smallamounts of interest rates in 2024 is anticipated to contribute to the yield stabilization.

Market Performance

While the average hotel tenancy level throughout the CEE-6 capitals in 2023 lagged behind 2019 by 9%, the ADR gonebeyond it by 23%, resulting in a 12% RevPAR development. The greatest boost was tape-recorded in Warsaw and Budapest. The favorable pattern is preparedfor to continue in 2024, albeit at a more moderate speed.

Supply Outlook

In 2023, 20 hotels with a overall of 2,658 spaces opened in CEE-6 capitals, consistingof 732 spaces resuming after rebranding or repair. Additional supply consistsof Ibis, Tribe, Dorothea Autograph Collection in Budapest, and Zleep Hotel in Prague. While Intercontinental Palace Athenee Bucharest and Almanac X in Prague resumed after restorations. Looking ahead to 2024, 22 hotels with 2,570 spaces are set to open, exposing a 2.1% supply boost throughout CEE-6 capitals (vs. 2023).

Demand Outlook

The need for hotel lodging continued to r