McKinsey thinks mainstream adoption of tokenization ‘still far’ inspiteof significant developments Assad Jafri · 1 day ago · 2 minutes checkout

McKinsey thinks mainstream adoption of tokenization ‘still far’ inspiteof significant developments Assad Jafri · 1 day ago · 2 minutes checkout

McKinsey stated mainstream adoption of tokenization stays evasive due to a “cold begin” issue and and other regulative, technological, and functional obstacles.

2 minutes checkout

Updated: Jun. 22, 2024 at 12: 56 am UTC

Cover art/illustration through CryptoSlate. Image consistsof integrated material which might consistof AI-generated material.

McKinsey thinks that tokenization of monetary possessions has sophisticated to a vital tipping point yet dealswith obstacles that prevent its prevalent approval.

According to the firm:

“The digitization of properties appears even more inescapable now as the innovation develops and shows quantifiable financial advantages. Despite this noticeable momentum, broad adoption of tokenization is still far away.”

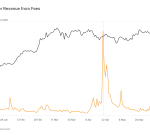

McKinsey stated in a June 20 researchstudy report that tokenization has advanced from pilot tasks to scaled implementations, with the veryfirst massive applications currently negotiating trillions of dollars regularmonthly.

However, mainstream adoption stays evasive due to a “cold start” issue and and other regulative, technological, and functional difficulties.

The ‘cold start’ issue

According to the report, the primary obstacles occur from restricted liquidity and deal volume, which avoid the facility of a robust market. The advantages of tokenization — such as increased security movement, faster settlement times, and enhanced openness — cannot be totally understood without considerable engagement from companies and financiers.

It included that the cold start issue provides a timeless chicken-and-egg circumstance. Without a crucial mass of tokenized possessions, capacity financiers stay reluctant due to issues over liquidity and market depth.

Simultaneously, providers are unwilling to tokenize more possessions duetothefactthat of the absence of adequate need and trading activity. Overcoming this difficulty needs usage cases that provide clear and verifiable advantages, such as lowering expenses, enhancing performance, and offering higher market gainaccessto.

For circumstances, tokenized cash market funds have broughtin over $1 billion in properties under management, showcasing early success. However, the morecomprehensive market requires more considerable engagement to attain the network ef