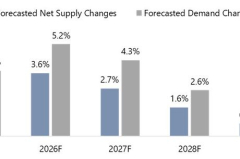

The Manhattan market has been experiencing a prolonged post-pandemic occupancy recovery, despite strong ADR gains. Although legislative and supply changes should bolster this recovery, recent geopolitical factors and the tariffs and policy changes enacted by the new federal administration are expected to affect short-term hotel market trends. Our current demand forecast shows a full recovery beyond 2019 levels by 2027/28.

The Manhattan market remained resilient during the decade ending 2019 but was severely affected by the COVID-19 pandemic. The last four years have been a period of continued occupancy recovery for the market, coupled with strong gains in average daily rate (ADR) driven in part by high inflationary levels. In 2023, the market ADR surpassed the 2019 level by over 20%. ADR then peaked in 2024, exceeding the 2019 level by over 26%. Occupancy continued to lag in 2024, ending in the mid-80s. Nonetheless, substantial ADR increases bolstered the market’s 2023 RevPAR approximately 14% above the 2019 level and its 2024 RevPAR approximately 24% above the 2019 level.

The full market recovery will require the complete return of international travel, meeting and group business, and commercial demand. The current geopolitical factors and recently imposed tariffs, however, have created a strong level of uncertainty regarding international visitation to the United States. The unpredictable timing and nature of policy decisions and the rhetoric of the new administration contribute to the uncertainty of inbound international travel, making it difficult to provide a near-term forecast.

In early May 2025, New York City Tourism + Conventions revised its projection of 2025 visitation to 61.4 million, down from the February 2025 forecast of 64.4 million. However, inflationary levels may increase from the recently imposed tariffs, which may indirectly boost domestic travel. Some consumers may consider more cost-effective domestic trips to manage discretionary income, which could offset a portion of any loss in international room-night demand. A resumed trend of inflation increases may also affect ADR growth.

Hotels as Temporary Shelter Facilities

Most hotels that closed temporarily in 2020 reopened following the most significant effects of the pandemic. However, some have permanently closed, others are operating as temporary shelters for unhoused individuals or migrants/asylum seekers, and still others have been or may be converted to alternate uses. Prior to the pandemic, some of the outer-borough hotels were already contracting guestrooms with the New York City Department of Homeless Services (NYC DHS) to provide temporary shelter facilities for residents experiencing homelessness. Additional lodging facilities were temporarily utilized as shelters during 2020 and 2021 to meet social-distance requirements during the height of the pandemic.

Intensifying the housing dilemma, an influx of migrants and asylum seekers (many of whom were transported directly from other states) began to arrive in New York City in the second quarter of 2022; such influxes became a regular occurrence through mid-year 2024. More than 210,000 migrants and asylum seekers arrived in the city during this period. Several dozen hotels within the five boroughs have been utilized as temporary shelters as city officials attempted to manage the crisis surrounding unhoused residents and the influx of migrants and asylum seekers.

Given the reduced arrivals of migrants and asylum seekers and the limited funding, city officials have been closing the temporary shelters in waves since mid-year 2024. Numerous hotels have reopened to the public following the shelter closures. At least a dozen more lodging facilities are slated to close as temporary shelters by the end of June 2025, including the Roosevelt Hotel in Midtown Manhattan, which served as the main intake center and Humanitarian Emergency Response and Relief Center for migrants and asylum seekers. While most of these properties are expected to reopen to the public as hotels, the Roosevelt Hotel is anticipated to be demolished to make room for a large-scale development. Furthermore, many of the hotels currently operating as temporary shelters, as well as those that have remained closed with uncertain reopening dates, are older assets that are in fair to good condition, and many have significant obsolescence drawbacks. As such, we anticipate that over 50% of those hotels have a high probability of either closing permanently or being converted to another use over the next several years. In some cases, the use of hotels to shelter New York City’s unhoused population could become a permanent solution to the city’s affordable housing crisis.

Local Law 18

Local Law 18, known as the Short-Term Rental Registration Law, was adopted on January 9, 2022, requiring all short-term-rental hosts to register with the Mayor’s Office of Special Enforcement (OSE). Local Law 18 prohibits booking platforms (such as Airbnb, Vrbo, and Hotels.com) from processing transactions for short-term rentals that are not registered with the OSE. On September 5, 2023, the OSE commenced the initial phase of Local Law 18 enforcement to ensure that short-term-rental hosts are using the city’s verification system consistently and correctly. Given the tight restrictions, a large portion of the short-term rentals in New York City are not permitted to operate. Hotels have reportedly been absorbing a portion of this room-night demand. Hotel owners and operators in the market continue to carefully observe hotel demand trends for changes that develop in response to Local Law 18; however, some time is needed for these trends to evolve.

There has been continued opposition to Local Law 18 from city residents, as the short-term rental restrictions have had negative financial consequences for homeowners who rely on short-term rentals for additional income. On November 13, 2024, a few City Council members presented Intro. 1107 that would grant some short-term-rental flexibility for owners of one- and two-family homes. The proposed Intro. 1107 has full support from the Restore Homeowners Autonomy & Rights group, which comprises several hundred homeowners and has been pushing for changes to Local Law 18. An amended Intro. 1107-A was introduced on February 3, 2025. Tenant advocates, hotel industry participants, and the Hotel Trades Council oppose the proposed Intro. 1107 and do not support the amended Intro. 1107-A. No final decision has been made yet regarding the amended Intro. 1107-A.

Local Law 97

Local Law 97 was passed in April 2019 as part of the Climate Mobilization Act, which requires that most buildings greater than 25,000 gross square feet must meet new energy-efficiency and greenhouse gas-emissions standards as of 2024, reduce emissions by 40% as of 2030, and reduce emissions by 100% as of 2050. Many property owners and operators have reported that their hotel buildings meet the 2024 and 2030 requirements.

Starting on July 1, 2025, penalties will be issued for either non-compliance with the requirements or non-reporting. Thus, owners of older hotels must take into account the cost of either making the required upgrades or remitting penalty fines. While Local Law 97 does not directly affect Manhattan guestroom inventory, these potential costs, along with the associated higher development costs and other expenses (e.g., higher property and liability insurance premiums), must be considered by hotel developers, hotel ownership entities, and hotel operators.