That’s one hell of a way for the agency holding companies to end the year.

Just as everyone was looking to slow down and take a holiday-induced break before what will be a turbulent 2025, along comes Omnicom with a proposed stock-driven acquisition of Interpublic Group. The two CEOs — Omnicom’s John Wren and IPG’s Philippe Krakowsky — shared on their conference call Monday morning to announce the deal that have been discussing this combination for the better part of a year.

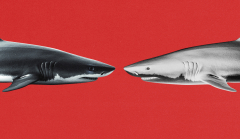

Suffice it to say that, should the deal clear regulatory and shareholder approvals — (those CEOs are hoping it will clear in the second half of 2025) — the combined $30 billion revenue will give the industry the equivalent of a megalodon shark in a sea of great whites and hammerheads.

Lest we forget, megalodon went extinct because it was simply too big. So before panic sets in too significantly for the likes of WPP, Publicis and Dentsu, and the myriad independent agencies that have made a living feeding off the fish that the sharks don’t eat, this kind of bigger isn’t always seen as better.

But to hear Wren and Krakowsky tell it, this merger makes more sense today than ever. They have their eyes on the Googles and Metas of the world. So much that Krakowsky referred the combined company as a platform rather than a holdco.

“Being a part of what is now a platform, essentially a company with exceptional talent and reach and capabilities, and knowing that you can bring those to bear for your client, or that they’re going to give you an opportunity, as John [Wren] says, to build a more interesting career — there’s a lot of enthusiasm for it inside our organization,” he told analysts and reporters on a Monday morning conference call with Wren and both companies’ CFOs.

The combined entity would become by far the largest holding company in the communications world, with an expected cash flow of more than $3 billion, according to the information provided by the companies. The principals also cite the complementary resources and geographies.

A few examples:

- Uniting IPG’s Acxiom data capabilities with Omnicom’s Flywheel e-commerce prowess and the massive Omni orchestration platform (IPG also has Interact but it’s less well known) could generate a deeper level of insights on consumers on clients’ behalf.

- Omnicom has enjoyed a marketplace advantage with its principal media usage, something IPG has stated it wants to leverage more — now they can share that practice.

- Geographically, the combined company establishes the U.S. as its strongest region, which analysts agree holds the best prospects for business and growth. According to the info provided by both companies, 57% of their revenue is generated in the U.S.

But the truth is, both com