PV Expo Tokyo 2024, Japan’s primary solar market occasion, has concluded with record numbers, ingenious items, and brand-new patterns. Storage auctions and brand-new guidelines for power purchase arrangements (PPAs) are driving the market to brand-new areas, as task designers scramble for land to construct on, while light-weight plastic modules continue to gain prominence.

Marian Willuhn

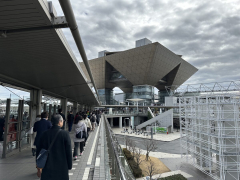

Making the finest of minimal areas was the overarching style at this year’s Smart Energy Week, held this week at Tokyo Big Sight. The occasion drewin around 70,000 visitors and exhibitors throughout 6 private exhibit areas in 5 halls. The organizers seen a 30% boost in exhibitors over last year’s program.

However, the development in exhibitors and visitors does not show the development of the market. Japan’s solar setup figures have stood constant at around 6 GW to 7 GW per year and will stay at that level in 2024, stated Izumi Kaizuka, director and principal expert at RTS Corp. She thinks the dive in exhibitors happened since module producers are sitting on a stockpile of modules that requirement to be offered. With China’s setup figures forecasted to take a small dip in 2024, competitors to sell modules is increasing, leading producers to sell their items in every market they can – and Japan is no exception.

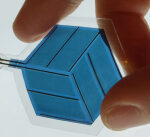

That stated, the Japanese market does have special attributes. For example, a absence of offered land suggests that the market has generally primarily been driven by the roof sector. Japanese property roofs are little and fragmented, significance that smallersized modules needto be pieced together to usage readilyavailable area, making them more popular than bigger modules with greater performance rates.

Japanese producers such as Sharp and Panasonic, as well as long-established providers from abroad, fulfill this need with their offerings for the nation. Trina Solar, for example, provides modules with the specific width for standardized corrugated metal roofings in Japan.

For bigger business and