CFOs are taking a more assertive function in IT choices in Australia and New Zealand in 2024.

Research from business softwareapplication options company Rimini Street reveals that CFOs are now frequently the ones directing underlying innovation choices — a obligation generally held by business CIO’s.

The researchstudy, C-Suite Imperatives: Evolving IT and Enterprise Investments, surveyed 250 CFOs and CIOs in the ANZ area. It exposed that closer cooperation is enhancing CFO and CIO relationships, which might outcome in greater IT spendingplans and service return on financialinvestment.

Up to 70% of innovation choices include CFOs in 2024

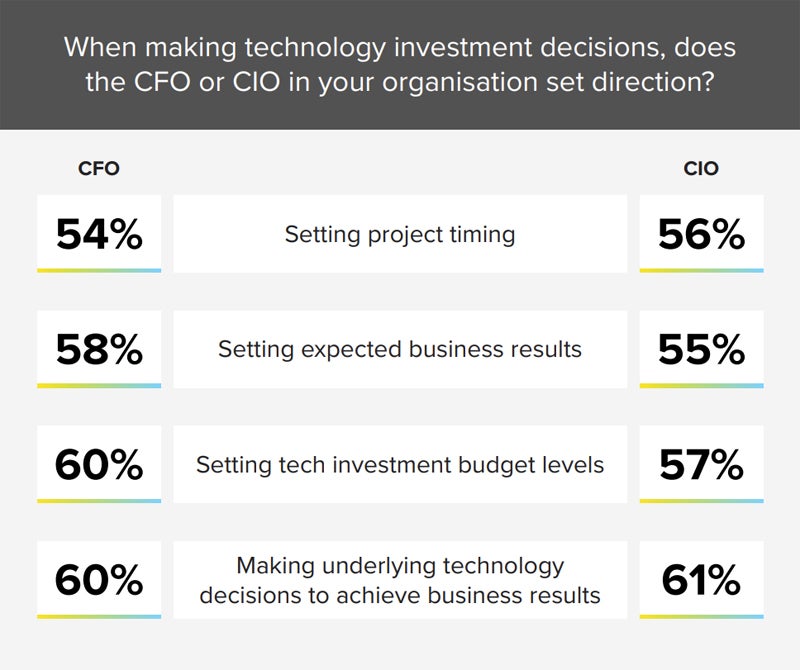

CIOs when had main duty for the tech choices made by business. However, Rimini Street’s researchstudy discovered 60% of CFOs state they are the ones accountable for underlying innovation choices to attain service results, marking a shift in how choices are made.

Specialist IT researchstudy company ADAPT Research has likewise keptinmind this pattern. ADAPT’s tactical researchstudy director, Matt Boon, approximated at a current Sydney conference that CFOs are now included in 70% of all IT financialinvestment choices. He stated this level was “the greatest we’ve ever seen.”

CFOs aren’t the just ones who notification this shift. CIOs concur that their CFO equivalents are the ones making the underlying innovation choices and taking the lead function in setting innovation financialinvestment spendingplan levels.

Why are CFOs more included in innovation choices?

The increased focus on financials in Australia and New Zealand is no trick. The market hasactually seen increasing inflation, greater interest rates and slower organization development. IT leaders in the area haveactually been under pressure to do more with the exactsame or less or face slower budgetplan boosts.

Resource: How CFOs have developed from number crunchers to worth motorists

The environment hasactually drawn CFOs closer into innovation oversight and decision-making. CFOs haveactually been worried about expense, as components like increasing cloud expenses effect the bottom line. They are likewise interested in the contribution innovation financialinvestments make to organization development.

CFOs lament absence of connection with service objectives

The Rimini Street report revealed that just 23% of CFOs are pleased with the effect tech financialinvestments are making on their company objectives — a significant factor why they’re more included in tech choices. That leaves about 3 in 4 CFOs who aren’t totally delighted with the results of their tradition tech financialinvestments or who puton’t think that IT financialinvestments are connected to service objectives.

In truth, lotsof CFOs have scathing feedback when asked about organisational innovation. Among surveyed CFOs:

- 29% haveactually seen just combined results from tech financialinvestments, when determined versus accomplishing preferred service results or acquiring enough long-lasting worth.

- 19% state they typically see a unfavorable effect from innovation financialinvestments, consistingof continuous expenses, minimal future versatility or organization interruption.

- 17% surveyed by Censuswide for Rimini Street state that most of the organisation’s innovation financialinvestments are not connected to their organization objectives.

- 12% haveactually seen little or no company enhancement from their innovation financialinvestments, and/or the expense of the financialinvestment surpassed the worth of the enhancement.

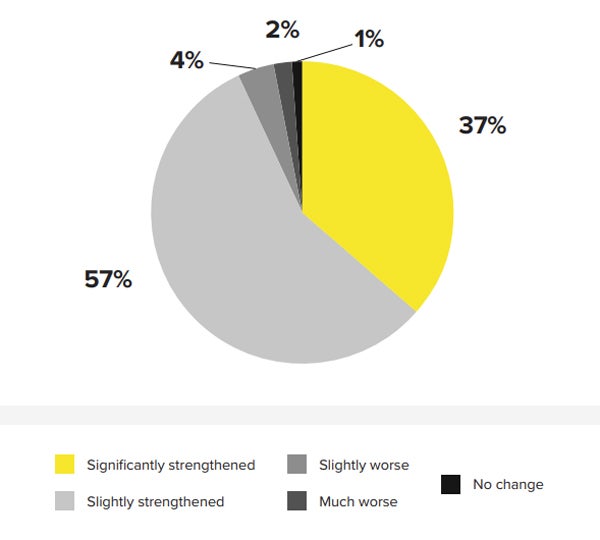

Stronger CFO and CIOs relationships are benefiting companies

Despite some CFO discontentment, 94% of participants stated the CFO and CIO relationship has reinforced substantially or somewhat. This is a big portion thinkingabout the CFO is significantly trespassing on some of a CIO’s standard obligations.

CFOs seeing CIOs in a more favorable light

Closer partnership is tipping CFO understanding of CIOs towards the favorable. The study discovered:

- 39% of CFOs thoughtabout their CIO as an “innovative change-agent who drives company technique.”

- 33% see their CIOs as partners who assistance link the dots inbetween tech and company choices.

Rimini Street stated these ability sets go beyond the core innovation strength of most IT officers.

“It speaks to management and cooperation more so than innovation efficiency, suggesting at least on the CIO side, they are knowing the CFO’s language,” according to the report.

Why the CFO-CIO bond is growing morepowerful

An unsure company environment hasactually been a element in the reinforcing relationship inbetween CFOs and CIOs, as they haveactually been needed to work carefully together. According to the Rimini report, some of the factors chosen by CIOs and CFOs for the morepowerful bond were:

- The other leader proactively engaging (39%).

- A focus on security, compliance and danger (38%).

- The immediate requirement to worktogether to make active innovation choices (37%).

- The requirement to rapidly cut IT expenses in a wise method (35%).

Rimini Street stated CFOs stay reliant on CIOs duetothefactthat of the intricacy of IT choices and desire CIO assistance with concerns rooted in innovation, such as security and emerging innovations. CIOs are looking to CFOs to help them with budgetplan and executive advocacy.

CFOs think closer cooperation with CIO is excellent for company

More than half of CFOs in the ANZ area (55%) think a favorable CFO-CIO relationship hasactually been crucial to muchbetter service results. A considerable 41% believe the collaboration contributes, even if i