WASHINGTON — With days to extra priorto a prospective first-ever federalgovernment default, President Joe Biden and House Speaker Kevin McCarthy reached last contract Sunday on a offer to raise the country’s financialobligation ceiling and worked to guarantee sufficient assistance in Congress to pass the procedure in the coming week.

The Democratic president and Republican speaker spoke late in the day as mediators hurried to draft and post the costs text for evaluation, with compromises that neither the hard-right or left flank is mostlikely to assistance. Instead, the leaders are working to collect support from the political middle as Congress rushes towards votes priorto a June 5 duedate to avoid a damaging federal default.

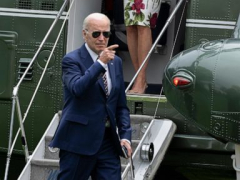

“Good news,” Biden stated Sunday night at the White House.

“The contract avoids the worst possible crisis, a default, for the veryfirst time in our country’s history,” he stated. “Takes the hazard of a devastating default off the table.”

The president advised both celebrations in Congress to come together for swift passage. “The speaker and I made clear from the start that the just method forward was a bipartisan contract,” he stated.

The last item consistsof costs cuts however dangers outraging some legislators as they take a closer appearance at the concessions. Biden informed pressreporters at the White House upon his return from Delaware that he was positive the strategy will make it to his desk.

McCarthy, too, was positive in remarks at the Capitol: “At the end of the day, individuals can appearance together to be able to pass this.”

The days ahead will figureout whether Washington is onceagain able to directly prevent a default on U.S. financialobligation, as it hasactually done numerous times priorto, or whether the international economy getsin a prospective crisis.

In the United States, a default might cause monetary markets to freeze up and trigger an worldwide monetary crisis. Analysts state millions of tasks would disappear, loaning and joblessness rates would leap, and a stock-market plunge might eliminate trillions of dollars in home wealth. It would all however shatter the $24 trillion market for Treasury financialobligation.

Anxious seniorcitizens and others were currently making contingency strategies for missedouton checks, with the next Social Security payments due quickly as the world enjoys American management at stake.

McCarthy and his mediators depicted the offer as providing for Republicans though it fell well short of the sweeping costs cuts they lookedfor. Top White House authorities were instruction Democratic legislators and telephoning some straight to shot to coast up assistance.

One surprise was a prov