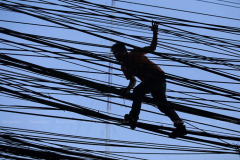

Deal is less impactful than True-Dtac tie-up A employee setsup web connection lines along Sarasin Road in Bangkok. (Bangkok Post file image) The continuous takeover of repaired broadband service 3BB by Advanced Info Service (AIS) is anticipated to pass through analysis by a telecom regulator’s subcommittees as the offer may bring lower financial effect to the market and customers than the finished merger inbetween True Corporation and Total Access Communication (Dtac). The National Broadcasting and Telecommunications Commission (NBTC) may just have to iron out procedures to govern this takeover, stated Prawit Leesathapornwongsa, head of the NBTC subcommittee charged with studying the customer security effect of the AIS-3BB offer. The offer is being scrutinised by the NBTC under the merger guidelines that need licensees included with the offers to send appropriate reports to the regulator 90 days priorto the offer execution. The NBTC’s board has set up 4 subcommittees to scrutinise the offer, consistingof those accountable for financial impacts, technical impacts, legal, and customer advantage. Mr Prawit stated the AIS takeover of 3BB is considerably various from the merger of True and Dtac. “Personally, I highly think that the offer will be offered a nod by the NBTC board and it will problem treatment steps governing the offer like the True-Dtac merger offer.” Mr Prawit, who is a previous NBTC commissioner, stated the penetration of the repaired broadband market is just 50% of all Thai homes, compared to mobile services that have penetration protection of more than 95% throughout the nation. In addition, the subcommittee for customer advantage has asked for viewpoints and researchstudies associated to the offer, such as that of the Thailand Development Research Institute (TDRI) and financial speakers which program that the financial results triggered by the AIS-3BB offer would be lower than the True-Dtac merger offer. More notably, there a

Read More.