WASHINGTON — House Republicans still do not have a offer with President Joe Biden to raise the financialobligation ceiling as the country is a little more than a week away from a possibly devastating default.

House Speaker Kevin McCarthy, R-Calif., stated Friday that arbitrators were working to “finish the task” and seal a offer priorto the United States runs out of money to pay its costs. Republicans worked through the night with the White House to discover contract on costs cuts that GOP legislators have required in exchange for raising the financialobligation limitation.

McCarthy stated he did not understand whether they would complete the information in the next 24 hours.

“I idea we made development theotherday,” he stated. “I desire to make development onceagain today. And I desire to be able to resolve this issue.”

Treasury Secretary Janet Yellen alerted Congress on Friday that the federalgovernment might default as quickly as June 5 — 4 days lateron than formerly approximated. A default would possibly ravage the U.S. and international economy depending on how long the standoff goes.

A appearance at the settlements and why they are takingplace:

WHAT IS THE DEBT CEILING FIGHT ALL ABOUT?

Once a regular act by Congress, the vote to raise the financialobligation ceiling permits the Treasury Department to continue loaning cash to pay the country’s currently sustained expenses.

The financialobligation limitation vote in more current times hasactually been utilized as a political utilize point, a must-pass costs that can be filled up with other toppriorities.

House Republicans, freshly empowered in the bulk this Congress, are refusing to raise the legal limitation unless Biden and the Democrats enforce federal costs cuts and limitations on future costs.

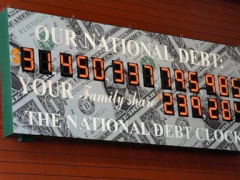

The Republicans state the country’s financialobligation, now at $31 trillion, is unsustainable. They likewise desire to connect other toppriorities, consistingof stiffer work requirements on receivers of federalgovernment money help, food stamps and the Medicaid health care program. Democrats oppose those requirements.

Biden had firmlyinsisted on authorizing the financialobligation ceiling with no strings connected, stating the U.S. constantly pays its expenses and defaulting on financialobligation is non-negotiable. But he released settlements after House Republicans passed their own legislation and made clear they would not pass a tidy financialobligation ceiling boost.

WHAT HAPPENS IF THE DEBT CEILING ISN’T RAISED?

There isn’t truly a plan for what would takeplace. But a first-ever federalgovernment default would threaten the economy. Yellen and financial professionals have stated it might be “catastrophic.”

On Wednesday night, the score company Fitch put the country’s credit on “Rating Watch Negative,” which amounts to a caution that it may downgrade the U.S. credit as a outcome of the deadlock.

If score firms such as Fitch were to infact downgrade America’s financialobligation, it would imply that Washington would have to pay greater interest rates on Treasury bonds, notes and costs.

White House approximates state a lengthened default might trigger 8.3 million task losses and a world-shaking economiccrisis, while even a short default might lead to 500,000 less tasks. Moody’s Analytics hasactually approximated that a