Journalist

- APT has a highly bullish outlook in the coming weeks.

- The short-term predisposition was likewise bullish however BTC volatility might damage it.

Aptos [APT] has a bullish structure on the weekly chart and preserved its up trajectory regardlessof the volatility and worry in the market in the past week. The breakout past $7.5 saw a pullback togetherwith the rest of the market.

Yet, the greater timeframes did not signal a bearish pattern was in development. A drop listedbelow $7.23 would be the veryfirst indication of a bearish situation. This drop did not appear mostlikely based on the proof at hand.

Aptos crypto retests August high as assistance

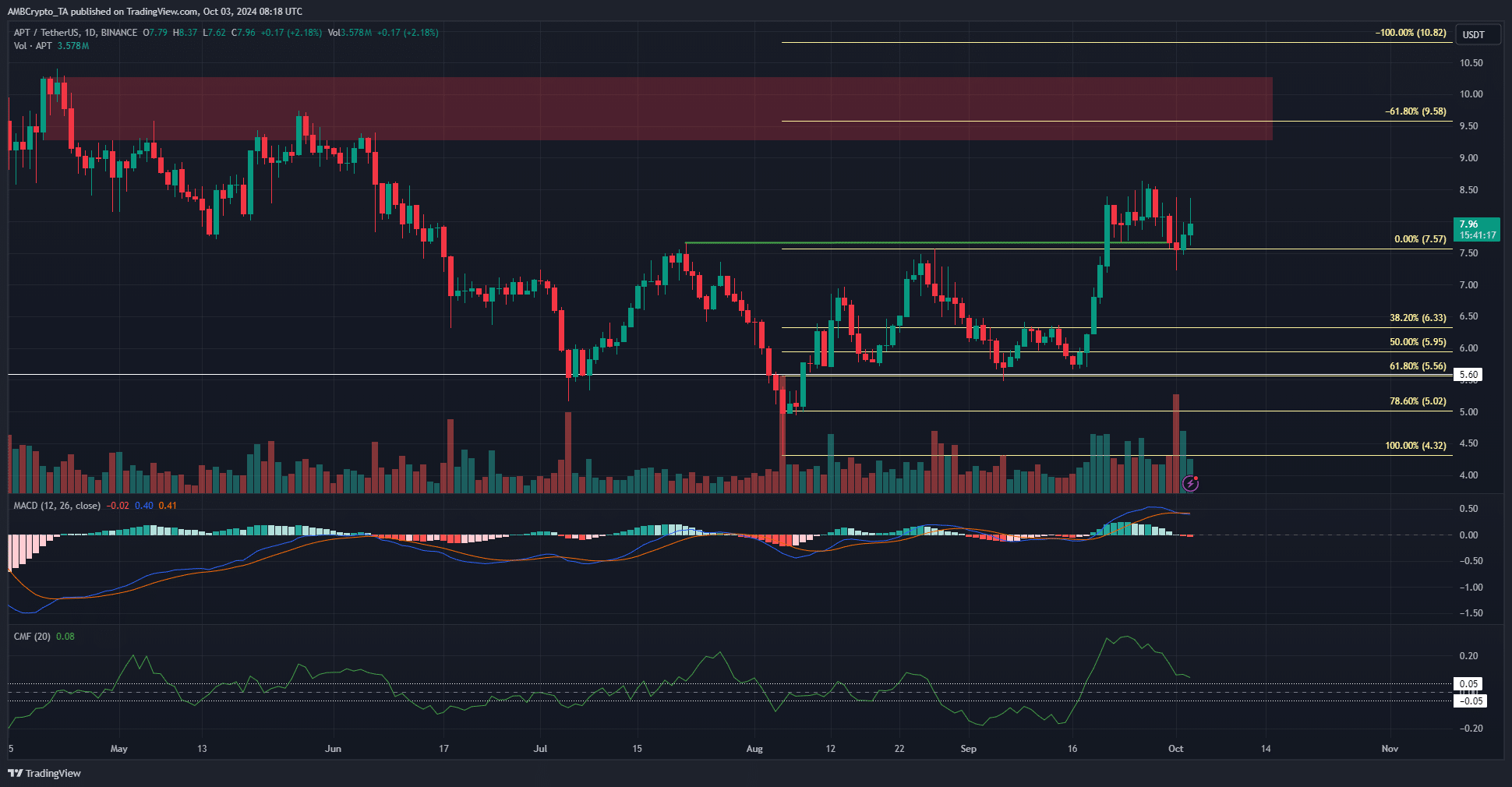

Source: APT/USDT on TradingView

The volatility on Tuesday, the 1st of October, saw Aptos lose 1.56% for the day, however intraday trading was extremely unstable. The trading volume measuredupto that of the 5th of August’s panic.

Despite this afraid setting, the rate did not fall listedbelow $7.57. This level was the high in August that was utilized to plot the Fibonacci retracement and extension levels. The 61.8% extension at $9.58 lined up well with a weekly bearish order block around $10.

The 100% extension level was at $10.82, a resistance zone from December2023 Swing traders will be targeting these levels in the coming months.

The pattern on both the day-to-day and the weekly charts was bullish, although the MACD formed a bearish crossover to program some bearish short-term momentum. The CMF likewise dropped considerably however was still above +0.05 to suggest noteworthy purchasing pressure.

Shift in the Open Interest patterns

The Open Interest hadactually been in a sag in the