Institutional financiers fuel Bitcoin’s development through ETFs, marking a shift from standard retail-driven rallies.

Key Takeaways

- Bitcoin’s climb to $80,000 is associated to strong institutional need through area Bitcoin ETFs, rather than retail FOMO.

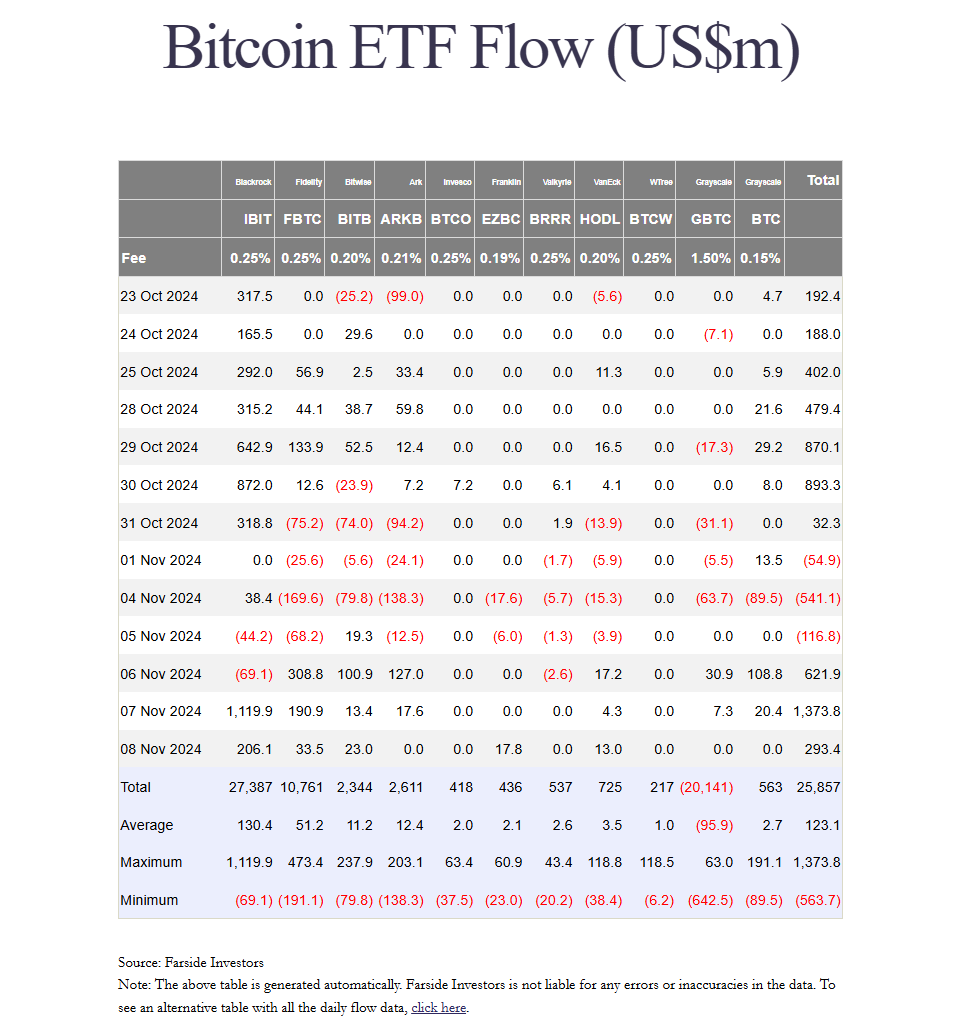

- Spot Bitcoin ETFs accumulated about $2.3 billion in internet inflows quickly after the UnitedStates governmental elections.

Bitcoin reached $80,000 mainly due to constant institutional need through area Bitcoin ETFs rather than retail financier activity, according to Gemini co-founder Cameron Winklevoss.

He thinks that this “sticky” need from institutional financiers is a indication of long-lasting bullish belief, and that the existing market cycle is still in its early phases.

“The roadway to $80k bitcoin was paved with constant ETF need. Not retail FOMO. Little excitement. People buy ETFs, they wear’t sell them. This is sticky HODL-like capital. Floor keeps increasing,” Winklevoss specified. “We simply won the coin toss, innings sanctuary’t began.”

The efficiency of UnitedStates crypto ETFs this week was mainly figuredout by the result of the governmental elections. After Trump stated his success on November 5, area Bitcoin and Ethereum ETFs reversed their pattern.

According to Farside Investors information, the group of eleven area Bitcoin ETFs drewin around $622 million in internet inflows on Wednesday. BlackRock’s IBIT accomplished a record $4.1 billion in trading volume regardlessof experiencing outflows that day.

IBIT consequently tape-recorded over $1 billion in internet inflows on Thursday, increasing its properties under management to more than $33 billion. The ETF has now wentbeyond the size of BlackRock’s iShares Gold Trust (IAU).

Overall, UnitedStates area Bitcoin ETFs jointly collected about $2.3 billion in web inflows throughout the 3 trading days following Election Day. Other crypto items likewise benefited, with area Ethereum ETFs illustration almost $218 million from Wednesday