Nansen CEO notes Coinbase holds 36% of cbBTC supply, Wintermute is amongst top holders.

Key Takeaways

- Coinbase’s cbBTC surpasses $100M market cap one day after its launch.

- TRON creator Justin Sun slammed cbBTC for absence of audits and centralization threats.

Coinbase’s brand-new covered Bitcoin token, cbBTC, has reached a market capitalization of $100 million following its launching on Ethereum and Base, according to information from Dune Analytics.

Coinbase Wrapped Bitcoin now has a distributing supply of 1,720 tokens, with about 42% on Base and around 58% on Ethereum, information programs.

Launched on Thursday, cbBTC is part of Coinbase’s continuous efforts to boost Bitcoin’s energy in DeFi applications. The brand-new token completes straight with BitGo’s WBTC, which is presently the most extensively utilized DeFi-compatible variation of Bitcoin.

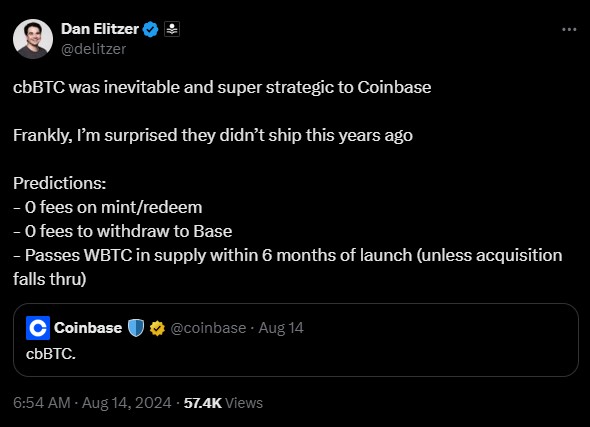

In a declaration following Coinbase’s tip at the covered Bitcoin launch, Dan Elitzer, co-founder of Nascent, recommended that cbBTC would be a tactical relocation for Coinbase. Elitzer anticipated it might gobeyond BitGo’s WBTC supply within 6 months.

At launch, Coinbase’s brand-new token likewise got favorable feedback from market professionals, especially for its possible to increase DeFi activities on Base, Coinbase’s layer 2 network.

Moonwell’s DeFi factor Luke Youngblood mentioned that the fungibility of cbBTC on Coinbase will allow retail and institutional holdings of Bitcoin to effortlessly incorporate with its on-chain community.

Nansen CEO Alex Svanevik keptinmind Coinbase presently holds about 36% of the supply, while market maker Wintermute is amongst the leading