Goldman Sachs eyes tokenization tasks for institutional customers by year-end Oluwapelumi Adejumo · 3 hours ago · 2 minutes checkout

Goldman Sachs eyes tokenization tasks for institutional customers by year-end Oluwapelumi Adejumo · 3 hours ago · 2 minutes checkout

The Goldman Sachs’ executive likewise hinted that the bank might broaden into crypto custody if the regulative environment modifications.

2 minutes checkout

Updated: Jul. 10, 2024 at 11: 01 pm UTC

Cover art/illustration bymeansof CryptoSlate. Image consistsof integrated material which might consistof AI-generated material.

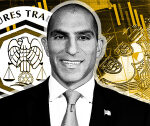

Goldman Sachs is preparing to launch 3 tokenization jobs by year-end for significant institutional customers, the firm’s worldwide head of digital properties, Mathew McDermott, informed Fortune Crypto in a July 10 interview.

McDermott discussed that tokenization, which is the procedure of transforming real-world properties (RWA) into digital tokens, provides a crucial chance for the bank due to increasing customer need for such items.

He specified:

“There’s no point doing it simply for the sake of it. The guaranteed feedback is, this is something that infact will modification the nature of how they can invest.”

Speaking on the tasks, he specified that they would be focused on markets for tokenized possessions, speed up deals, and diversify security possessions. Meanwhile, he likewise exposed that one of the jobs will target the UnitedStates fund complex, while another will focus on Europe’s financialobligation issuance.

Goldman Sachs’ relocation shows the growing institutional interest in tokenizing real-world possessions. The pattern hasactually seen substantial adoption, exhibited by BlackRock’s BUIDL fund, which exceeded $500 million in properties under management in less than 6 months regardlessof morecomprehensive market difficulties.

Crypto custody tips

McDermott hinted that the firm’s participation in the crypto sector may broaden to consistof custodial services if the federalgovernment’s regulative method modifications.

He stated:

“There might be other things that we as a company would naturally be interested, topic to approval, to do, like execution and perhaps sub-custody.”

As the UnitedStates governmental election techniques, crypto hasactually endedupbeing a secret political concern. The leading prospects—President Joe Biden and previous President Donald Trump—have revealed substantial interest in the market, although their views vary.

While Biden hasactually started to soften his administration’s previous position towards the sector, Trump has openly voiced strong assistance for the market, promising to c