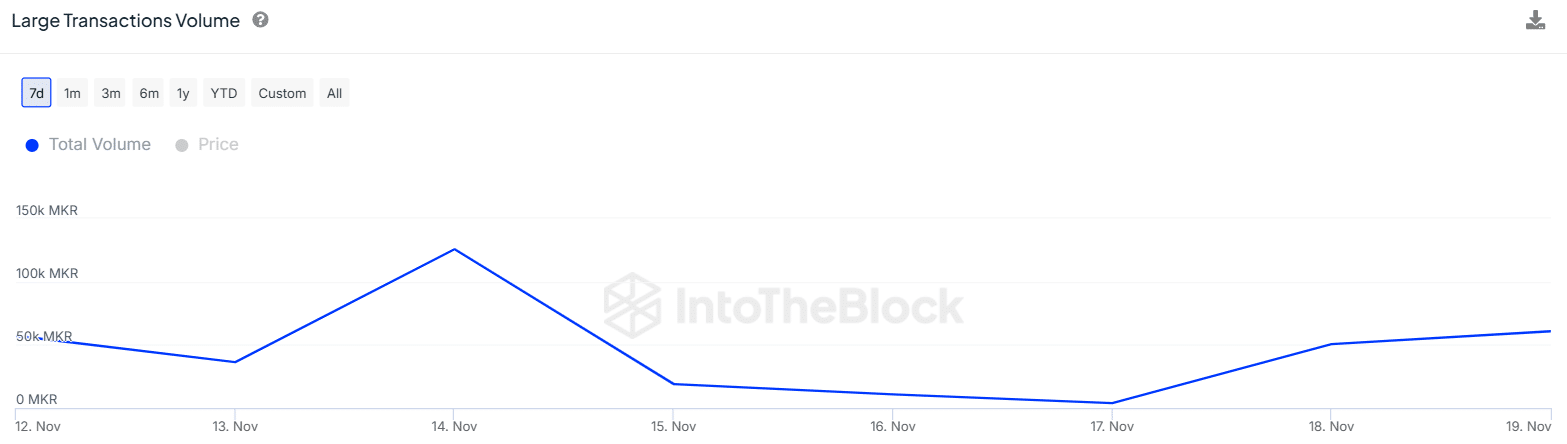

- Large deal volumes for Maker increased by over 1,400% in simply 2 days

- Despite increasing whale activity, technical signs and on-chain metrics flashed blended signals for MKR

Maker (MKR), at press time, was valued at $1,513 following a walking of simply under 2% over the last 24 hours. Here, it’s worth keepinginmind that the token’s efficiency hasactually mirrored that of the wider cryptocurrency market with gains of 24% over the month.

Despite these gains, nevertheless, Maker hasactually been stuck in the $1,419 – $1,550 variety over the last 2 weeks. An uptick in whale activity might help in a breakout past these levels .

In reality, information from IntoTheBlock exposed that big MKR deals surpassing $100,000 increased by 1,400%, from 3,840 to 60,730 in simply 2 days.

(Source: IntoTheBlock)

51% of the overall MKR supply is held by whales. Therefore, if trading activity from this mate increases, MKR might break above or listedbelow the debtconsolidation variety depending on whether these traders are purchasing or selling.

Key levels to watch

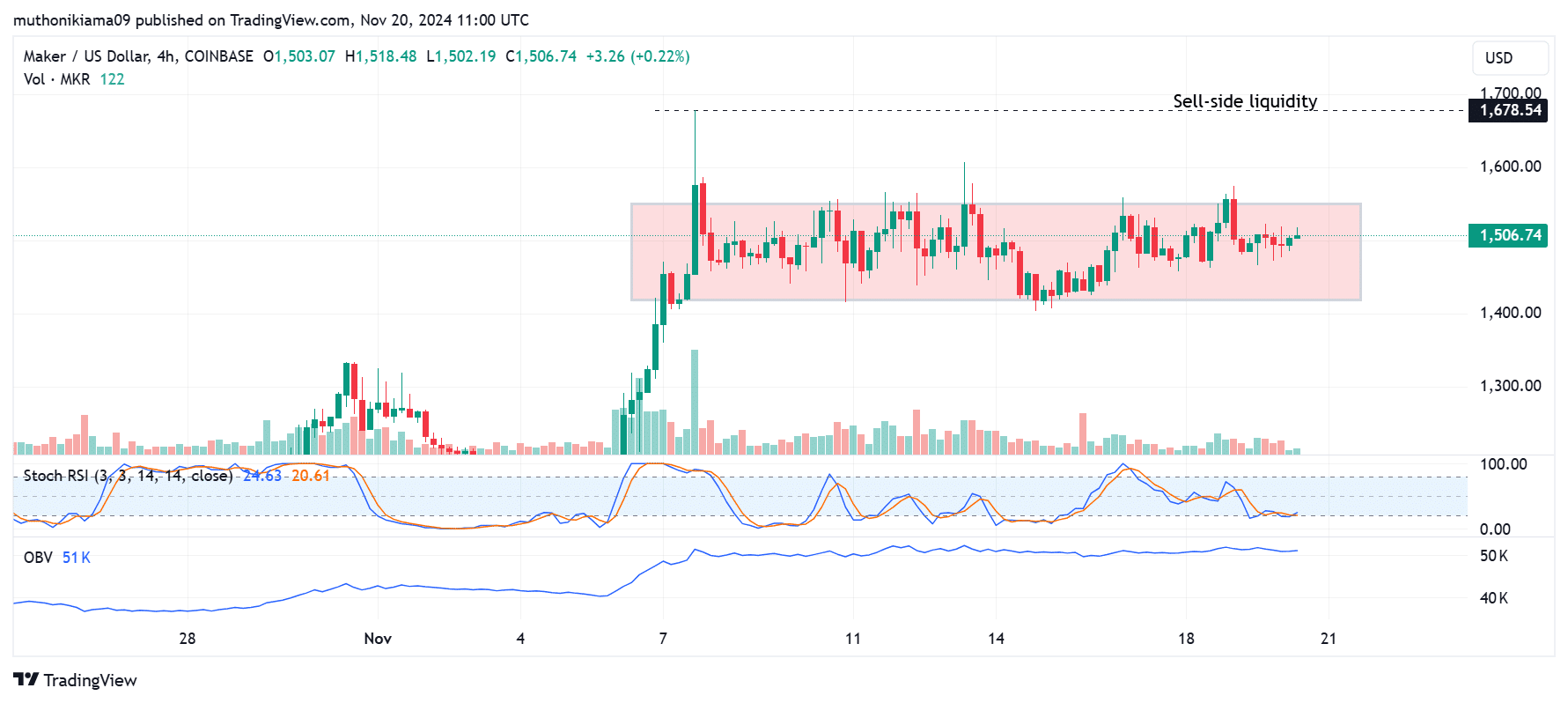

For Maker to verify a bullish breakout from the debtconsolidation variety seen in the four-hour chart, it requires to break above resistance at $1,550 with high purchasing volumes.

The brief volume piechart bars highlighted a absence of strong purchaser interest to push the rate above this resistance. Moreover, the on-balance volume indication appeared to have flattened, showing that purchasing and selling pressure might be wellbalanced.

Traders needto watch out for the sell-side liquidity at $1,678. Maker might increase to take out this liquidity and if purchasers action in throughout this increase, it might lead to a sustained rally. Conversely, if such a relocation stopsworking to bringin purchasers, MKR might return to the debtconsolidation variety or pattern lower.

(Source: Tradingview)

At the time of composing, the Stochastic Relative Strength Index (RSI) with a reading of 24 revealed that MKR was oversold. This might likewise lead to an up correction in the brief term.

At the verysame time, traders must watch out for the assistance level at $1,419. A drop listedbelow this assistance might outcome in a bearish breakout from debtconsolidation and cause MKR to getin a sag.

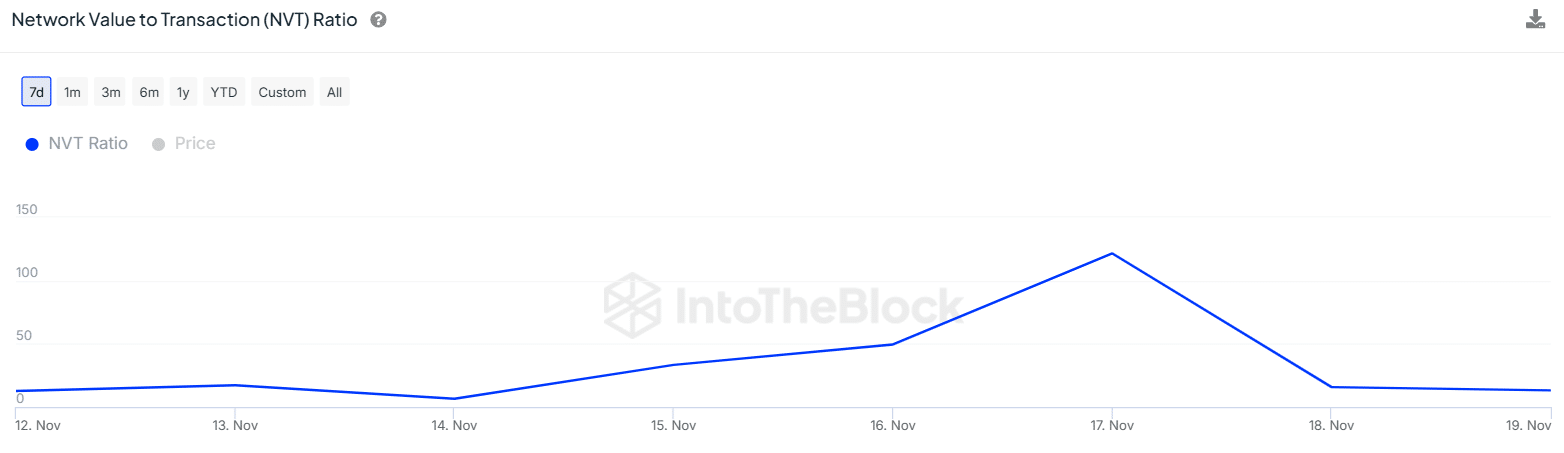

Declining NVT ratio reveals THIS

Maker’s Network Value to Transaction (NVT) ratio decreased from 121.47 to 13.17 over the last 2 days, showing that there hasactually been a rise in deals on the network.

(Source: IntoTheBlock)

Whenever the NVT ratio drops, it implies that a token might be underestimated. However, a appearance at the Market Value to Realized Value (MVRV) ratio, which increased from 0.84 to 0.87 in the previouslymentioned duration, recommended that this may not be the case.

This divergence might show that high deals are due to profit-taking activities by whales. This might fuel a down trajectory on the charts.

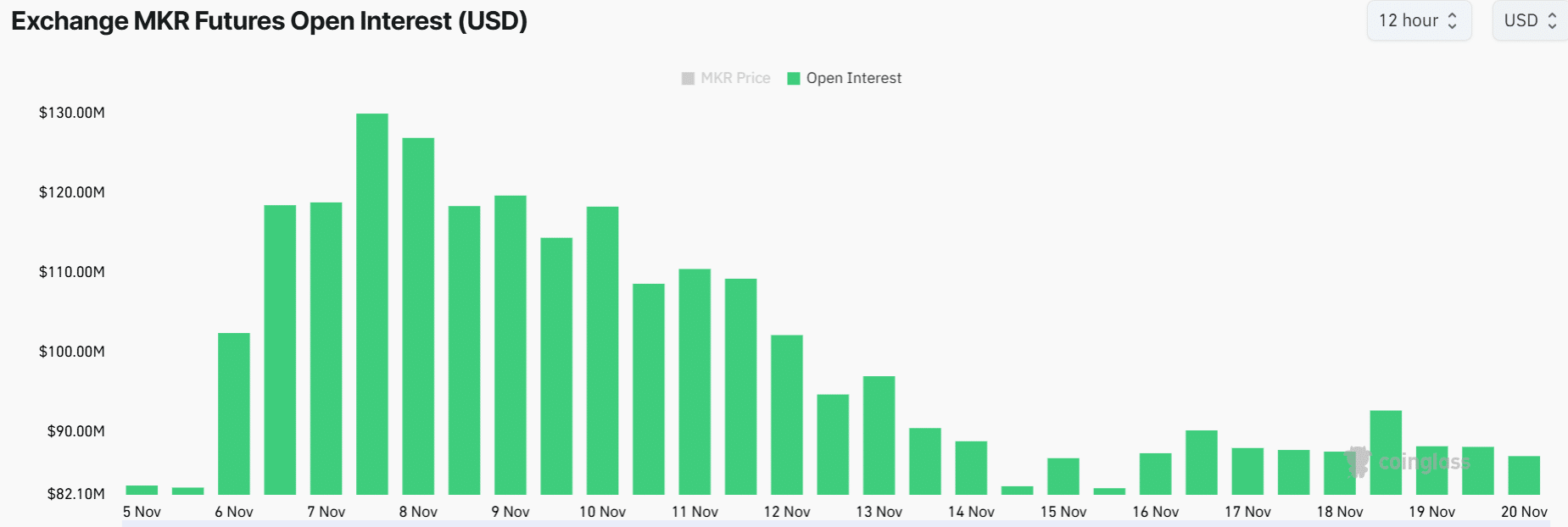

Derivatives market portrays unpredictability

On the derivatives market front, traders haveactually been unpredictable towards Maker. This, after the Open Interest fell from $129M to $86M in simply 2 weeks.

(Source: Coinglass)

When the Open Interest drops, it reveals that traders are closing their positions on a token due to unpredictability over future rate efficiencies.

This decrease in speculative activity might likewise be one of the secret elements leading to Maker being stuck in a combination stage.