MicroStrategy’s tactical financialinvestment technique under Michael Saylor sees considerable development inthemiddleof bullish market conditions.

Key Takeaways

- MicroStrategy’s Bitcoin holdings haveactually produced over $10 billion in latent gains.

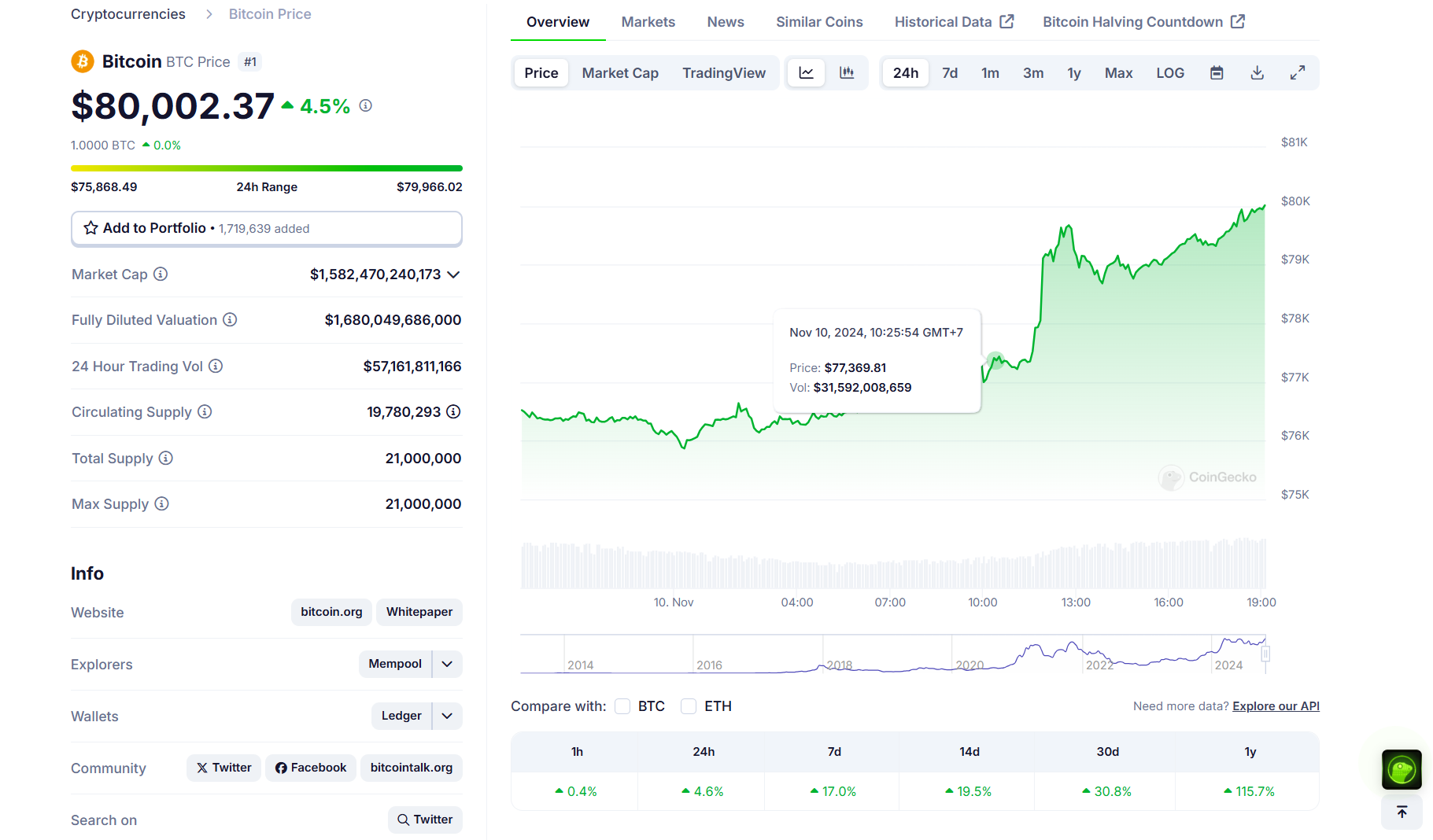

- Bitcoin’s cost boost to $80,000 corresponded with Trump’s reelection and international financial changes.

MicroStrategy’s Bitcoin holdings have rose to over $20 billion in worth, getting more than $10 billion in latent gains as Bitcoin’s rate topped $80,000 today, according to information tracked by its portfolio.

The business, headed by Bitcoin supporter Michael Saylor, hasactually collected 252,220 Bitcoin giventhat its preliminary purchase in 2020, with an average acquisition expense of around $39,200 per Bitcoin, equating to a overall financialinvestment expense of around $9.9 billion.

MicroStrategy’s latent gains have increased inthemiddleof Bitcoin’s cost rally. Bitcoin reached $77,000 following Donald Trump’s election triumph and the Fed’s interest rate choice, before skyrocketing to $80,000 earlier today, according to CoinGecko information.

At the time of reporting, BTC was trading at around $79,700, up over 4% in the last 24 hours and approximately 118% year-to-date.

Trump’s reelection as UnitedStates president has stimulated optimism about beneficial crypto policies. He has showed assistance for digital possessions by gettinginvolved in market occasions, consistingof the Bitcoin 2024 Conference.

Recent financial policy shifts have likewise contributed to the rally, with both the US Fed and Bank of England carryingout 25 basis point rate cuts on Thursday.

The morecomprehensive crypto market has benefited from Bitcoin’s momentum, with Ethereum increasing over 5%, Solana getting 2%, and Do