- Popcat’s $1 advancement stimulates speculation of a 26% rise, with secret resistance at $1.05.

- Bullish signals recommend Popcat might push to $1.3350, however combined volume information keeps traders careful.

Popcat [POPCAT] has rose past the important $1 mark, with its market cap now exceeding $1 billion. POPCAT is drawingin attention due to increased trading activity, which reached a 24-hour volume of $153 million.

Despite current volatility, Popcat hasactually revealed durability, although the rate has decreased somewhat by 1.02% over the last 24 hours, per Coingecko.

Popcat’s market momentum comes as traders display its prospective for additional gains. The existing market environment recommends that the coin is considering a breakout from its $0.90 – $1 resistance zone, which linesup with a technical pattern that might signal more upward motion.

Inverse head and shoulders pattern shows bullish reversal

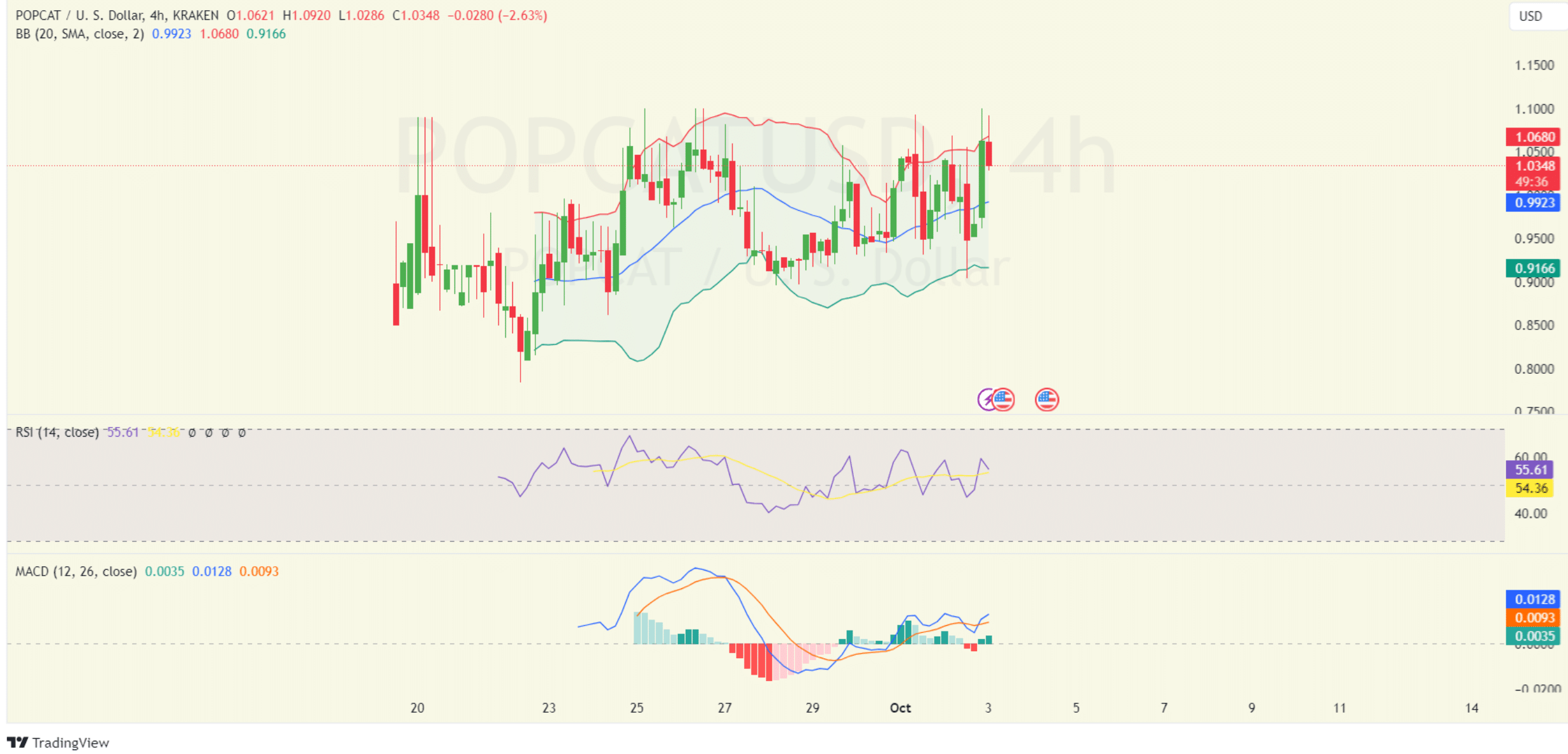

The POPCATUSD chart shows a clear inverted head-and-shoulders pattern, a bullish technical indication recommending a prospective turnaround. The neckline, which is located around $1.05, hasactually endedupbeing a vital resistance point.

If the cost handles to break above this level, it might trigger a strong upward relocation towards the next target of $1.3350, representing a possible 26% rate rise.

Source: TradingView

However, if the rate stopsworking to break the neckline, secret assistance lies around $0.90, the point where the right shoulder formed. This level offers a security net, permitting traders to gauge the threat of a stoppedworking breakout.

Should Popcat break through the neckline, traders are considering intermediate resistance at $1.20, with the prospective for continued bullish momentum towards the $1.3350 target.

POPCAT indications recommend evenmore upside prospective

Meanwhile, the Bollinger Bands suggest moderate volatility in the market, with the cost touching the upper band near $1.0680, signaling capacity short-term overbought conditions.

A pullback towards the middle band at $0.9923 might takeplace if selling pressure boosts.

The Relative Strength Index (RSI) stands at 55.61, simply above the neutral mark of 50, recommending a reasonably bullish belief. The RSI is not yet in overbought area, which implies there is still space for additional cost gratitude if purchasing pressure continues.

Source: TradingView

The Moving Average Convergence Divergence (MACD) sign reveals a current bullish crossover, with the MACD line crossing above the signal line, recommending possible upward m