South Africa’s monetary regulator hasactually provided 63 licenses to VASPs, taking the overall number of certified digital property companies to 138.

The Financial Sector Conduct Authority (FSCA) revealed justrecently that it has got 383 applications from VASPs because its brand-new regulative structure took impact. The veryfirst batch of licensees, consistingof leading exchanges Luno and VALR, were exposed earlier this year.

Of the 383, 80 were willingly withdrawn by the candidates, the FSCA exposed. These entities can use onceagain in the future, “provided they can show complete and appropriate compliance with the suitable licensing requirements.” However, they needto stop all digital possession activities instantly.

The guarddog decreased 5 applications from unnamed entities that stoppedworking to satisfy functional capability or proficiency requirements.

With its brand-new licensing program, South Africa hasactually endedupbeing the local leader in digital property policy in Africa. Others like Kenya, Nigeria and Ghana still absence official structures inspiteof a considerable share of their populations owning digital possessions.

The UN approximates that around 8.5% of Kenyans own digital possessions, the fifth-highest share worldwide. In Nigeria, digital property deal volume hit $57 billion inbetween July 2022 and June2023 Yet, these 2 nations continue to practice policy by enforcement and tax, with Nigeria’s crackdown magnifying this year.

South Africa’s clear regulative structure is now poaching VASPs from other African nations. One of these is Kenyan stablecoin payments start-up Kotani Pay, which inspiteof being based in Nairobi and doing most of its company in the East African country, is now certified by the FSCA.

South Africa’s regulative structure likewise enables regional regulators to fracture down on digital property lawbreakers and safeguard financiers. The FSCA justrecently exposed in its yearly regulative actions report that it had introduced 30 digital currency-related probes.

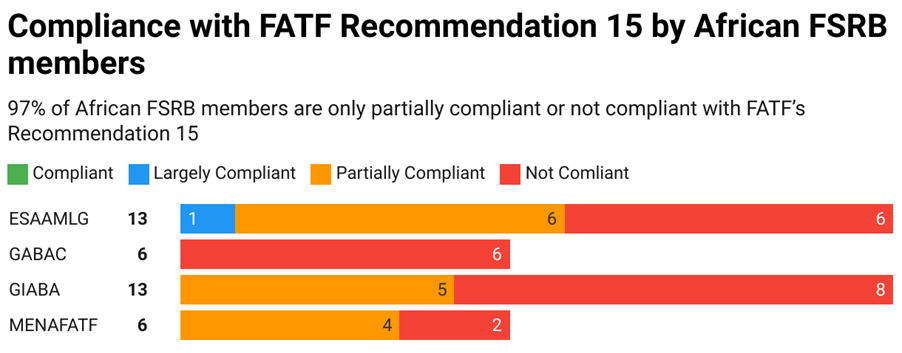

A well-laid-out regulative structure more guides VASPs and enables them to comply with regional and worldwide standards, which African start-ups haveactually been havingahardtime with. According to the FATF, 97%