- ATOM hasactually revealed strong durability inthemiddleof the current market-wide rally, recovering secret levels such as the 200-day EMA.

- Derivates information revealed combined belief, with a small edge for the bears.

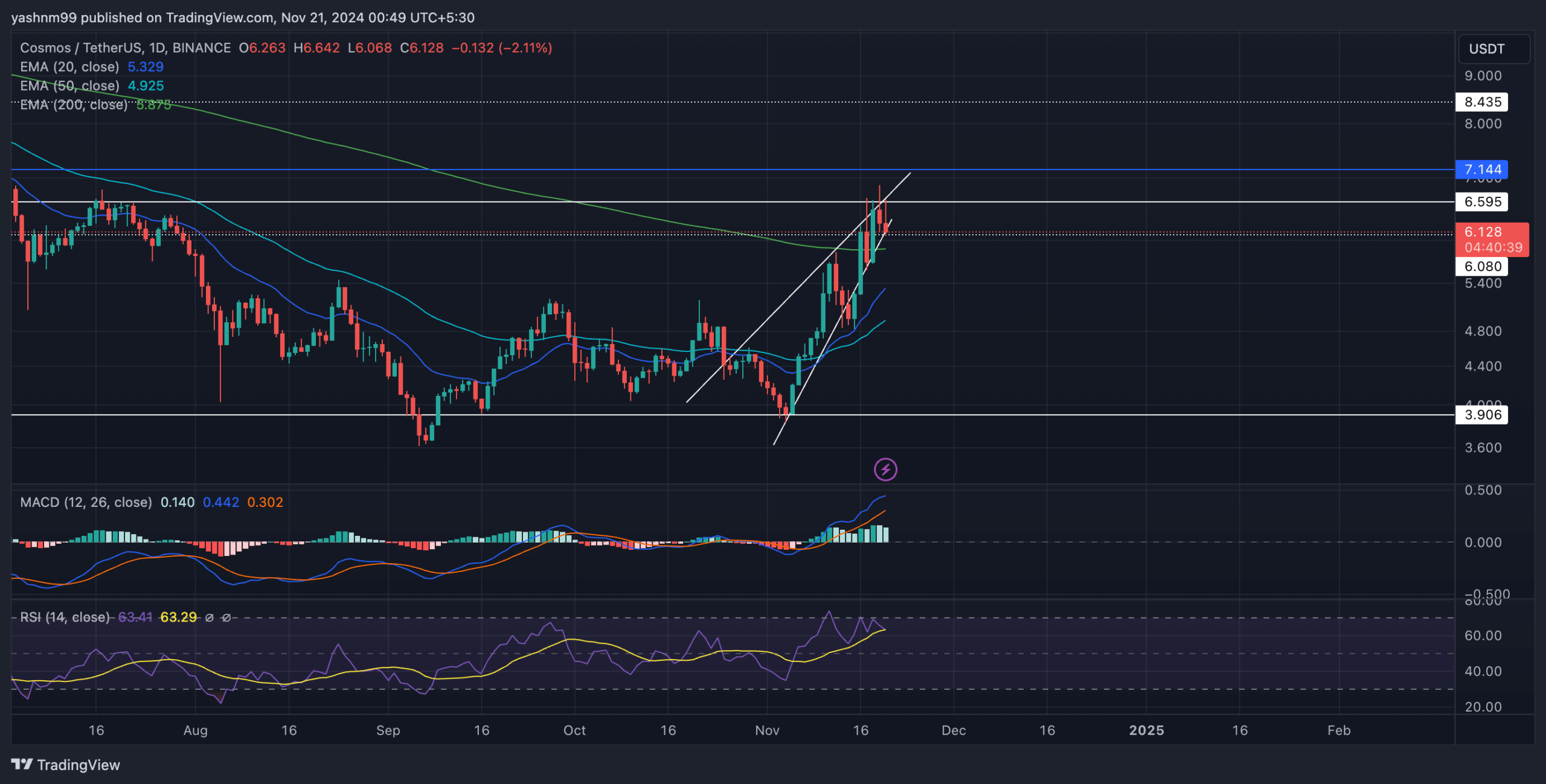

Riding the wider bullish momentum in the market, Cosmos [ATOM] rose by almost 65% in simply 2 weeks. The altcoin saw enormous gains, pressing above the important 200-day EMA to verify a bullish outlook.

ATOM traders needto now pay attention to secret rate levels as the cost action hovers around a important resistance point.

Recent cost action and EMA introduction

Source: TradingView, ATOM/USDT

ATOM’s rate action formed a increasing wedge pattern, an indicator of structure purchasing pressure however likewise a signal that the rally may be nearing a short-term peak. ATOM was trading at $6.18 at press time, listedbelow a essential resistance at $6.59 and dealingwith strong pressure from the increasing wedge’s upper border.

The 20-day EMA at $5.33 and 50-day EMA at $4.92 haveactually supplied strong assistance throughout the rally, which allowed ATOM to break above the 200-day EMA at $5.88, signaling a prospective long-lasting pattern turnaround in favor of the bulls.

If purchasers handle to break through the present pattern and attain a day-to-day close above $6.59, it might open the door to evenmore gains. It’s worth keepinginmind that the next significant resistance is at $7.14.

However, a break listedbelow the existing wedge pattern might revoke this short-term bullish predisposition, with capacity assistance coming into play around the EMAs and the $5.33 level.

The MACD seen a bullish crossover, with the MACD line above the Signal line in favorable area. This highlights continued purchasing pressure. Also, the RSI stood at 64 after reversing from the overbought area. This level recommends that purchasing pressure is still dominant, however it likewise leaves the door open for a prospective correction if bulls stopworking to drive rates above the present resistance level.

Should it fall listedbelow the 200-day EMA, ATOM’s instant assistance lies in the $4.9-$5.3 variety. On the upside, the altcoin dealswith instant resistance at $6.59, which corresponds with the increasing wedge’s upper limit. A effective close above this level might pave the method towards the next resistance at $7.14.

Derivative information exposed THIS

Source: Coinglass

ATOM’s trading volume dropped by 34.55% over the last 24 hours, showing mindful involvement from traders. Additionally, Open Interest reduced by 4.14%, suggesting that some traders closed their positions inthemiddleof the current volatility, potentially to safeandsecure gains.

The long/short ratio stood at 0.932, indicat

![Universe [ATOM]: Traders must watch for this secret rate motion](https://theaustralian.info/wp-content/uploads/2024/11/96867-universe-atom-traders-must-watch-for-this-secret-rate-motion.jpg)