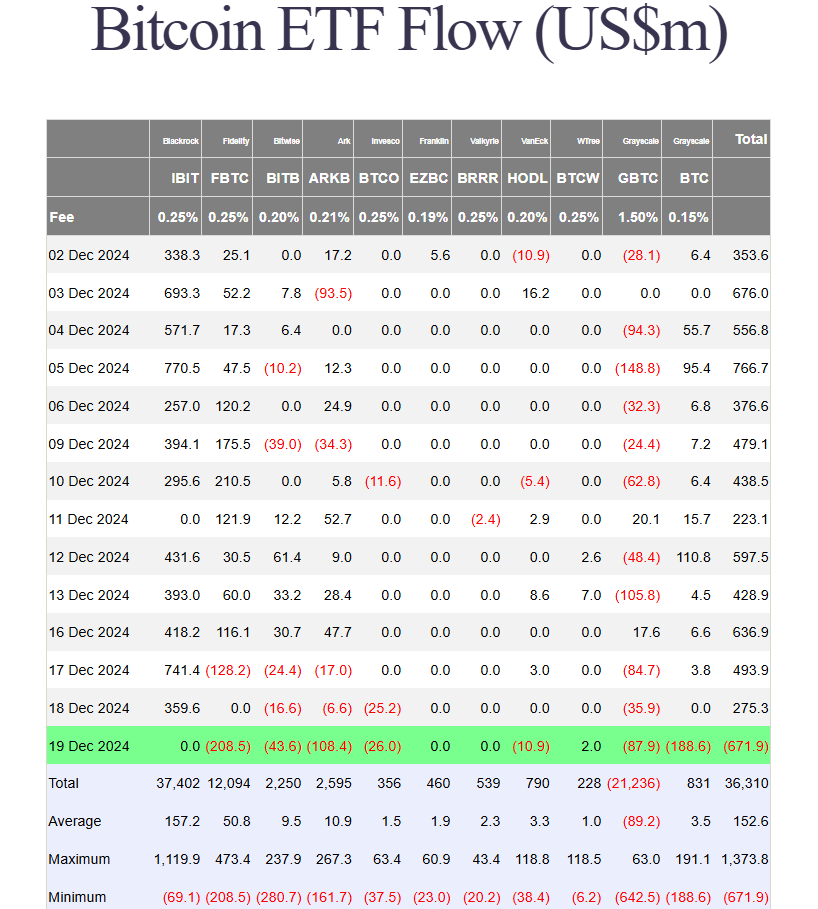

Investors react to economic signals, leading to the largest recorded fund withdrawals in a single day.

Key Takeaways

- US Bitcoin ETFs experienced historic outflows with investors withdrawing $672 million in a day.

- Fidelity’s Bitcoin Fund led the outflows, followed by Grayscale and ARK Invest ETFs.

US spot Bitcoin ETFs suffered their largest-ever single-day outflow amid a sharp crypto market sell-off following the FOMC meeting. According to Farside Investors data, approximately $672 million exited these funds on Thursday, ending a period of net inflows that began in late November.

The massive withdrawal eclipsed the previous record of nearly $564 million set on May 1, when the group of spot Bitcoin ETFs saw nearly $564 million in withdrawals after Bitcoin dropped 10% to $60,000 over a week.

Fidelity’s Bitcoin Fund (FBTC) led the exodus with $208.5 million in outflows, while Grayscale’s Bitcoin Mini Trust (BTC) recorded its lowest point since launch with over $188 million in net outflows.

ARK Invest’s Bitcoin ETF (ARKB) and Grayscale’s Bitcoin Trust (GBTC) also saw huge withdrawals, with ARKB losing $108 million and GBTC shedding nearly $88 million. Meanwhile, three competing ETFs managed by Bitwise, Invesco, and Valkyrie collectively lost $80 million.

BlackRock’s iShares Bitcoin Trust (IBIT), which logged $1.9 billion in net inflows this week and was a major contributor to the group’s recent strong performance, recorded zero flows for the day.

WisdomTree’s Bitcoin Fund (BTCW) was the sole gainer, attracting $2 million in new investments.

Bitcoin’s price fell below $96,000 during the market downturn and currently trades at around $97,00