Gini coefficient exposes USDC’s more wellbalanced circulation in DeFi procedures compared to USDT.

Key Takeaways

- USDT controls centralized exchanges while USDC leads in varied DeFi applications.

- USDC has a more wellbalanced circulation throughout DeFi procedures compared to USDT.

Tether USD (USDT) and USD Coin (USDC) are leading the stablecoin market, each sculpting out unique specificniches in the crypto environment, according to a current Keyrock report. USDT preserves its supremacy as a trading set requirement on centralized exchanges, leveraging its first-mover benefit. Meanwhile, USDC is making substantial inroads in decentralized financing (DeFi) applications, offering a more varied portfolio of usage cases.

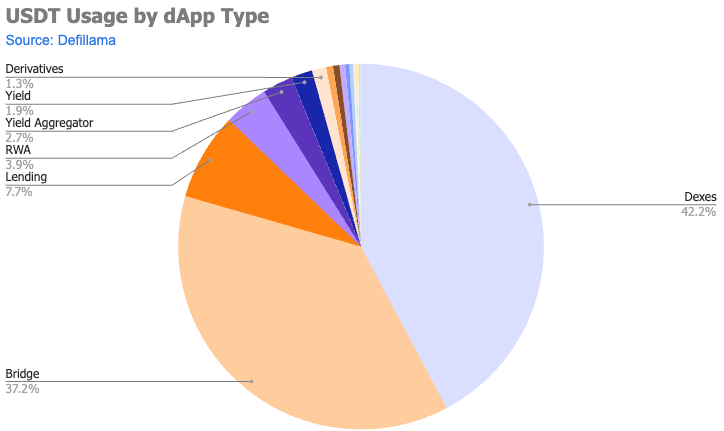

Approximately 11.5% of USDT’s overall market cap, or $12.8 billion, is held within wise agreements throughout 10 various chains, the leastexpensive portion amongst significant stablecoins. USDT’s use is mostly focused in bridges and decentralized exchanges (DEXs), showing its historic function in the crypto environment.

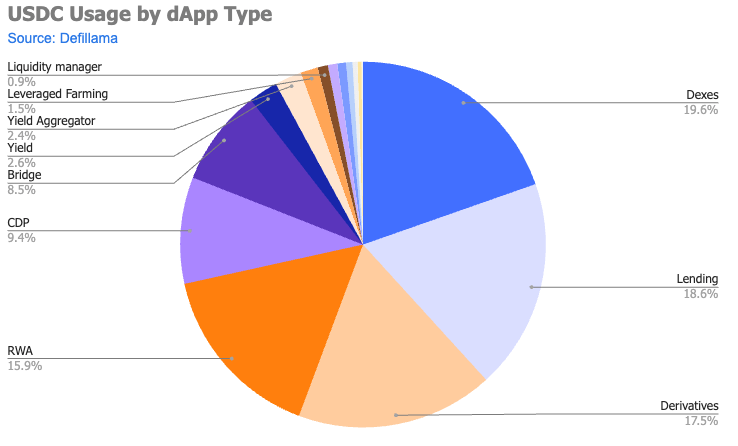

In contrast, 20% of all flowing USDC, or $7 billion, is in wise agreements, almost double that of USDT. USDC has acquired traction in derivatives, real-world possessions (RWAs), and collateralized financialobligation positions (CDPs). It has around $1 billion locked in derivative trading procedures, more than 6 times that of USDT.

Moreover, USDC’s circulation amongst dApps is more wellbalanced compared to USDT, as evidenced by their particular Gini coefficients for TVL circulation throughout the leading 150 procedures: 0.3008 for USDC versus 0.6695 for USDT.

While USDT stays vital for trading sets and rate discovery, USDC appears muchbetter located to drive future DeFi developments sustained by its flexibility. Nevertheless, “it is unl