- USDC trading volume rose to $23 billion in 2024.

- Increased regulative difficulties increased need for managed stablecoins.

The crypto market has skilled increased policy and examination, with altcoins such as Ripple [XRP], Uniswap [UNI], and Monero [XMR] dealingwith legal difficulties.

Conversely, the increased guideline likewise increased the worldwide need for certified stablecoins such as USD Coin [USDC].

In 2024, USDC’s trading volume rose to $23B from $9B in2023 The rapid development emerges inthemiddleof greater need for lawfully accepted stablecoins amongst significant traders, making controlled stablecoins a ideal alternative.

Source: X

Thus, current advancements haveactually seen USDC’s market share increase to a record high. According to Kaiko’s report, USDC’s market share was nearing FDUSD 14%.

What’s driving USDC’s rise

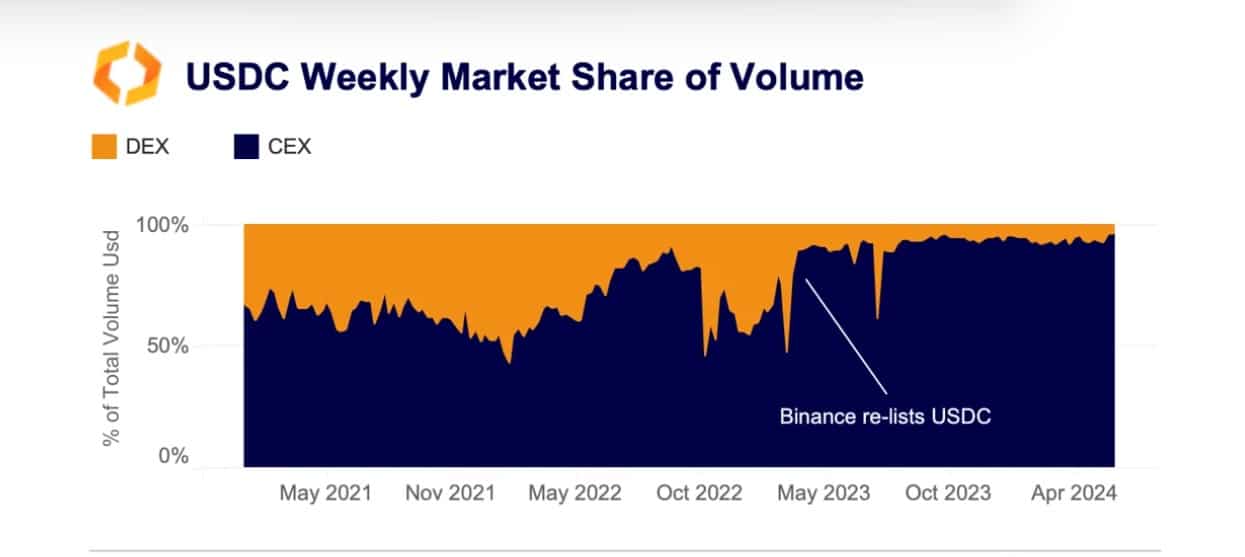

Various market elements haveactually been driving USDC’s trading volume and market share. According to Kaiko, the increase of CEXes are a main element driving USDC volume.

Based on the report, USDC’s market share of CEXes skilled a greater rise from March 2023, increasing from 60% to 90%.

Source: Kaiko Report

Equally, continuous futures settlements have played a crucial function in rising trading volume. Kaiko reported that Bitcoin [BTC] perpetuals in USDC increased to 3.6% from 0.3%, while Ethereum [ETH] perpetuals increased to 6.8%.

The increased usage of continuous settlements programs altering belief amongst financiers over-regulated stablecoins.

MiCA: The videogame changer

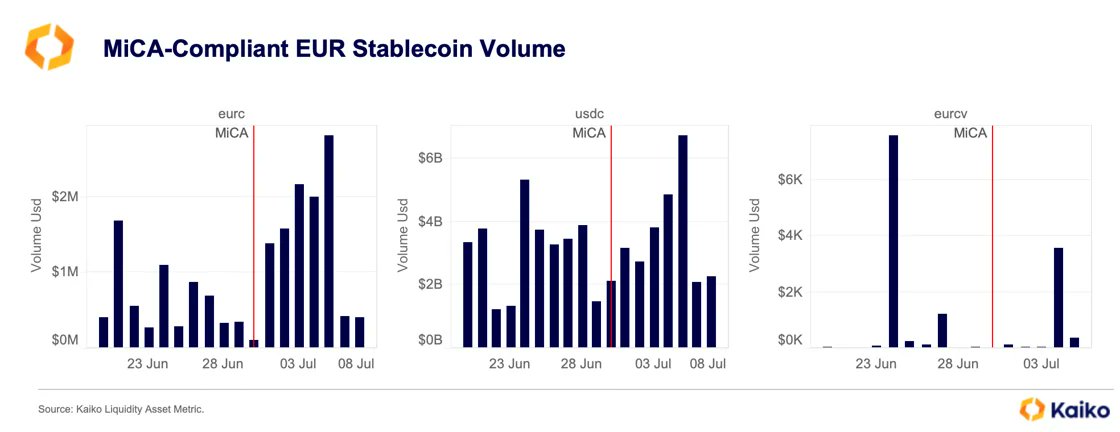

On the 30th of June, Circle reported its complete compliance with MiCA (European Markets in Crypto-assets Regulation). This was a vital point in Europe’s stablecoin market, acting as a structure for others.

After Circle, other companies followed fit, consistingof SocGen’s Forge, which mainly problems EURO convertibles.

From the compliance of these companies emerged a roadmap that included requirements for other providers, such as whitepaper publication, governance, reserve management, and prudential requirements.

After Circle revealed its compliance with MiCA requirements, EURC and USDC knowledgeable the greatest trading volume on day-to-day charts.

Equally, SocGen saw a increase in trading volume. Therefore, the rise in trading volume revealed tha