Investing.com — While much of the world is inviting indications of cooling in inflation following an historical bout of sky-high cost gains, China is dealingwith installing fears that it might be goinginto a duration of established deflation.

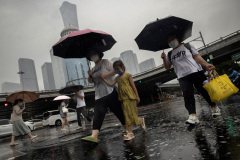

In August, customer rate inflation in China hit its fastest rate in half a year, however the information did little to relieve issues over the state of need in the world’s second-largest economy. Much of this was due to the reality that food costs — the primary motorist of the 0.6% uptick in China’s customer rate index compared to a year earlier — were boosted generally by inclement summerseason weathercondition, rather than a more sustainable rebound in domestic need.

Core customer inflation, removing out products like food and fuel, came in at 0.3% in August, slowingdown from 0.4% in July. It was the leastexpensive reading in practically 3 and a half years.

At the exactsame time, manufacturer costs diminished by 1.8% year-on-year, speedingup from a decrease of 0.8% in the prior month.

Prolonged deflation provides a prospective threat to the financial outlook, experts at Morgan Stanley alerted, including that income sizes in specific might see decreases. Such a pattern threaten to initiate a domino impact of decreasing investing, lower business incomes, and subsequent layoffs.

In the 1990s, Japan wentinto into a comparable stretch of deflation that stimulated what has giventhat endedupbeing understood as its “lost years” — or a time of ec